gov revenue formsandresources forms ESW-FID_fill-in

•

0 likes•233 views

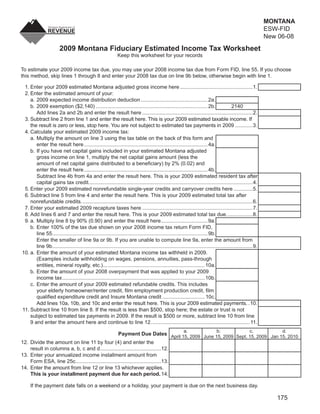

This document provides instructions for a 2009 Montana Fiduciary Estimated Income Tax Worksheet. It explains how to estimate income tax due for 2009 using tax due from 2008. It also provides guidance on recalculating estimated tax payments if income changes during the year, determining estimated withholding, nonresident tax payment requirements, and penalties for underpayment of estimated taxes.

Report

Share

Report

Share

Download to read offline

Recommended

gov revenue formsandresources forms ESW_fill-in

This document provides instructions for estimating 2009 Montana individual income tax liability and determining required estimated tax payments. It includes a worksheet to calculate estimated taxable income, total tax, payments, and credits. It then provides a table to determine the amount due for each of four installment payments on April 15, June 15, September 15, and January 15 of the following year. It advises recalculating payments if income changes and how to estimate withholding amounts.

Individual Income Tax Return and Form

This document provides instructions for filing a 2008 North Carolina individual income tax return using Form D-400. Some key points:

1. Filing requirements for North Carolina tax returns are different than federal, as NC does not adjust for inflation. Most taxpayers must file if their gross income exceeds thresholds based on filing status.

2. New in 2008, NC offers a refundable Earned Income Tax Credit equal to 3.5% of the federal credit. Bonus depreciation requires an addition on the NC return. The top income tax rate was reduced to 7.75%.

3. The instructions provide guidance on filing status, exemptions, deductions, credits, and forms

2M_Worksheets_fill-in

This document contains worksheets to help taxpayers calculate various deductions and amounts for their 2008 Montana individual income tax return. Worksheet I helps calculate the qualified mortgage insurance premiums deduction. Worksheet II determines what portion, if any, of a federal income tax refund received in 2008 is taxable. Subsequent worksheets help calculate partial pension/annuity exemptions, standard deductions, itemized deductions, and interest owed for underpaying estimated taxes. The worksheets walk through step-by-step calculations using figures from the taxpayer's tax forms and tables of thresholds and rates.

azdor.gov Forms .. ADOR Forms 140ESf

This document is an Arizona state tax form for making estimated individual income tax payments for the 2002 tax year. It includes instructions for calculating estimated tax payments due throughout the year based on estimated income, deductions, exemptions, and withholding amounts. The form requires the taxpayer to provide identifying information and select whether the payment is mandatory or voluntary, and for which quarter. It also includes a worksheet to help calculate the estimated tax liability and payment amounts due.

azdor.gov Forms .. ADOR Forms 140ESf

This document is an Arizona state tax form for making individual estimated tax payments for the 2003 tax year. It provides instructions for taxpayers to fill out their name, address, social security number, indicate if the payment is mandatory or voluntary, the quarter being paid, and the payment amount enclosed. It also includes a worksheet to help calculate estimated tax payments throughout the year based on estimated income, additions, subtractions, deductions, exemptions, and tax liability.

tax.Oklahoma.gov/it2007

This document is an application for an extension of time to file an Oklahoma income tax return. It provides important information about the extension:

1) The extension is not for an extension of time to pay tax, only to file the return. Applicants must pay 90% of their total tax liability by the original due date.

2) Corporations may request a total extension of no more than 7 months beyond the original due date.

3) The application requires applicants to estimate their total tax liability and payments/credits to calculate any balance due. They must pay the balance due or 90% of the total liability, whichever is lower, to qualify for the extension.

azdor.gov Forms .. ADOR Forms 140ES_2004fillable

This document is an Arizona state individual estimated tax payment form for tax year 2004. It provides instructions for taxpayers to make estimated tax payments for the year. The form requests identifying information about the taxpayer and their spouse. It includes spaces to enter the payment amount and select the quarter being paid. The accompanying worksheet helps taxpayers calculate their estimated tax liability and determine the amount to pay for each quarterly installment.

azdor.gov Forms .. ADOR Forms 140ES-2006_f

This document is an Arizona estimated tax payment form for individual taxpayers for tax year 2006. It provides instructions for calculating estimated tax payments owed and includes a worksheet to help estimate taxable income, additions, subtractions, deductions, exemptions, and estimated tax liability. Taxpayers must provide identifying information like names and addresses, select if the payment is mandatory or voluntary, and enter the amount of the estimated tax payment being submitted.

Recommended

gov revenue formsandresources forms ESW_fill-in

This document provides instructions for estimating 2009 Montana individual income tax liability and determining required estimated tax payments. It includes a worksheet to calculate estimated taxable income, total tax, payments, and credits. It then provides a table to determine the amount due for each of four installment payments on April 15, June 15, September 15, and January 15 of the following year. It advises recalculating payments if income changes and how to estimate withholding amounts.

Individual Income Tax Return and Form

This document provides instructions for filing a 2008 North Carolina individual income tax return using Form D-400. Some key points:

1. Filing requirements for North Carolina tax returns are different than federal, as NC does not adjust for inflation. Most taxpayers must file if their gross income exceeds thresholds based on filing status.

2. New in 2008, NC offers a refundable Earned Income Tax Credit equal to 3.5% of the federal credit. Bonus depreciation requires an addition on the NC return. The top income tax rate was reduced to 7.75%.

3. The instructions provide guidance on filing status, exemptions, deductions, credits, and forms

2M_Worksheets_fill-in

This document contains worksheets to help taxpayers calculate various deductions and amounts for their 2008 Montana individual income tax return. Worksheet I helps calculate the qualified mortgage insurance premiums deduction. Worksheet II determines what portion, if any, of a federal income tax refund received in 2008 is taxable. Subsequent worksheets help calculate partial pension/annuity exemptions, standard deductions, itemized deductions, and interest owed for underpaying estimated taxes. The worksheets walk through step-by-step calculations using figures from the taxpayer's tax forms and tables of thresholds and rates.

azdor.gov Forms .. ADOR Forms 140ESf

This document is an Arizona state tax form for making estimated individual income tax payments for the 2002 tax year. It includes instructions for calculating estimated tax payments due throughout the year based on estimated income, deductions, exemptions, and withholding amounts. The form requires the taxpayer to provide identifying information and select whether the payment is mandatory or voluntary, and for which quarter. It also includes a worksheet to help calculate the estimated tax liability and payment amounts due.

azdor.gov Forms .. ADOR Forms 140ESf

This document is an Arizona state tax form for making individual estimated tax payments for the 2003 tax year. It provides instructions for taxpayers to fill out their name, address, social security number, indicate if the payment is mandatory or voluntary, the quarter being paid, and the payment amount enclosed. It also includes a worksheet to help calculate estimated tax payments throughout the year based on estimated income, additions, subtractions, deductions, exemptions, and tax liability.

tax.Oklahoma.gov/it2007

This document is an application for an extension of time to file an Oklahoma income tax return. It provides important information about the extension:

1) The extension is not for an extension of time to pay tax, only to file the return. Applicants must pay 90% of their total tax liability by the original due date.

2) Corporations may request a total extension of no more than 7 months beyond the original due date.

