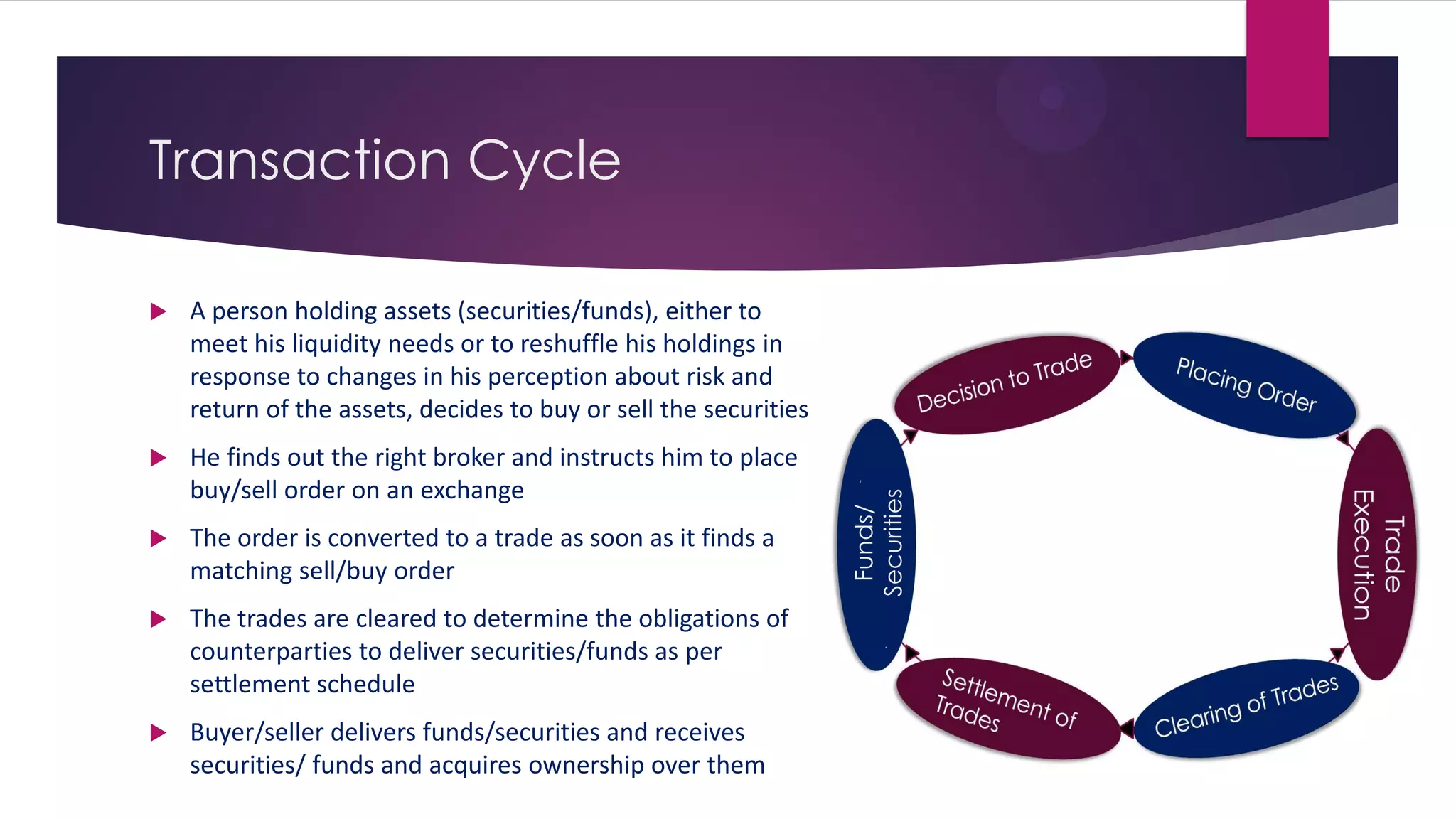

