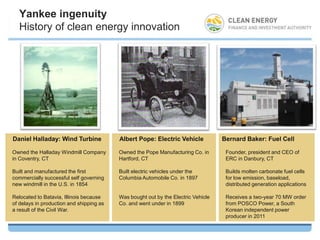

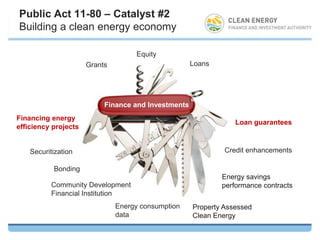

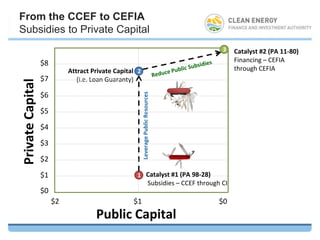

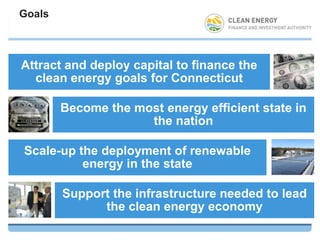

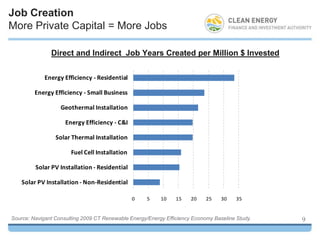

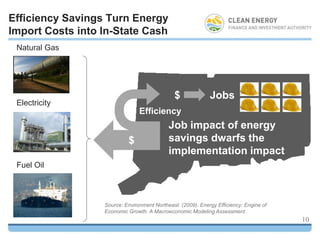

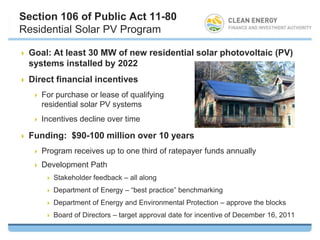

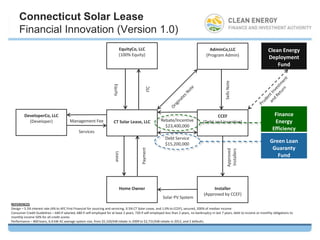

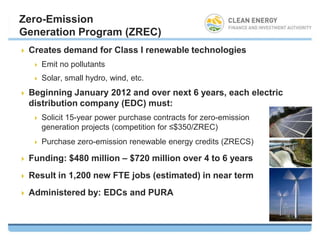

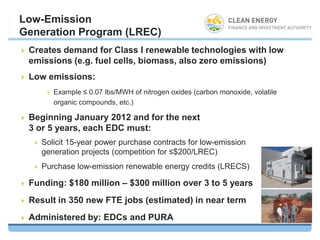

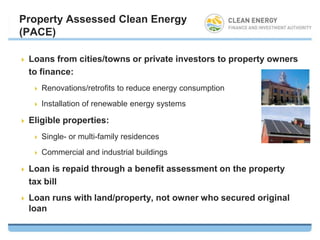

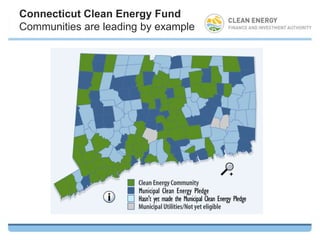

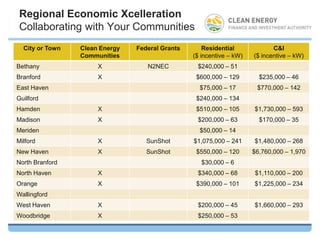

The document outlines opportunities for advancing Connecticut's clean energy economy, highlighting historical innovations and legislative catalysts that promote renewable energy and energy efficiency. Key initiatives include financial incentives for residential solar photovoltaic installations, job creation through energy efficiency projects, and various loan programs supporting clean energy investments. The agenda stresses community collaboration and upcoming steps for municipalities to engage in clean energy programs.