3) The application requires applicants to estimate their total tax liability and payments/credits to calculate any balance due. They must pay the balance due or 90% of the total liability, whichever is lower, to qualify for the extension.

azdor.gov Forms .. ADOR Forms 140ES_2004fillable

This document is an Arizona state individual estimated tax payment form for tax year 2004. It provides instructions for taxpayers to make estimated tax payments for the year. The form requests identifying information about the taxpayer and their spouse. It includes spaces to enter the payment amount and select the quarter being paid. The accompanying worksheet helps taxpayers calculate their estimated tax liability and determine the amount to pay for each quarterly installment.

azdor.gov Forms .. ADOR Forms 140ES-2006_f

This document is an Arizona estimated tax payment form for individual taxpayers for tax year 2006. It provides instructions for calculating estimated tax payments owed and includes a worksheet to help estimate taxable income, additions, subtractions, deductions, exemptions, and estimated tax liability. Taxpayers must provide identifying information like names and addresses, select if the payment is mandatory or voluntary, and enter the amount of the estimated tax payment being submitted.

state.ia.us tax forms 0845007

This document provides instructions for calculating penalties for underpayment of estimated taxes on an Iowa individual income tax return form (IA 2210). Key details:

- Lines 1-10 calculate the amount of tax owed for the year. Line 10 is the smaller of the current year or prior year tax.

- Line 11 divides the amount on line 10 by the number of required installment payments, generally 4. This is the minimum payment due per period.

- Line 12 allows for calculating installments using an annualized income method if income varies greatly during the year.

- Lines 13-18 calculate any penalties owed for underpayment of estimated taxes by comparing actual payments to the required installments on line 11 or 12

1040ES-ME vouchers for estimated tax payments

This document provides instructions for filing estimated individual income tax payments in Maine. It outlines who must make estimated payments, how to calculate the estimated tax, when and where payments are due. It includes a worksheet to calculate estimated tax and record of payments form. Key details include paying estimated tax in four installments on April 15, June 16, September 15, and January 15, with options to pay all at once or use prior year overpayment. Penalties apply for underpayment below required thresholds.

Tax return (2)

Norma J. Buchanon electronically filed her 2011 federal tax return showing a refund of $8,234. Some fees were deducted, lowering the refund to $8,176.10. The IRS estimates the refund will be direct deposited by February 1, 2012. Norma provided her bank account information for the deposit. She is not required to sign any documents since she filed electronically. Norma needs to keep her electronic filing instructions and a printed copy of her return.

Claim for Refund of Estimated Gross Income Tax Payment Required on the Sale o...

This document provides instructions for completing Form A-3128 to claim a refund of estimated gross income tax paid in New Jersey. It outlines how to calculate estimated tax liability based on the sale of property and determine the amount of refund being claimed. The form is used by nonresidents to request refunds of overpayments and requires providing details of the property sale such as date, sale price, basis, and gain/loss. It also notes the process involves submitting documentation and the tax year remains open until all filings and payments are made.

revenue.ne.gov tax current f_2210n

This document is an individual underpayment of estimated tax form for Nebraska tax year 2008. It provides instructions for calculating penalties for underpaying estimated quarterly tax payments throughout the year. The form has sections to calculate the required annual payment, quarterly installment amounts, amounts paid vs owed for each period, and sections to figure any underpayment amounts and penalties owed. There are also special instructions and calculations for farmers and ranchers who file by March 1 to qualify for an exemption from estimated tax penalties.

Tax return

This document provides instructions for Carter L April regarding their 2009 federal tax return. It shows that April is due a $437 refund, which was reduced to $379.10 after TurboTax fees were deducted. It provides information on when the refund should be deposited, how to check the status of the refund, and a summary of April's tax filing information. No signature is needed as the return was filed electronically. It includes consent forms for TurboTax to use and disclose certain tax return information in order to process the refund and pay for tax preparation services.

2009 Estimated Individual Income Tax Vouchers

This document provides instructions for filing estimated individual income tax payments in Mississippi for 2009. It outlines who must file estimated payments, when payments are due (in four equal installments on April 15, June 15, September 15, and January 15), and exceptions. It also lists personal exemptions, optional standard deductions, and tax rates that can be used to calculate estimated taxes. The mailing checklist provides details on how to submit estimate payments by mail.

Tax return

This document summarizes Steffanie M Popejoy's 2013 federal tax return. It shows that she is due a $200 refund, which will be direct deposited into her bank account. It provides her address, income of $3,289, and tax details showing $0 tax owed and a $200 refund. The document includes instructions to keep it along with her printed tax return and other tax documents.

azdor.gov Forms .. ADOR Forms 140ES-2007_f

This document is an Arizona estimated tax payment form for individual taxpayers for tax year 2007. It provides instructions for taxpayers to make estimated tax payments, including which box to check for mandatory or voluntary payments. It also includes a worksheet to help calculate estimated tax payments, with steps to estimate taxable income, additions, subtractions, deductions, exemptions, and estimated tax liability. Taxpayers are instructed to enter their payment amount, make checks payable to the Arizona Department of Revenue, and mail the form and payment by a certain date.

MI-8453_260849_7 michigan.gov documents taxes

This document is the Michigan Department of Treasury Form MI-8453 for 2008. It contains sections for taxpayers to declare information about their state tax return that is being e-filed, including income amounts, taxes owed or refunded. The form requires signatures from the taxpayer and preparer to declare that the electronic return is true, correct and complete based on all information provided to them. Instructions are included for how to complete and submit the form if filing a state-only Michigan return separately from the federal return.

Turbo taxreturn

The document provides filing instructions for Fran Swaine's 2013 federal tax return. It shows that she owes $2,941, which she will pay by check by the April 15, 2014 deadline. It includes her signed Form 1040 to mail with her payment, as well as estimated tax payment vouchers for 2014 that she should not send with her 2013 return. Finally, it notes that she can still choose to e-file her 2013 return instead of mailing it.

Amended Individual Income Tax Return

This document is an Indiana amended individual income tax return form (IT-40X) for the year being amended. It provides instructions for taxpayers to correct errors or omissions on their original Indiana individual income tax return. The form collects identifying information about the taxpayer, income and exemption amounts, tax due, credits, payments, and refund or amount due. It directs taxpayers to provide explanations for amendments and attach supporting documentation.

Application for Extension of Time to File

This document is an application for an extension of time to file an Oklahoma income tax return. It provides instructions for taxpayers to request up to a 6 month extension if they cannot file their state return by the original due date. The application requires the taxpayer to estimate their total income tax liability for the tax year and pay at least 90% of that amount by the original filing deadline to qualify for the extension. It also notes that having a federal extension does not automatically provide additional time to file the state return.

azdor.gov Forms 140PTC

This document is an Arizona property tax refund claim form for tax year 2008. It requests information to determine eligibility for the refund such as whether the applicant owned or rented their home in 2008, their Arizona residency status, and total household income. It then calculates the potential refund amount based on an income-based credit schedule, or actual property taxes paid, whichever is less. It provides instructions for direct deposit of any refund amount and for amending a previously filed 2008 claim.

Worksheet IX fill-in

1) The document provides a worksheet and instructions for calculating the taxable amount of recovered itemized deductions from prior years.

2) It explains that only the amount of a recovered deduction that reduced tax liability in the original year is taxable in the recovery year.

3) The worksheet walks through calculating standard deductions, adjusted gross income, taxable income, and recovery amounts to include in income for the current tax year.

ftb.ca.gov forms 09_540esins

This document provides instructions for California taxpayers to estimate their tax liability and make estimated tax payments for tax year 2009. Key details include:

- Taxpayers must make estimated payments if they expect to owe $500 or more in tax for 2009 after subtracting withholding and credits.

