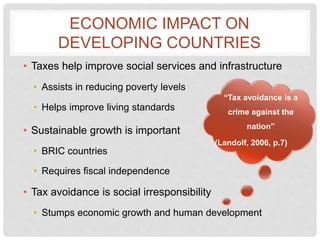

Tax avoidance by corporations negatively impacts developing countries in three main ways:

1) It diminishes funds for public services and economic growth by reducing tax revenue. Developing countries lose out on large amounts needed for infrastructure and social programs.

2) By shifting profits to tax havens, corporations avoid paying their fair share and their social responsibility to the countries and societies that help them generate profits.

3) The practices undermine justice and fairness in societies by exacerbating inequality and poverty. International regulations have so far not adequately addressed this issue facing developing nations.

![TAX AVOIDANCE

• “Tax avoidance [...] is mostly associated with companies, rather than

individuals. It usually falls just within the limits of the law, but goes against

the spirit of the law. Using aggressive tax planning techniques, certain

companies exploit legal loopholes in tax systems and mismatches between

national rules to minimise their tax bills and avoid paying their fair share of

taxes” (European Commission, 2015)

• Especially practiced by MNCs

• Leads to distortion of

competition

(McTague , 2013)](https://image.slidesharecdn.com/c04123f2-6833-4595-a197-d96fd97a43ff-160128151833/85/MN5001-Presentation-on-Tax-Avoidance-5-320.jpg)

![REFERENCES

• Baker, B., 2013. World Development Book Case Studies: Tax avoidance and its Impacts in the Developing World. New

Internationalist. [Online] Newint.org. Available at: http://newint.org/books/reference/world-development/case-

studies/avoidance-and-its-impacts/ [Last Accessed 23 November 2015].

• Carroll, A. B., 1987. In Search of the Moral Manager. Business Horizons, 30 (2), pp.7-15.

• Carroll, A. B., 1999. Corporate Social Responsibility: Evolution of a Definitional Construct. Business & Society, 38(3),

pp.268–295.

• Christensen, J. & Murphy, R., 2004. The Social Irresponsibility of Corporate Tax Avoidance: Taking CSR to the Bottom

Line. Journal of Development, 47, pp.37-44.

• Christian Aid, 2005. The Shirts Off Their Backs: How Tax Policies Fleece The Poor. London: Christian Aid.

• Cobham, A., 2005. Tax Evasion, Tax Avoidance and Development Finance. Oxford: University of Oxford.

• Country Reports, 2015. Zambia Facts and Culture. [Online] Available at:

http://www.countryreports.org/country/Zambia.htm [Last Accessed 20 November 2015].

• European Commission, 2012. Commission Recommendation of 6.12.2012 on aggressive tax planning. [Online] Available

at: http://ec.europa.eu/taxation_customs/resources/documents/taxation/tax_fraud_evasion/c_2012_8806_en.pdf [Last

Accessed 23 November 2015].

• Farny, O. Franz, M., Gerhartinger, P., Lunzer, G., Neuwirth, M., Saringer M., 2015. Tax avoidance, tax evasion and tax

havens. [Online] Available at: http://media.arbeiterkammer.at/wien/PDF/studien/Studie_tax_avoidance.pdf [Last

Accessed 23 November 2015].

• Garriga, E. & Melé, D., 2004. Corporate social responsibility theories: Mapping the territory. Journal of Business Ethics,

53(1-2), pp.51–71.

• Houlder, V., 2013. ‘Dutch sandwich’ grows as Google shifts €8.8bn to Bermuda. [Online] Financial Times. Available at:

http://www.ft.com/cms/s/0/89acc832-31cc-11e3-a16d-00144feab7de.html#axzz3sEDK43aK [Last Accessed 23

November 2015].](https://image.slidesharecdn.com/c04123f2-6833-4595-a197-d96fd97a43ff-160128151833/85/MN5001-Presentation-on-Tax-Avoidance-13-320.jpg)

![• International Monetary Fund., 2014. IMF Policy Paper: Spillovers in International Corporate Taxation. [Online] Available at:

https://www.imf.org/external/np/pp/eng/2014/050914.pdf [Last Accessed 23 November 2015].

• International Monetary Fund., 2011. Revenue Mobilisation in Developing Countries. Washington: IMF.

• Landolf, U., 2006. Tax and Corporate Responsibility. International Tax Reveiew, 29, pp.6-9.

• Lind, E. A., & Tyler, T. R., 1988. The Social Psychology of Procedural Justice. New York: Plenum Press.

• Lin-Hi, N. & Müller, K., 2013. The CSR bottom line: Preventing corporate social irresponsibility. Journal of Business

Research, 66(10), pp.1928–1936.

