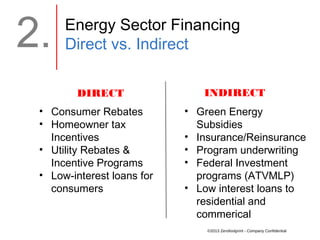

The document discusses challenges with financing energy efficiency projects. It notes that two key challenges are a lack of quality data and low consumer engagement. It describes different models for direct financing to consumers and indirect financing of larger projects. Open energy data initiatives could help address data issues and allow better assessment of risks. Improving consumer engagement on energy use would also help promote direct financing options.