- Payments are due April 15, June 15, September 15 of 2009, and January 15 of 2010.

- A worksheet is provided to help calculate estimated tax liability based on 2008 tax return or expected 2009 income.

- Failure to make required estimated payments may result in penalties. Electronic payment is required for payments over $20,000.

Individual Estimated Tax Instructions (2009)

The document provides information about estimated income tax payments in Minnesota, including who must pay estimated tax, how to calculate estimated tax amounts, payment due dates and amounts. Taxpayers can pay estimated tax electronically, by credit card, or by check along with Form M14. The penalties for underpaying estimated tax are also described. Tax rates for 2009 are provided to help calculate estimated tax liabilities.

gov revenue formsandresources forms EXT FID 08 fill-in

This document provides instructions and a worksheet for estates and trusts to calculate their 2008 Montana income tax extension payment. Key details:

- Estates and trusts now have a 5-month automatic extension to file their Montana return instead of 6 months.

- To receive an extension, the taxpayer must have applied for a federal extension and paid 90% of the current year or 100% of the prior year's Montana tax liability by April 15.

- The extension is for filing only, not payment. Late payment penalties and interest apply if the full tax owed is not paid by the deadline.

- The worksheet calculates the minimum payment needed to avoid penalties by comparing the prior and current year tax liabilities to payments and

ML 2016 Year End Tax Planning

This document discusses several tax planning strategies related to estimated quarterly tax payments and year-end transactions. It notes that estimated tax payments are due quarterly and outlines three methods to calculate payments to avoid penalties: the 90% rule, 100/110% rule, and annualization method. It also addresses that estimated tax payments must include taxes from the 3.8% net investment income surtax and additional 0.9% Medicare tax. The document provides tips on timing deductions to maximize their tax benefit and discusses how itemized deductions may be reduced under the phase-out rules. It also covers some AMT planning strategies related to the exemption amounts and timing transactions.

MI-1040ES_michigan.gov documents taxes

This document provides instructions for filing Michigan estimated income tax payments for individuals for 2009. Key details include:

- Estimated tax payments are due April 15, June 15, September 15, 2009 and January 15, 2010. Late payments may incur penalties.

- Payments should be mailed to the Michigan Department of Treasury with the taxpayer's Social Security number and "2009 MI-1040ES" written on the check.

- A worksheet is provided to help taxpayers estimate their 2009 income and exemption amounts to calculate estimated tax payments.

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

1) This document provides instructions for filing estimated tax vouchers in Kentucky for 2009. It notes that the standard deduction has increased to $2,190 and who must make estimated tax payments. 2) Estimated tax payments are due April 15, June 15, September 15, 2009 and January 15, 2010. Failure to pay at least 70% of the tax liability may result in penalties. 3) It provides details on calculating estimated taxes, including the family size tax credit and tax rates. Farmers have different filing requirements.

2008 Amended Income Tax Return for Individuals

The document provides instructions for filing Connecticut estimated income tax payments for 2008 using Form CT-1040ES. Key details include:

- Taxpayers must make estimated payments if their Connecticut tax minus withholding is $1,000 or more and withholding is less than required annual payments.

- Required annual payments are 90% of 2008 Connecticut tax or 100% of 2007 tax if a return was filed for a 12-month period.

- Estimated payments are due April 15, June 15, September 15, 2008 and January 15, 2009.

- Taxpayers may owe interest if estimated payments are insufficient by installment due dates.

More Related Content

What's hot

state.ia.us tax forms 0845007

This document provides instructions for calculating penalties for underpayment of estimated taxes on an Iowa individual income tax return form (IA 2210). Key details:

- Lines 1-10 calculate the amount of tax owed for the year. Line 10 is the smaller of the current year or prior year tax.

- Line 11 divides the amount on line 10 by the number of required installment payments, generally 4. This is the minimum payment due per period.

- Line 12 allows for calculating installments using an annualized income method if income varies greatly during the year.

- Lines 13-18 calculate any penalties owed for underpayment of estimated taxes by comparing actual payments to the required installments on line 11 or 12

1040ES-ME vouchers for estimated tax payments

This document provides instructions for filing estimated individual income tax payments in Maine. It outlines who must make estimated payments, how to calculate the estimated tax, when and where payments are due. It includes a worksheet to calculate estimated tax and record of payments form. Key details include paying estimated tax in four installments on April 15, June 16, September 15, and January 15, with options to pay all at once or use prior year overpayment. Penalties apply for underpayment below required thresholds.

Tax return (2)

Norma J. Buchanon electronically filed her 2011 federal tax return showing a refund of $8,234. Some fees were deducted, lowering the refund to $8,176.10. The IRS estimates the refund will be direct deposited by February 1, 2012. Norma provided her bank account information for the deposit. She is not required to sign any documents since she filed electronically. Norma needs to keep her electronic filing instructions and a printed copy of her return.

Claim for Refund of Estimated Gross Income Tax Payment Required on the Sale o...

This document provides instructions for completing Form A-3128 to claim a refund of estimated gross income tax paid in New Jersey. It outlines how to calculate estimated tax liability based on the sale of property and determine the amount of refund being claimed. The form is used by nonresidents to request refunds of overpayments and requires providing details of the property sale such as date, sale price, basis, and gain/loss. It also notes the process involves submitting documentation and the tax year remains open until all filings and payments are made.

revenue.ne.gov tax current f_2210n

This document is an individual underpayment of estimated tax form for Nebraska tax year 2008. It provides instructions for calculating penalties for underpaying estimated quarterly tax payments throughout the year. The form has sections to calculate the required annual payment, quarterly installment amounts, amounts paid vs owed for each period, and sections to figure any underpayment amounts and penalties owed. There are also special instructions and calculations for farmers and ranchers who file by March 1 to qualify for an exemption from estimated tax penalties.

Tax return

This document provides instructions for Carter L April regarding their 2009 federal tax return. It shows that April is due a $437 refund, which was reduced to $379.10 after TurboTax fees were deducted. It provides information on when the refund should be deposited, how to check the status of the refund, and a summary of April's tax filing information. No signature is needed as the return was filed electronically. It includes consent forms for TurboTax to use and disclose certain tax return information in order to process the refund and pay for tax preparation services.

2009 Estimated Individual Income Tax Vouchers

This document provides instructions for filing estimated individual income tax payments in Mississippi for 2009. It outlines who must file estimated payments, when payments are due (in four equal installments on April 15, June 15, September 15, and January 15), and exceptions. It also lists personal exemptions, optional standard deductions, and tax rates that can be used to calculate estimated taxes. The mailing checklist provides details on how to submit estimate payments by mail.

Tax return

This document summarizes Steffanie M Popejoy's 2013 federal tax return. It shows that she is due a $200 refund, which will be direct deposited into her bank account. It provides her address, income of $3,289, and tax details showing $0 tax owed and a $200 refund. The document includes instructions to keep it along with her printed tax return and other tax documents.

azdor.gov Forms .. ADOR Forms 140ES-2007_f

This document is an Arizona estimated tax payment form for individual taxpayers for tax year 2007. It provides instructions for taxpayers to make estimated tax payments, including which box to check for mandatory or voluntary payments. It also includes a worksheet to help calculate estimated tax payments, with steps to estimate taxable income, additions, subtractions, deductions, exemptions, and estimated tax liability. Taxpayers are instructed to enter their payment amount, make checks payable to the Arizona Department of Revenue, and mail the form and payment by a certain date.