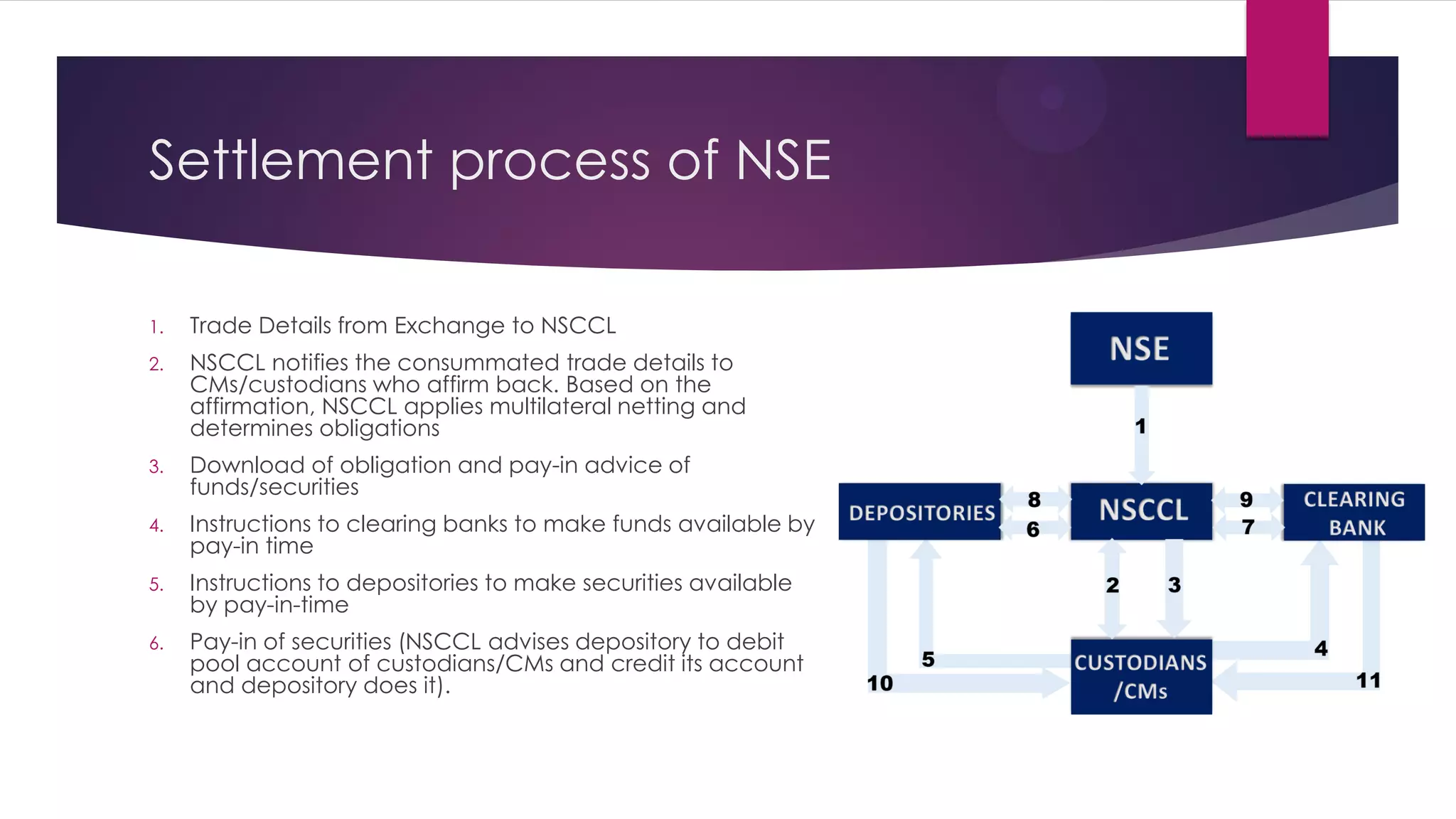