• Logsdon, J.M. et al., 2012. Corporate Stakeholder Organizational Social Performance , and Moral Development, 16(12),

pp.1213–1226.

• Lord Holme & Richard Watts, 1999. Corporate social responsibility. Geneva: World Business Council for Sustainable

Development.

• May, P.H., 2008. Overcoming Contradictions Between Growth and Sustainability: Institutional Innovation in the BRICS.

Chinese Journal of Population Resources and Environment, 6(3), pp.3-13.

• Mfula, C., 2010. Farmers Plan to Invest in Zambia - Govt. [Online] Available at:

http://in.reuters.com/article/2010/08/05/idINIndia-50657020100805 [Last Accessed 18 November 2015].

• Molina, N., 2015. A UK Tax Avoidance Bill Could Save Developing Countries Billions. [Online] Available at:

http://www.theguardian.com/global-development/2015/feb/13/uk-tax-avoidance-bill-save-developing-countries-billions [Last

Accessed 14 November 2015].

• Nylen, U., 1998. Ethical Views on Tax Evasion among Swedish CEOs. Journal of Accounting, Ethics & Public Policy, 1 (3),

pp.435-459.

• Otusanya, O. J., 2011. The Role of Multinational Companies in Tax Evasion and Tax Avoidance: The Case of Nigeria. Critical

Perspectives on Accounting, 22 (3), pp.316-332.

• Oxfam International., 2013. Tax Evasion Damaging Poor Country Economies. [Online] Available at:

https://www.oxfam.org/en/pressroom/pressreleases/2013-09-01/tax-evasion-damaging-poor-country-economies [Last

Accessed 14 November 2015].

• Pease, M., 2014. You pay taxes, and rich corporations don't. [Online] CNN. Available at:

http://edition.cnn.com/2014/07/16/opinion/pease-tax-avoidance/ [Last Accessed 23 November 2015].

• Tax Justice Network-Africa., 2012. Tax competition in East Africa: A race to the bottom. [Online] Available at:

http://www.actionaid.org/sites/files/actionaid/eac_report.pdf [Last Accessed 23 November 2015].](https://image.slidesharecdn.com/c04123f2-6833-4595-a197-d96fd97a43ff-160128151833/85/MN5001-Presentation-on-Tax-Avoidance-14-320.jpg)

![• Pomerleau, K., 2015. Sources of Government Revenue across the OECD, 2015. [Online] Available at:

http://taxfoundation.org/article/sources-government-revenue-across-oecd-2015 [Last Accessed 17 November 2015].

• Rawls, J., 1999. A theory of Justice. Cambridge, MA: Harvard University Press

• Reidenbach, R.E. & Robin, D.P., 1991. A conceptual model of corporate moral development. Journal of Business Ethics,

10(4), pp.273–284.

• Sayer, A., 2008. Moral Economic Regulation in Organizations: A University Example. Organization, 15 (2), pp.147-164.

• Searcy, C. & Buslovich, R., 2014. Corporate Perspectives on the Development and Use of Sustainability Reports. Journal of

Business Ethics, 121(2), pp.149–169.

• Sikka P., 2008. Enterprise Culture and Accountancy Firms: New Masters of the Universe. Accounting, Auditing and

Accountability Journal, 21 (2), pp.268-295.

• Specialised Training Solutions, 2013. Health and hygiene in the Workplace. [Online] Available at: http://sts.co.zm/about.php

[Last Accessed 19 November 2015].

• Spicer, M. W., 1975. New Approaches to the Problem of Tax Evasion. British Tax Review, 3, pp.152-154.

• Tax Justice Network Limited, 2015. UNCTAD: Multinational Tax Avoidance Costs Developing Countries $100 Billion Plus.

[Online] Available at: http://www.taxjustice.net/2015/03/26/unctad-multinational-tax-avoidance-costs-developing-countries-

100-billion/ [Last Accessed 14 November 2015].

• Tax Justice Network, 2015. Press Release: OECD’s BEPS Proposals Will not be the End of Tax Avoidance by

Multinationals. [Online] Available at: http://www.taxjustice.net/2015/10/05/press-release-oecds-beps-proposals-will-not-be-

the-end-of-tax-avoidance-by-multinationals/ [Last Accessed 20 November 2015].

•

• Tax Justice Network-Africa., 2012. Tax competition in East Africa: A race to the bottom. [Online] Available at:

http://www.actionaid.org/sites/files/actionaid/eac_report.pdf [Last Accessed 23 November 2015].](https://image.slidesharecdn.com/c04123f2-6833-4595-a197-d96fd97a43ff-160128151833/85/MN5001-Presentation-on-Tax-Avoidance-15-320.jpg)