MI-8453_260849_7 michigan.gov documents taxes

This document is the Michigan Department of Treasury Form MI-8453 for 2008. It contains sections for taxpayers to declare information about their state tax return that is being e-filed, including income amounts, taxes owed or refunded. The form requires signatures from the taxpayer and preparer to declare that the electronic return is true, correct and complete based on all information provided to them. Instructions are included for how to complete and submit the form if filing a state-only Michigan return separately from the federal return.

Turbo taxreturn

The document provides filing instructions for Fran Swaine's 2013 federal tax return. It shows that she owes $2,941, which she will pay by check by the April 15, 2014 deadline. It includes her signed Form 1040 to mail with her payment, as well as estimated tax payment vouchers for 2014 that she should not send with her 2013 return. Finally, it notes that she can still choose to e-file her 2013 return instead of mailing it.

Amended Individual Income Tax Return

This document is an Indiana amended individual income tax return form (IT-40X) for the year being amended. It provides instructions for taxpayers to correct errors or omissions on their original Indiana individual income tax return. The form collects identifying information about the taxpayer, income and exemption amounts, tax due, credits, payments, and refund or amount due. It directs taxpayers to provide explanations for amendments and attach supporting documentation.

Application for Extension of Time to File

This document is an application for an extension of time to file an Oklahoma income tax return. It provides instructions for taxpayers to request up to a 6 month extension if they cannot file their state return by the original due date. The application requires the taxpayer to estimate their total income tax liability for the tax year and pay at least 90% of that amount by the original filing deadline to qualify for the extension. It also notes that having a federal extension does not automatically provide additional time to file the state return.

azdor.gov Forms 140PTC

This document is an Arizona property tax refund claim form for tax year 2008. It requests information to determine eligibility for the refund such as whether the applicant owned or rented their home in 2008, their Arizona residency status, and total household income. It then calculates the potential refund amount based on an income-based credit schedule, or actual property taxes paid, whichever is less. It provides instructions for direct deposit of any refund amount and for amending a previously filed 2008 claim.

Worksheet IX fill-in

1) The document provides a worksheet and instructions for calculating the taxable amount of recovered itemized deductions from prior years.

2) It explains that only the amount of a recovered deduction that reduced tax liability in the original year is taxable in the recovery year.

3) The worksheet walks through calculating standard deductions, adjusted gross income, taxable income, and recovery amounts to include in income for the current tax year.

What's hot (15)

Claim for Refund of Estimated Gross Income Tax Payment Required on the Sale o...

Claim for Refund of Estimated Gross Income Tax Payment Required on the Sale o...

Similar to gov revenue formsandresources forms ESW-FID_fill-in

ftb.ca.gov forms 09_540esins

This document provides instructions for California taxpayers to estimate their tax liability and make estimated tax payments for tax year 2009. Key details include:

- Taxpayers must make estimated payments if they expect to owe $500 or more in tax for 2009 after subtracting withholding and credits.

- Payments are due April 15, June 15, September 15 of 2009, and January 15 of 2010.

- A worksheet is provided to help calculate estimated tax liability based on 2008 tax return or expected 2009 income.

- Failure to make required estimated payments may result in penalties. Electronic payment is required for payments over $20,000.

Individual Estimated Tax Instructions (2009)

The document provides information about estimated income tax payments in Minnesota, including who must pay estimated tax, how to calculate estimated tax amounts, payment due dates and amounts. Taxpayers can pay estimated tax electronically, by credit card, or by check along with Form M14. The penalties for underpaying estimated tax are also described. Tax rates for 2009 are provided to help calculate estimated tax liabilities.

gov revenue formsandresources forms EXT FID 08 fill-in

This document provides instructions and a worksheet for estates and trusts to calculate their 2008 Montana income tax extension payment. Key details:

- Estates and trusts now have a 5-month automatic extension to file their Montana return instead of 6 months.

- To receive an extension, the taxpayer must have applied for a federal extension and paid 90% of the current year or 100% of the prior year's Montana tax liability by April 15.

- The extension is for filing only, not payment. Late payment penalties and interest apply if the full tax owed is not paid by the deadline.

- The worksheet calculates the minimum payment needed to avoid penalties by comparing the prior and current year tax liabilities to payments and

ML 2016 Year End Tax Planning

This document discusses several tax planning strategies related to estimated quarterly tax payments and year-end transactions. It notes that estimated tax payments are due quarterly and outlines three methods to calculate payments to avoid penalties: the 90% rule, 100/110% rule, and annualization method. It also addresses that estimated tax payments must include taxes from the 3.8% net investment income surtax and additional 0.9% Medicare tax. The document provides tips on timing deductions to maximize their tax benefit and discusses how itemized deductions may be reduced under the phase-out rules. It also covers some AMT planning strategies related to the exemption amounts and timing transactions.

MI-1040ES_michigan.gov documents taxes

This document provides instructions for filing Michigan estimated income tax payments for individuals for 2009. Key details include:

- Estimated tax payments are due April 15, June 15, September 15, 2009 and January 15, 2010. Late payments may incur penalties.

- Payments should be mailed to the Michigan Department of Treasury with the taxpayer's Social Security number and "2009 MI-1040ES" written on the check.

- A worksheet is provided to help taxpayers estimate their 2009 income and exemption amounts to calculate estimated tax payments.

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

1) This document provides instructions for filing estimated tax vouchers in Kentucky for 2009. It notes that the standard deduction has increased to $2,190 and who must make estimated tax payments. 2) Estimated tax payments are due April 15, June 15, September 15, 2009 and January 15, 2010. Failure to pay at least 70% of the tax liability may result in penalties. 3) It provides details on calculating estimated taxes, including the family size tax credit and tax rates. Farmers have different filing requirements.

2008 Amended Income Tax Return for Individuals

The document provides instructions for filing Connecticut estimated income tax payments for 2008 using Form CT-1040ES. Key details include:

- Taxpayers must make estimated payments if their Connecticut tax minus withholding is $1,000 or more and withholding is less than required annual payments.

- Required annual payments are 90% of 2008 Connecticut tax or 100% of 2007 tax if a return was filed for a 12-month period.

- Estimated payments are due April 15, June 15, September 15, 2008 and January 15, 2009.

- Taxpayers may owe interest if estimated payments are insufficient by installment due dates.

ct2008 Connecticut Telefile Tax Return and Instructions -

The document provides instructions for filing Connecticut estimated income tax payments for 2008 using Form CT-1040ES. Key details include:

- Taxpayers must make estimated payments if their Connecticut income tax minus withholding is $1,000 or more, and withholding is less than their required annual payment.

- The required annual payment is the lesser of 90% of the 2008 Connecticut income tax or 100% of the 2007 tax.

- Estimated payments are due April 15, June 15, September 15, 2008 and January 15, 2009.

- The worksheet provides guidance on calculating estimated tax liability and payment amounts due each installment.

ct-1040esdrs forms 2008forms incometax

The document provides instructions for filing Connecticut estimated income tax payments for 2008 using Form CT-1040ES. Key details include:

- Taxpayers must make estimated payments if their Connecticut income tax minus withholding is $1,000 or more, and withholding is less than their required annual payment.

- The required annual payment is the lesser of 90% of the 2008 Connecticut income tax or 100% of the 2007 tax.

- Estimated payments are due April 15, June 15, September 15, 2008 and January 15, 2009.

- The worksheet provides guidance on calculating estimated tax liability and payment amounts due each installment.

If you are self-employed or do not have Maryland income taxes withheld by an ...

This document is a Maryland personal declaration of estimated income tax form for tax year 2009. It provides instructions for taxpayers to estimate their income tax liability and pay it in quarterly installments throughout the year. Key details include:

- Taxpayers must file a declaration if their income tax is expected to exceed $500 of what will be withheld from wages.

