Embed presentation

Download to read offline

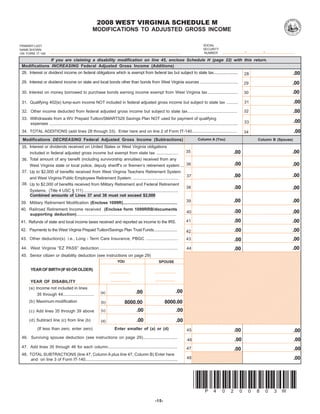

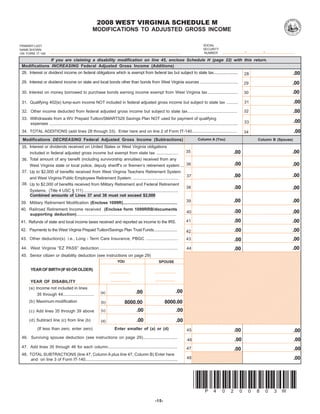

This document is a 2008 West Virginia tax form for reporting modifications to adjusted gross income. It lists various additions and subtractions that can modify a taxpayer's federal adjusted gross income for state tax purposes. Some key additions include tax-exempt interest from other states/localities and withdrawals from college savings plans not used for education. Key subtractions include certain retirement benefits, railroad retirement income, and senior/disability deductions. The taxpayer calculates total additions and subtractions and reports the amounts on the state tax return.