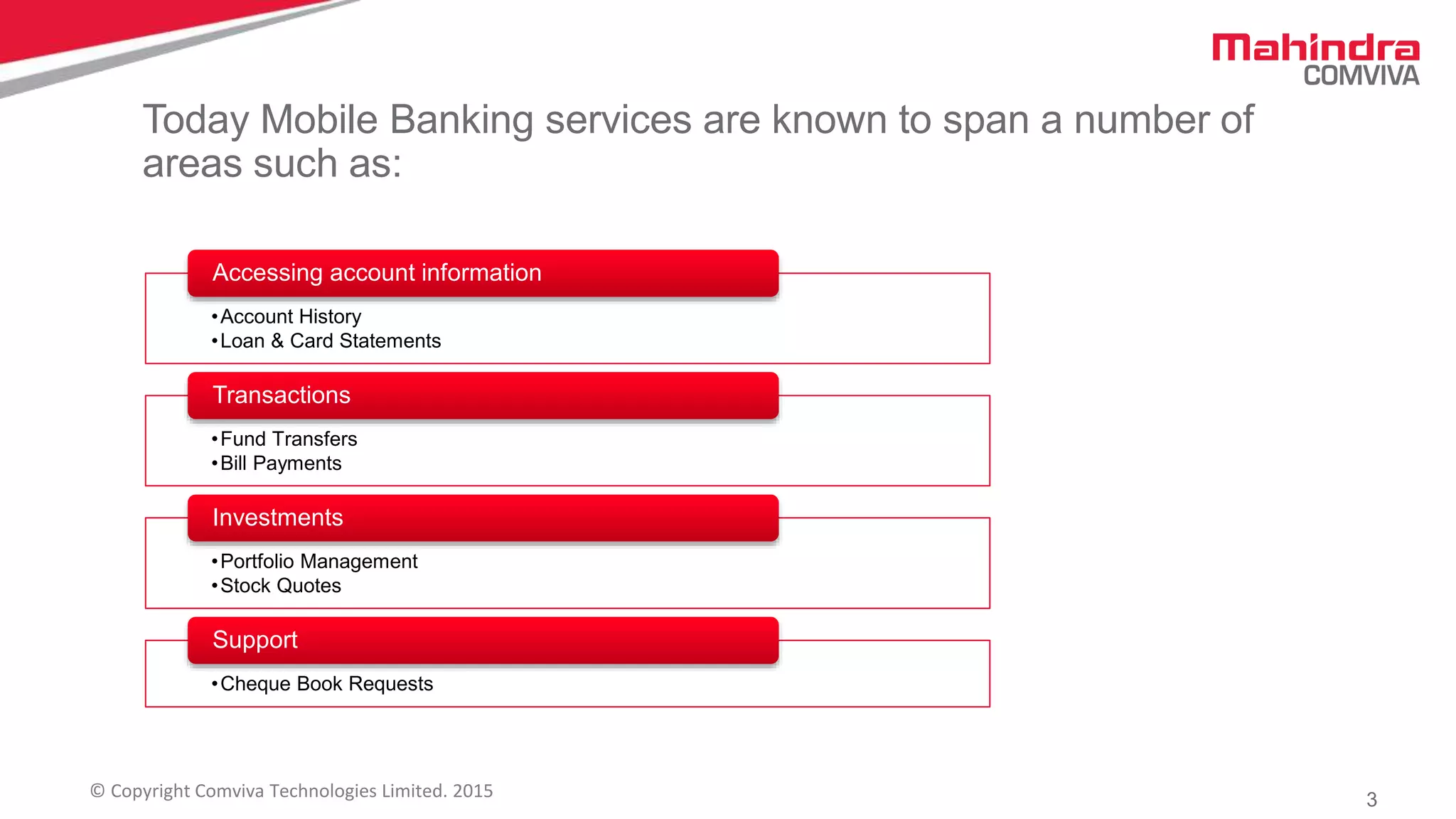

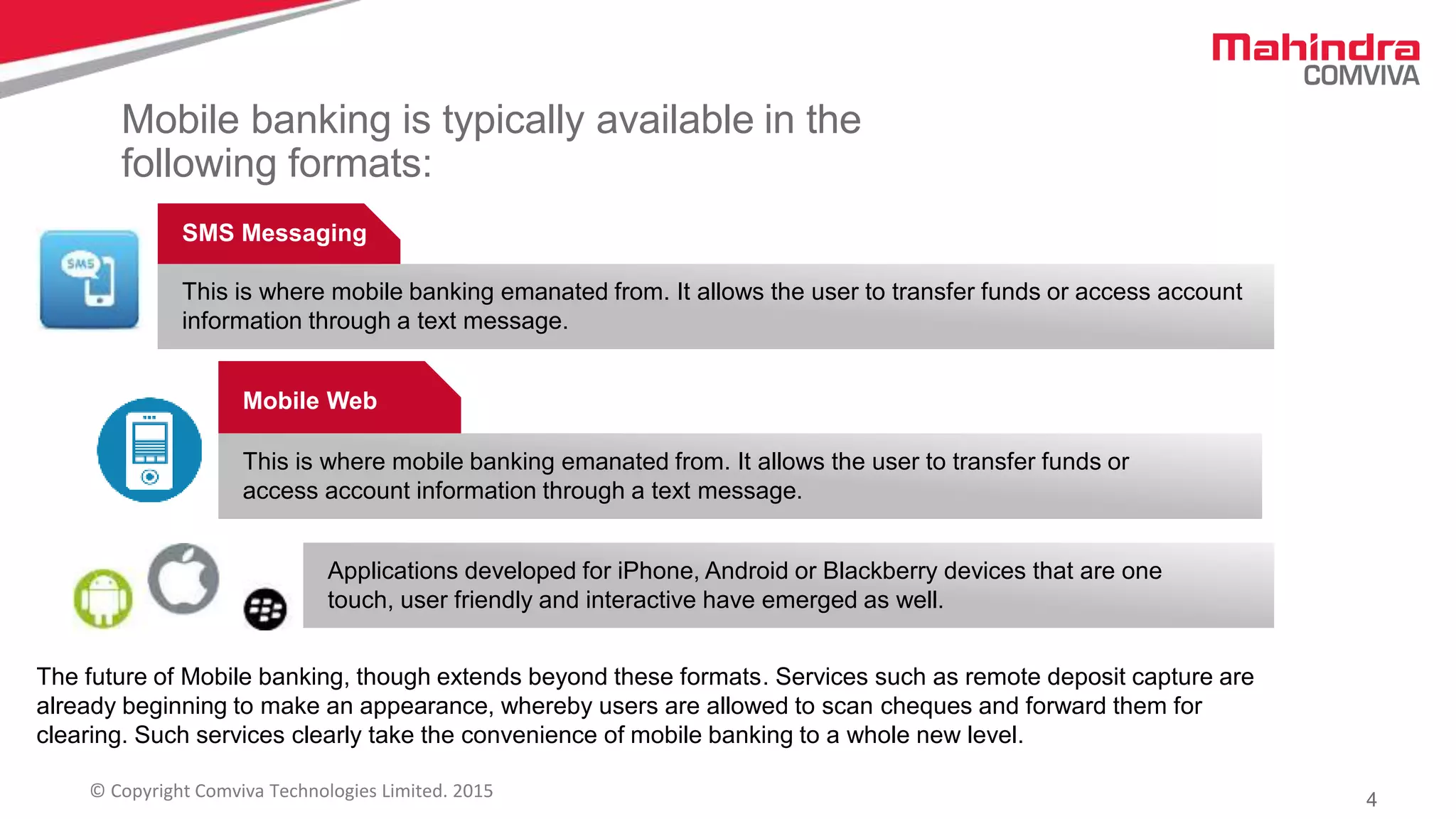

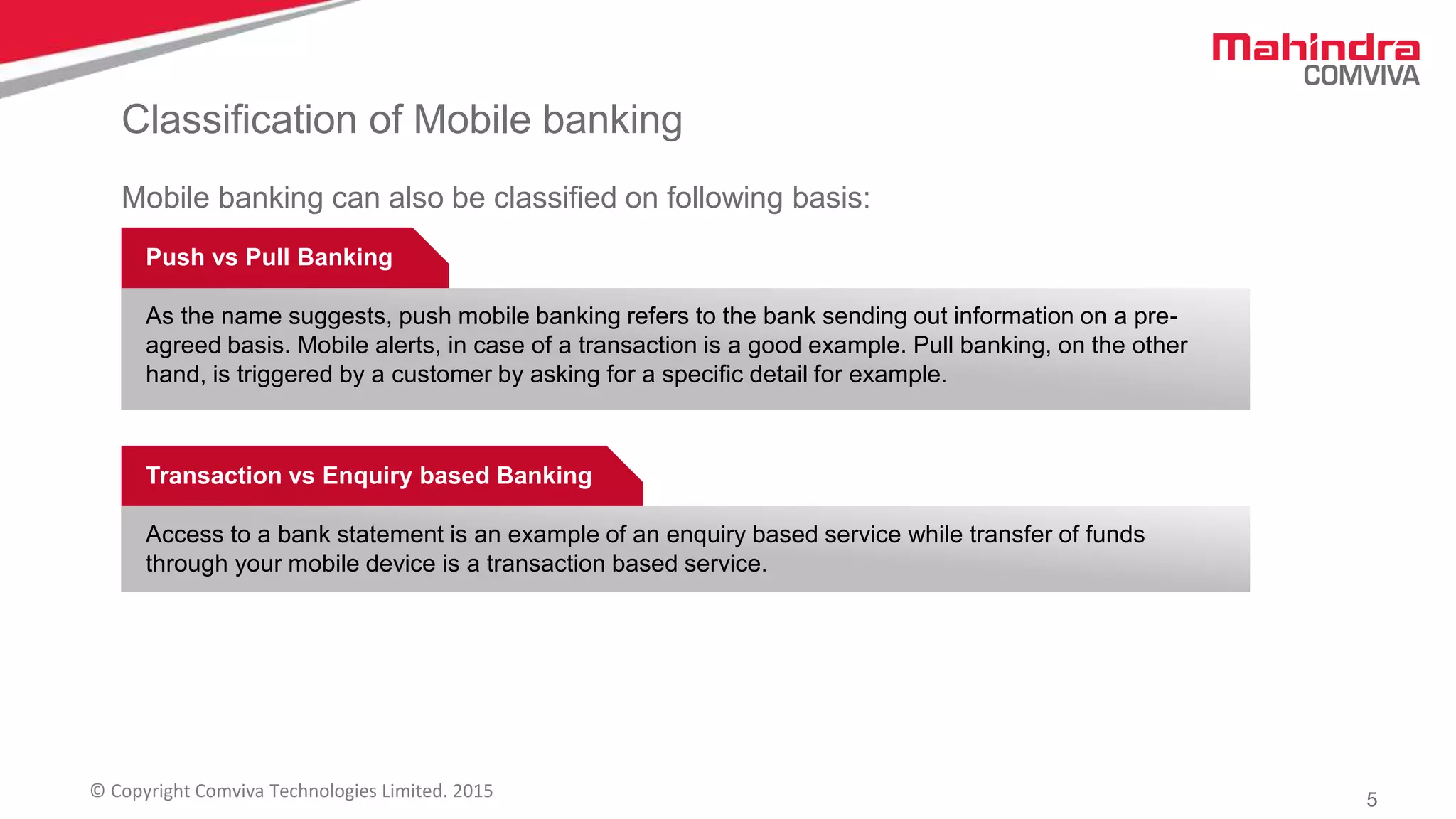

Mobile banking is increasingly favored by consumers due to the convenience it offers, allowing users to manage their banking needs through mobile devices. Services include fund transfers, bill payments, and account access, available through SMS messaging, mobile web, and applications. This trend benefits both consumers and banking providers by enhancing customer retention and enabling targeted marketing while reducing operational costs.