- The first estimated payment of 25% of the total estimated tax is due April 15, 2009, with subsequent payments due June 15, September 15, and January 15 of the following year.

- A worksheet is provided to help taxpayers calculate their estimated federal adjusted gross income, Maryland adjusted gross income, deductions, exemptions, taxable income, income tax amount,

Declaration of Estimated Maryland Income Tax

This document is a Maryland personal declaration of estimated income tax form for tax year 2009. It provides instructions for taxpayers to estimate their 2009 income tax liability and pay in quarterly installments. Key details include:

- Taxpayers must file a declaration if their estimated tax is over $500 more than Maryland income tax withheld.

- The first estimated payment of at least 25% of the total is due April 15, 2009, with subsequent payments due June 15, September 15, 2009 and January 15, 2010.

- A worksheet is provided to help estimate adjusted gross income, deductions, exemptions, taxable income, and state and local income tax amounts.

2009 Estimated Connecticut Income Tax Payment Coupon for Individuals [

This document provides instructions for filing Connecticut estimated income tax payments for the 2009 tax year using Form CT-1040ES. Key details include:

- Taxpayers must make estimated payments if their Connecticut income tax will be $1,000 or more more than taxes withheld.

- Payments are due on April 15, June 15, September 15 of 2009 and January 15 of 2010.

- The required annual payment is the lesser of 90% of the tax on the 2009 return or 100% of the tax on the 2008 return.

- A worksheet is provided to calculate the estimated tax liability and required installment payments. It takes into account items like modifications, credits, and alternative minimum tax.

2008 Connecticut CT-1040EZ/Telefile Tax Return and

This document provides instructions for filing estimated income tax payments for the 2009 tax year in Connecticut. Key details include:

- Taxpayers must make estimated payments if their Connecticut income tax minus withholding is $1,000 or more and withholding is less than their required annual payment.

- The required annual payment is 90% of the tax on the 2009 return or 100% of the tax on the 2008 return.

- Estimated payment coupons are due on April 15, June 15, September 15, 2009, and January 15, 2010.

- Taxpayers may owe interest if estimated payments are insufficient by the due dates, even if the total tax is paid by the filing deadline.

ct-1040esdrs forms 2008forms incometax

This document provides instructions for filing Connecticut estimated income tax payments for the 2009 tax year using Form CT-1040ES. Key details include:

- Taxpayers must make estimated payments if their Connecticut income tax will be $1,000 or more more than taxes withheld.

- Payments are due on April 15, June 15, September 15 of 2009 and January 15 of 2010.

- The required annual payment is the lesser of 90% of the tax on the 2009 return or 100% of the tax on the 2008 return.

- A worksheet is provided to calculate the estimated tax liability and required installment payments. Farmers and fishermen need only make one payment by January 15, 2010.

gov revenue formsandresources forms EXT-08_fill-in

This document provides instructions for calculating an extension payment for Montana individual income tax for tax year 2008. It explains how to determine the payment amount owed by April 15, 2009 in order to receive an extension to file the tax return. The form walks through a worksheet to calculate the payment as the smaller of 100% of the 2007 tax liability or 90% of the calculated 2008 tax liability, less credits and payments made. It stresses that an extension to file is not an extension to pay, so penalties and interest will apply to any unpaid amounts by the deadline.

2007 Package A Request Form For Tax Preparers

The document provides instructions and information for filing estimated tax declarations and making payments for Arkansas state income tax year 2009. It states that taxpayers must file a declaration if their estimated tax is over $1,000. Taxpayers must make estimated payments in four installments due April 15, June 15, September 15, and January 15. The document provides a worksheet to help calculate estimated tax and instructions for completing declaration vouchers to submit estimated payments.

AR1000ES - Estimated Income Tax Vouchers & Instructions for 2009

The document provides instructions and information for filing estimated tax declarations and making payments for Arkansas state income tax year 2009. It states that taxpayers must file a declaration if their estimated tax is over $1,000. Taxpayers must make estimated payments in four installments by April 15, June 15, September 15, and January 15. The document provides a worksheet to help calculate estimated tax and instructions for completing declaration vouchers to submit estimated payments.

revenue.ne.gov tax current f_1040nes_2009

The document provides instructions for making estimated income tax payments in Nebraska for 2009. It notes that estimated payments are required if an individual's Nebraska income tax is expected to exceed withholding and credits by $500 or more. It instructs taxpayers on how to calculate their estimated tax, when payments are due, and penalties for underpayment. The document includes worksheets, payment vouchers, and information on electronic payment options.

revenue.ne.gov tax current f_1040nes_2009

The document provides instructions for making estimated income tax payments in Nebraska for 2009. It notes that estimated payments are required if an individual's Nebraska income tax is expected to exceed withholding and credits by $500 or more. It instructs taxpayers on how to calculate their estimated tax, when payments are due, and penalties for underpayment. It also provides options for electronic payment of estimated taxes by EFT or credit card.

revenue.ne.gov tax current f_1040nes_2009

The document provides instructions for making estimated income tax payments in Nebraska for 2009. It notes that estimated payments are required if an individual's Nebraska income tax is expected to exceed withholding and credits by $500 or more. It instructs taxpayers on how to calculate their estimated tax, when payments are due, and penalties for underpayment. The document includes worksheets, payment vouchers, and information on electronic payment options.

Similar to gov revenue formsandresources forms ESW-FID_fill-in (20)

gov revenue formsandresources forms EXT FID 08 fill-in

gov revenue formsandresources forms EXT FID 08 fill-in

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

ct2008 Connecticut Telefile Tax Return and Instructions -

ct2008 Connecticut Telefile Tax Return and Instructions -

If you are self-employed or do not have Maryland income taxes withheld by an ...

If you are self-employed or do not have Maryland income taxes withheld by an ...

2009 Estimated Connecticut Income Tax Payment Coupon for Individuals [

2009 Estimated Connecticut Income Tax Payment Coupon for Individuals [

2008 Connecticut CT-1040EZ/Telefile Tax Return and

2008 Connecticut CT-1040EZ/Telefile Tax Return and

gov revenue formsandresources forms EXT-08_fill-in

gov revenue formsandresources forms EXT-08_fill-in

AR1000ES - Estimated Income Tax Vouchers & Instructions for 2009

AR1000ES - Estimated Income Tax Vouchers & Instructions for 2009

More from taxman taxman

ftb.ca.gov forms 09_3528a

This document is an application for a California homebuyer's tax credit. It contains sections for the seller to certify that the home has never been occupied, as well as sections for the escrow company to provide closing details. Finally, there are sections for up to three qualified buyers to provide their contact and ownership information and certify that they intend to use the home as their primary residence for at least two years. The buyers will receive a tax credit of up to 5% of the home's purchase price or $10,000, whichever is less.

ftb.ca.gov forms 09_593bk

This document contains Forms 593-C and 593-E and instructions for real estate withholding in California for 2009. It explains that real estate withholding is a prepayment of estimated income tax due from gains on real estate sales in California. The Real Estate Escrow Person is responsible for providing the forms to sellers and withholding the appropriate amount based on the forms submitted.

ftb.ca.gov forms 09_593v

This document provides instructions for completing Form 593-V Payment Voucher for Real Estate Withholding Electronic Submission. Key details include:

1) Form 593-V is used to remit real estate withholding payment to the Franchise Tax Board if Form 593 was filed electronically. It must include the withholding agent's identifying information and payment amount.

2) Payments can be made by check or money order payable to the Franchise Tax Board, or through electronic funds transfer for large payments. The payment must match the electronically filed Form 593.

