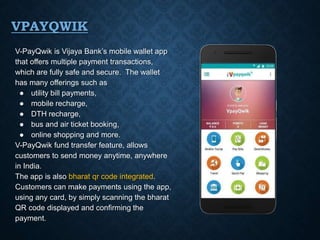

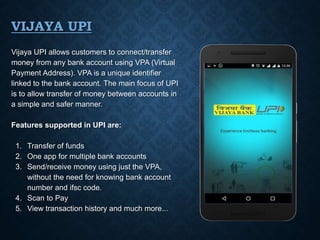

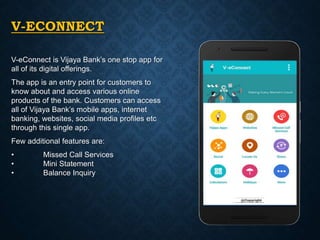

Digital banking is a major trend in the banking sector, focusing on customer-centric models like SMAC (social, mobile, analytics, and cloud) to enhance agility and reduce costs. Vijaya Bank offers various digital products including the V-Payqwik mobile wallet, UPI services for easy fund transfers, and the V-Mobile banking app for secure transactions. Additionally, the V-Econnect app serves as a comprehensive platform for accessing all of Vijaya Bank's digital offerings.