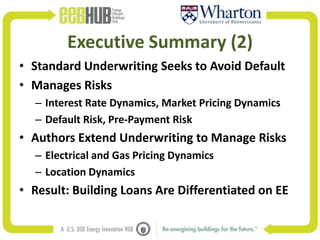

The document summarizes a paper that proposes a new method for commercial mortgage lenders to explicitly factor energy risk and building energy efficiency into mortgage underwriting. It finds that standard underwriting does not account for risks from volatile energy prices, which can significantly impact building cash flows. The authors develop a model to simulate cash flows under different energy price scenarios and incorporate these risks into loan valuations. The results show loan valuations are 8.5% lower when accounting for energy, with larger reductions for larger buildings and loans. The paper concludes this method can help lenders more accurately price loans based on location-specific energy risks and efficiency levels.