3) Payments are due within 20 days of the end of the month in which the real estate transaction occurred. Interest and penalties

ftb.ca.gov forms 09_593i

This document provides instructions for California real estate withholding on installment sales. It explains that for tax years beginning on or after January 1, 2009, the buyer is required to withhold taxes on the principal portion of each installment payment for properties sold via an installment sale. The form guides the buyer through providing their contact information, the seller's information, acknowledging the withholding requirement, and signing to indicate they understand their obligation to withhold taxes and send payments to the state. Escrow agents are instructed to send the initial withholding amount to the state and provide copies of documents to help facilitate ongoing withholding as future installment payments are made.

ftb.ca.gov forms 09_593c

This document is a California Form 593-C, which is a Real Estate Withholding Certificate. It allows a seller of California real estate to certify exemptions from real estate withholding requirements. The form has four parts: seller information, certifications that fully exempt from withholding, certifications that may partially or fully exempt, and the seller's signature. Checking boxes in Part II or III can allow full or partial exemption from the default 3 1/3% withholding on the sales price of California real estate.

ftb.ca.gov forms 09_593

This document is a California Form 593 for real estate withholding tax. It contains information about the withholding agent, seller or transferor, escrow or exchange details, and transaction details. The form requires the seller to sign a perjury statement if electing an optional gain on sale calculation method rather than the default 3 1/3% of total sales price withholding amount.

ftb.ca.gov forms 09_592v

This document provides instructions for completing Form 592-V, the payment voucher for electronically filed Form 592 (Quarterly Resident and Nonresident Withholding Statement) and Form 592-F (Foreign Partner or Member Annual Return). Key details include verifying complete information is provided on the voucher, rounding cents to dollars, mailing the payment and voucher to the Franchise Tax Board by the payment due date, and interest and penalties for late payments.

ftb.ca.gov forms 09_592b

This document is a California Form 592-B for the tax year 2009. It provides instructions for withholding agents and recipients regarding nonresident and resident withholding. Key details include:

- Form 592-B is used to report income subject to withholding and the amount of California tax withheld.

- It must be provided to recipients by January 31 and to foreign partners by the 15th day of the 4th month following the close of the taxable year.

- The recipient should attach Copy B to their California tax return to claim the withholding amount.

ftb.ca.gov forms 09_592a

This document is a Foreign Partner or Member Quarterly Withholding Remittance Statement form for tax year 2009 from the California Franchise Tax Board. It contains instructions for three installment payments due by the 15th day of the 4th, 6th, and 9th months of the tax year. The form collects identifying information about the Withholding Agent such as name, address, ID number, and payment amounts to be remitted to the Franchise Tax Board.

ftb.ca.gov forms 09_592

This document is a Quarterly Resident and Nonresident Withholding Statement form for tax year 2009. It is used to report tax amounts withheld from payments made to independent contractors, recipients of rents/royalties, distributions to shareholders/partners/beneficiaries, and other types of income. The form includes sections to enter information about the withholding agent, types of income, amounts of tax withheld and due, and a schedule of payees listing details of payments made and tax withheld for each recipient. Instructions are provided on filing deadlines, common errors to avoid, electronic filing requirements, interest and penalties.

ftb.ca.gov forms 09_590p

This document is a Nonresident Withholding Exemption Certificate form used to certify an exemption from withholding on distributions of previously reported income from an S corporation, partnership, or LLC. It allows a nonresident shareholder, partner, or member to claim exemption if the income represented by the distribution was already reported on their California tax return. The form requires information about the entity and individual, and certification that the income has been reported. It is to be kept by the entity and presented to claim exemption from withholding requirements on distributions of prior year income.

ftb.ca.gov forms 09_590

This document is a Withholding Exemption Certificate form from the California Franchise Tax Board. It allows individuals and entities to certify an exemption from California nonresident income tax withholding. The form contains checkboxes for different types of taxpayers, including individuals, corporations, partnerships, LLCs, tax-exempt entities, and trusts, to claim an exemption based on their status. It requires the taxpayer's name, address, and signature to certify that the information provided is true and correct.

ftb.ca.gov forms 09_588

This document is a request form for a waiver of nonresident withholding in California. It requests information about the requester, withholding agent, and payees. The requester provides their name and address and selects the type of income payment for which a waiver is requested. The withholding agent's name and address are also provided. In the vendor/payee section, names, addresses, and tax identification numbers are listed along with the reason for waiver request. Reasons include having current tax returns on file, making estimated payments, being a member of a combined reporting entity, or other special circumstances. The form is signed under penalty of perjury.

ftb.ca.gov forms 09_587

This document is a Nonresident Withholding Allocation Worksheet (Form 587) used to determine if withholding of income tax is required for payments made by a withholding agent to a nonresident vendor/payee. The vendor/payee provides information about the types of payments received and allocation of income between California and other states. The withholding agent uses this information to determine if withholding of 7% is required based on the amount of California-source income payments exceeding $1,500.

ftb.ca.gov forms 09_570

This document is a tax return form for California's nonadmitted insurance tax. It provides instructions for calculating taxes owed on insurance premiums paid to insurers not authorized to conduct business in California. The form includes sections to enter the taxpayer's information, identify the tax period and insurance contracts, compute the tax amount, and make payments or claim refunds. It also provides directions on filing amended returns, payment due dates, and authorizing a third party to discuss the filing with the tax agency.

ftb.ca.gov forms 09_541es

The document provides instructions for Form 541-ES, which is used to calculate and pay estimated tax for estates and trusts. Key details include:

- Estimated tax payments for 2009 are now required to be 30% of the estimated tax liability for the 1st and 2nd installments and 20% for the 3rd and 4th installments.

- Estates and trusts with a 2009 adjusted gross income of $1,000,000 or more must base estimated tax payments on their 2009 tax liability rather than the prior year's tax.

- The form and instructions provide guidance on calculating estimated tax, payment due dates, and how to complete and submit Form 541-ES.

ftb.ca.gov forms 09_540es

This document provides instructions for making estimated tax payments for individuals in California. It includes:

1) Directions for making online payments through the Franchise Tax Board website for ease and to schedule payments up to a year in advance.

2) A form for making estimated tax payments by mail on April 15, June 15, September 15, and January 15 that includes fields for name, address, amounts owed, and payment instructions.

3) Reminders not to combine estimated tax payments with tax payments from the previous year and to write your name and identification number on the check.

ftb.ca.gov forms 1240

This document contains contact information for the California Franchise Tax Board. It lists phone numbers and addresses for various tax-related services, including automated phone services, taxpayer assistance, tax practitioner services, and departments within the FTB that handle issues like collections, bankruptcy, and deductions. The board members and executive officer are also named.

ftb.ca.gov forms 1015B

This document provides answers to frequently asked questions about tax audits conducted by the Franchise Tax Board of California. It explains that the purpose of an audit is to fairly verify the correct amount of taxes owed. It addresses questions about obtaining representation, responding to information requests, payment plans if additional taxes are owed, and appeal rights. The document directs taxpayers to contact their auditor or the Franchise Tax Board directly for additional assistance.

101-170-05fill

This document is an Oregon Working Family Child Care Credit form for tax year 2005. It contains instructions for calculating an individual's child care credit based on their household size, adjusted gross income, qualifying child care expenses paid, and number of qualifying children. Tables are provided that correspond to different household sizes and income brackets to determine the decimal amount used in the credit calculation formula.

