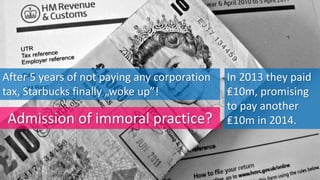

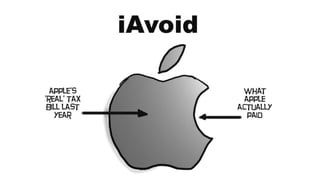

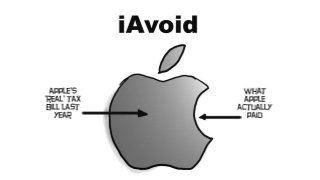

The document discusses the morality of tax avoidance, particularly by large companies, and its impact on public services and economic security. It emphasizes that while tax avoidance may be legal, it is considered immoral as these companies benefit from public resources without contributing fairly. The example of Starbucks is used to illustrate how multinational corporations exploit tax regulations for profit while sacrificing ethical responsibility.