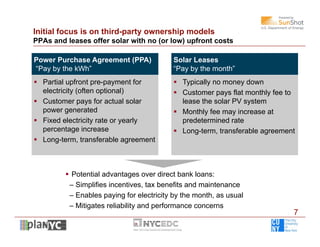

The document summarizes a working group established by NYCEDC and the Mayor's Office to address barriers to solar financing in NYC. The working group will evaluate best practices, analyze the NYC building stock and solar market needs, and develop a plan to facilitate financing models like power purchase agreements and solar leases that offer solar with no upfront costs. The initial focus is on third-party ownership models to simplify incentives and allow customers to pay for solar electricity monthly. Other innovative financing models may also be explored.