More from taxman taxman (20)

Recently uploaded

IMG_20240615_091110.pdf dpboss guessing

Satta matka fixx jodi panna all market dpboss matka guessing fixx panna jodi kalyan and all market game liss cover now 420 matka office mumbai maharashtra india fixx jodi panna

Call me 9040963354

WhatsApp 9040963354

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

9356872877Sattamatka.satta.matka.satta matka.kalyan weekly chart.kalyan chart.kalyan jodi chart.kalyan penal chart.kalyan today.kalyan open.fix satta.fix fix fix Satta matka nambar.Discover the Beauty and Functionality of The Expert Remodeling Service

Unlock your kitchen's true potential with expert remodeling services from O'Brien Group Inc. Transform your space into a functional, modern, and luxurious haven with their experienced professionals. From layout reconfiguration to high-end upgrades, they deliver stunning results tailored to your style and needs. Visit obriengroupinc.com to elevate your kitchen's beauty and functionality today.

The Steadfast and Reliable Bull: Taurus Zodiac Sign

Explore the steadfast and reliable nature of the Taurus Zodiac Sign. Discover the personality traits, key dates, and horoscope insights that define the determined and practical Taurus, and learn how their grounded nature makes them the anchor of the zodiac.

1 Circular 003_2023 ISO 27001_2022 Transition Arrangments v3.pdf

1 Circular 003_2023 ISO 27001_2022 Transition Arrangments v3.pdf

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

SATTA MATKA DPBOSS KALYAN MATKA RESULTS KALYAN MATKA MATKA RESULT KALYAN MATKA TIPS SATTA MATKA MATKA COM MATKA PANA JODI TODAY BATTA SATKA MATKA PATTI JODI NUMBER MATKA RESULTS MATKA CHART MATKA JODI SATTA COM INDIA SATTA MATKA MATKA TIPS MATKA WAPKA ALL MATKA RESULT LIVE ONLINE MATKA RESULT KALYAN MATKA RESULT DPBOSS MATKA 143 MAIN MATKA KALYAN MATKA RESULTS KALYAN CHART KALYAN CHART

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Transport Solution

NIMA2024 | De toegevoegde waarde van DEI en ESG in campagnes | Nathalie Lam |...

Nathalie zal delen hoe DEI en ESG een fundamentele rol kunnen spelen in je merkstrategie en je de juiste aansluiting kan creëren met je doelgroep. Door middel van voorbeelden en simpele handvatten toont ze hoe dit in jouw organisatie toegepast kan worden.

欧洲杯投注-欧洲杯投注外围盘口-欧洲杯投注盘口app|【网址🎉ac22.net🎉】

【网址🎉ac22.net🎉】欧洲杯投注是体育博彩和在线赌场之一,得益于UKGC的三项许可。 成立之初是三名博彩公司将40家博彩商店的合并的结果,共同创建一家名为欧洲杯投注的公司。 欧洲杯投注在线赌场为游戏爱好者提供了300多种游戏,其中200多种老虎机,其他游戏包括二十一点,轮盘,真人荷官和真人赌场等。

High-Quality IPTV Monthly Subscription for $15

Experience high-quality entertainment with our IPTV monthly subscription for just $15. Access a vast array of live TV channels, movies, and on-demand shows with crystal-clear streaming. Our reliable service ensures smooth, uninterrupted viewing at an unbeatable price. Perfect for those seeking premium content without breaking the bank. Start streaming today!

https://rb.gy/f409dk

2024.06 CPMN Cambridge - Beyond Now-Next-Later.pdf

Slides presented by Phil Hornby, Founder and Director of "for product people", at Cambridge Product Management Network, on Monday 17th June 2024.

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

SATTA MATKA DPBOSS KALYAN MATKA RESULTS KALYAN CHART KALYAN MATKA MATKA RESULT KALYAN MATKA TIPS SATTA MATKA MATKA COM MATKA PANA JODI TODAY BATTA SATKA MATKA PATTI JODI NUMBER MATKA RESULTS MATKA CHART MATKA JODI SATTA COM INDIA SATTA MATKA MATKA TIPS MATKA WAPKA ALL MATKA RESULT LIVE ONLINE MATKA RESULT KALYAN MATKA RESULT DPBOSS MATKA 143 MAIN MATKA KALYAN MATKA RESULTS KALYAN CHART

欧洲杯赌球-欧洲杯赌球买球官方官网-欧洲杯赌球比赛投注官网|【网址🎉ac55.net🎉】

【网址🎉ac55.net🎉】欧洲杯赌球是世界上历史最悠久的博彩公司之一。其历史可以追溯到十九世纪末,确切时间是1886年。这家英国公司拥有超过15000名员工,是博彩行业规模最大的公司。欧洲杯赌球是英国最受欢迎的实体博彩公司之一,其排名仅次于欧洲杯赌球,旗下2800家投注站遍布全英国。

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

SATTA MATKA DPBOSS KALYAN MATKA RESULTS KALYAN CHART KALYAN MATKA MATKA RESULT KALYAN MATKA TIPS SATTA MATKA MATKA COM MATKA PANA JODI TODAY BATTA SATKA MATKA PATTI JODI NUMBER MATKA RESULTS MATKA CHART MATKA JODI SATTA COM INDIA SATTA MATKA MATKA TIPS MATKA WAPKA ALL MATKA RESULT LIVE ONLINE MATKA RESULT KALYAN MATKA RESULT DPBOSS MATKA 143 MAIN MATKA KALYAN MATKA RESULTS KALYAN CHART

Efficient PHP Development Solutions for Dynamic Web Applications

Unlock the full potential of your web projects with our expert PHP development solutions. From robust backend systems to dynamic front-end interfaces, we deliver scalable, secure, and high-performance applications tailored to your needs. Trust our skilled team to transform your ideas into reality with custom PHP programming, ensuring seamless functionality and a superior user experience.

Adani Group's Active Interest In Increasing Its Presence in the Cement Manufa...

Time and again, the business group has taken up new business ventures, each of which has allowed it to expand its horizons further and reach new heights. Even amidst the Adani CBI Investigation, the firm has always focused on improving its cement business.

Unlocking WhatsApp Marketing with HubSpot: Integrating Messaging into Your Ma...

50 million companies worldwide leverage WhatsApp as a key marketing channel. You may have considered adding it to your marketing mix, or probably already driving impressive conversions with WhatsApp.

But wait. What happens when you fully integrate your WhatsApp campaigns with HubSpot?

That's exactly what we explored in this session.

We take a look at everything that you need to know in order to deploy effective WhatsApp marketing strategies, and integrate it with your buyer journey in HubSpot. From technical requirements to innovative campaign strategies, to advanced campaign reporting - we discuss all that and more, to leverage WhatsApp for maximum impact. Check out more details about the event here https://events.hubspot.com/events/details/hubspot-new-delhi-presents-unlocking-whatsapp-marketing-with-hubspot-integrating-messaging-into-your-marketing-strategy/

Recently uploaded (20)

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka

Discover the Beauty and Functionality of The Expert Remodeling Service

Discover the Beauty and Functionality of The Expert Remodeling Service

The Steadfast and Reliable Bull: Taurus Zodiac Sign

The Steadfast and Reliable Bull: Taurus Zodiac Sign

1 Circular 003_2023 ISO 27001_2022 Transition Arrangments v3.pdf

1 Circular 003_2023 ISO 27001_2022 Transition Arrangments v3.pdf

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

NIMA2024 | De toegevoegde waarde van DEI en ESG in campagnes | Nathalie Lam |...

NIMA2024 | De toegevoegde waarde van DEI en ESG in campagnes | Nathalie Lam |...

