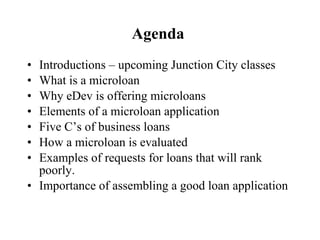

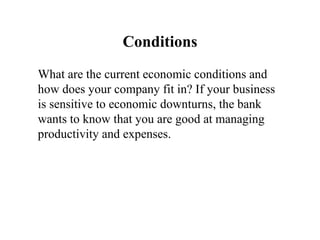

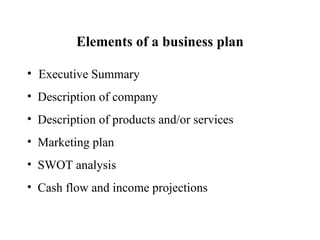

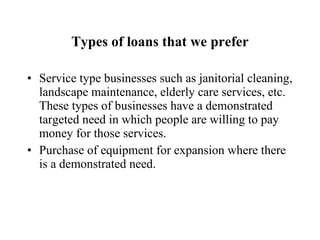

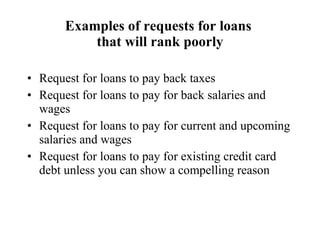

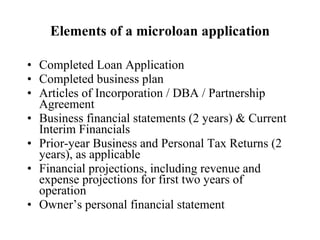

The document summarizes a microloan workshop presented by eDev, a nonprofit organization that provides classes, assistance and access to capital for small businesses and economic development. eDev was designated as an SBA microloan lender and initially has $150,000 to offer in loans ranging from $500 to $35,000. To qualify for a loan, applicants must demonstrate good character, repayment capacity, sufficient capital, collateral and ability to withstand economic conditions based on the Five C's of credit. Strong applications include service-based businesses and equipment purchases while restaurants, hobbies and requests to pay back taxes or wages are less likely to succeed. Interest rates start at 4.9% and applicants must submit documentation like business plans,

![Contact information Martin Desmond 1445 Willamette Street, Suite 120 Eugene, Oregon 97401 541-463-4616 [email_address] www.edev.org](https://image.slidesharecdn.com/microloanpresentationjc-1259793519442-phpapp01/85/Microloan-PowerPoint-Presentation-21-320.jpg)