2024.06 CPMN Cambridge - Beyond Now-Next-Later.pdf

2024.06 CPMN Cambridge - Beyond Now-Next-Later.pdf

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

Satta Matka Dpboss Kalyan Matka Results Kalyan Chart

Efficient PHP Development Solutions for Dynamic Web Applications

Efficient PHP Development Solutions for Dynamic Web Applications

Adani Group's Active Interest In Increasing Its Presence in the Cement Manufa...

Adani Group's Active Interest In Increasing Its Presence in the Cement Manufa...

Unlocking WhatsApp Marketing with HubSpot: Integrating Messaging into Your Ma...

Unlocking WhatsApp Marketing with HubSpot: Integrating Messaging into Your Ma...

gov revenue formsandresources forms ESW-FID_fill-in

- 1. MONTANA CLEAR FORM ESW-FID New 06-08 2009 Montana Fiduciary Estimated Income Tax Worksheet Keep this worksheet for your records To estimate your 2009 income tax due, you may use your 2008 income tax due from Form FID, line 55. If you choose this method, skip lines 1 through 8 and enter your 2008 tax due on line 9b below, otherwise begin with line 1. 1. Enter your 2009 estimated Montana adjusted gross income here ..................................................1. 2. Enter the estimated amount of your: a. 2009 expected income distribution deduction .............................................. 2a. b. 2009 exemption ($2,140) ............................................................................. 2b. 2140 Add lines 2a and 2b and enter the result here ............................................................................2. 3. Subtract line 2 from line 1 and enter the result here. This is your 2009 estimated taxable income. If the result is zero or less, stop here. You are not subject to estimated tax payments in 2009 ............3. 4. Calculate your estimated 2009 income tax: a. Multiply the amount on line 3 using the tax table on the back of this form and enter the result here ..................................................................................... 4a. b. If you have net capital gains included in your estimated Montana adjusted gross income on line 1, multiply the net capital gains amount (less the amount of net capital gains distributed to a beneficiary) by 2% (0.02) and enter the result here ..................................................................................... 4b. Subtract line 4b from 4a and enter the result here. This is your 2009 estimated resident tax after capital gains tax credit.................................................................................................................4. 5. Enter your 2009 estimated nonrefundable single-year credits and carryover credits here .............5. 6. Subtract line 5 from line 4 and enter the result here. This is your 2009 estimated total tax after nonrefundable credits. .....................................................................................................................6. 7. Enter your estimated 2009 recapture taxes here ............................................................................7. 8. Add lines 6 and 7 and enter the result here. This is your 2009 estimated total tax due. .................8. 9. a. Multiply line 8 by 90% (0.90) and enter the result here ................................ 9a. b. Enter 100% of the tax due shown on your 2008 income tax return Form FID, line 55........................................................................................................... 9b. Enter the smaller of line 9a or 9b. If you are unable to compute line 9a, enter the amount from line 9b..........................................................................................................................................9. 10. a. Enter the amount of your estimated Montana income tax withheld in 2009. (Examples include withholding on wages, pensions, annuities, pass-through entities, mineral royalty, etc.) ...................................................................... 10a. b. Enter the amount of your 2008 overpayment that was applied to your 2009 income tax .................................................................................................. 10b. c. Enter the amount of your 2009 estimated refundable credits. This includes your elderly homeowner/renter credit, film employment production credit, film qualified expenditure credit and Insure Montana credit ............................. 10c. Add lines 10a, 10b, and 10c and enter the result here. This is your 2009 estimated payments. .10. 11. Subtract line 10 from line 8. If the result is less than $500, stop here; the estate or trust is not subject to estimated tax payments in 2009. If the result is $500 or more, subtract line 10 from line 9 and enter the amount here and continue to line 12. ................................................................... 11. a. b. c. d. Payment Due Dates April 15, 2009 June 15, 2009 Sept. 15, 2009 Jan 15, 2010 12. Divide the amount on line 11 by four (4) and enter the result in columns a, b, c and d ..........................................12. 13. Enter your annualized income installment amount from Form ESA, line 25c...........................................................13. 14. Enter the amount from line 12 or line 13 whichever applies. This is your installment payment due for each period. 14. If the payment date falls on a weekend or a holiday, your payment is due on the next business day. 175

- 2. dates are the 15th day of the fourth, sixth, and ninth months 2008 Montana Fiduciary Income Tax Table of the fiscal year and the first month of the following fiscal If Your Taxable Multiply But Not And This Is year. Income Is Your Taxable More Than Subtract Your Tax I completed my estimated income tax worksheet at the More Than Income By $0 $2,600 1% (0.010) $0 beginning of the year and did not anticipate a change $2,600 $4,600 2% (0.020) $26 in my income throughout the year. What do I need to $4,600 $7,000 3% (0.030) $72 do if my income situation changes during the year? $7,000 $9,500 4% (0.040) $142 If your tax situation changes during the year, you will need $9,500 $12,200 5% (0.050) $237 to recalculate your estimated tax payments. Your remaining $12,200 $15,600 6% (0.060) $359 installment payments will need to be proportionally More Than $15,600 6.9% (0.069) $499 changed so that the balance of your estimated payments is For Example: Taxable Income $6,800 X 3% (0.030) = $204; $204 paid equally over the remaining installment periods. Minus $72 = $132 Tax How can I determine the amount of my estimated withholding that I will have in 2009? General Information You can use your 2009 paycheck or pension check stubs that you have received to date to estimate the amount of What is the purpose of Form ESW-FID? withholding that you may have in 2009. The purpose of this form is to assist you in calculating your I am a nonresident of Montana. Do I have to make 2009 estimated income tax. Estimated tax payments are estimated tax payments? a method used to pay tax on income that is not subject to withholding. Examples of income that may not be subject As a nonresident trust, you are required to make estimated to withholding includes interest, dividends, rents, capital tax payments if you expect to owe at least $500 in Montana gains, royalties, etc. income tax after subtracting your Montana withholding paid and credits that you are entitled to. Am I required to make estimated tax payments in 2009? I did not make estimated tax payments in 2009 and my You are required to make estimated tax payments in 2009 income tax due is more than $500. Am I subject to any if you expect to owe an income tax liability of at least penalties and interest on my underpayment? $500 after you subtract your tax credits and withholding payments. Yes you are. You are required to pay your income tax liability throughout the year. You can make your payments If you are required to make estimated tax payments, these through employer withholding, installment payments of payments will be the smaller of: estimated taxes, or a combination of employer withholding • 100% of your 2008 Montana tax due reported on Form and estimated tax payments. FID-3, line 55, or If you did not pay in advance at least 90% of your 2009 • 90% of your 2009 Montana income tax due. income tax liability (after applying your credits) or 100% of Who is not required to make estimated payments? your 2008 income tax liability (after applying your credits), you may have to pay interest on the underpayment of your You are not required to make estimated tax payments in estimated tax. 2009 if you meet one of the following criteria: If you have questions, please call us toll free at • Your 2009 income tax due after credits and withholding (866) 859-2254 (in Helena, 444-6900). is less than $500. • Your 2008 tax period covered 12 months and your Montana tax due was zero. • You were not required to file a 2008 Montana income tax return. When are my estimated tax payments due? When you file your return on a calendar year basis, you may prepay all of your estimated taxes for 2009 by April 15, 2009, or you may pay them in four equal amounts that are due on the dates listed below. First payment - due April 15, 2009 Second payment - due June 15, 2009 Third payment - due Sept 15, 2009 Fourth payment - due Jan 15, 2010 If any of these installment dates fall on a weekend or a holiday, your payment is due on the next business day. If you file your return on a fiscal year basis, your payment