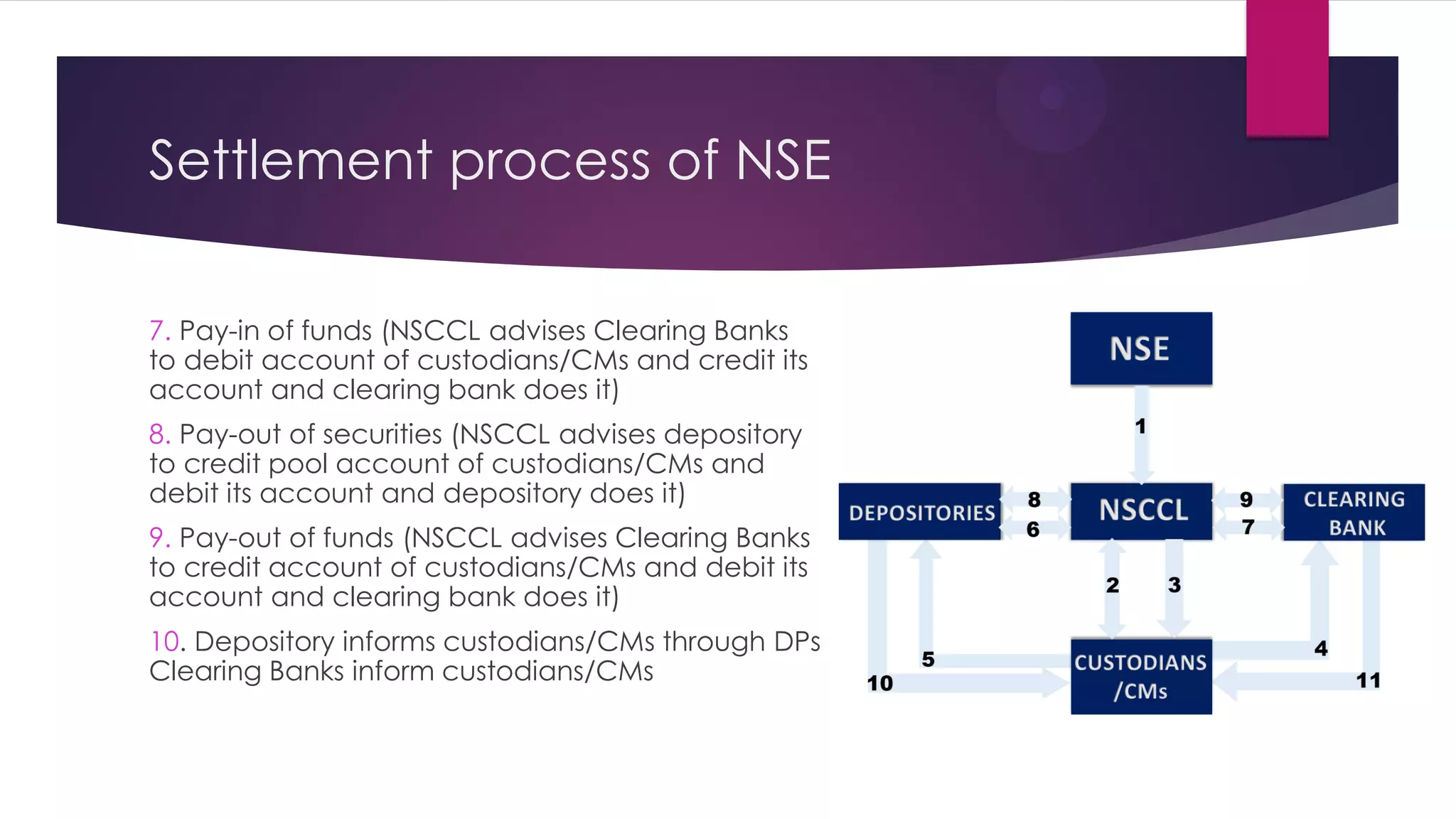

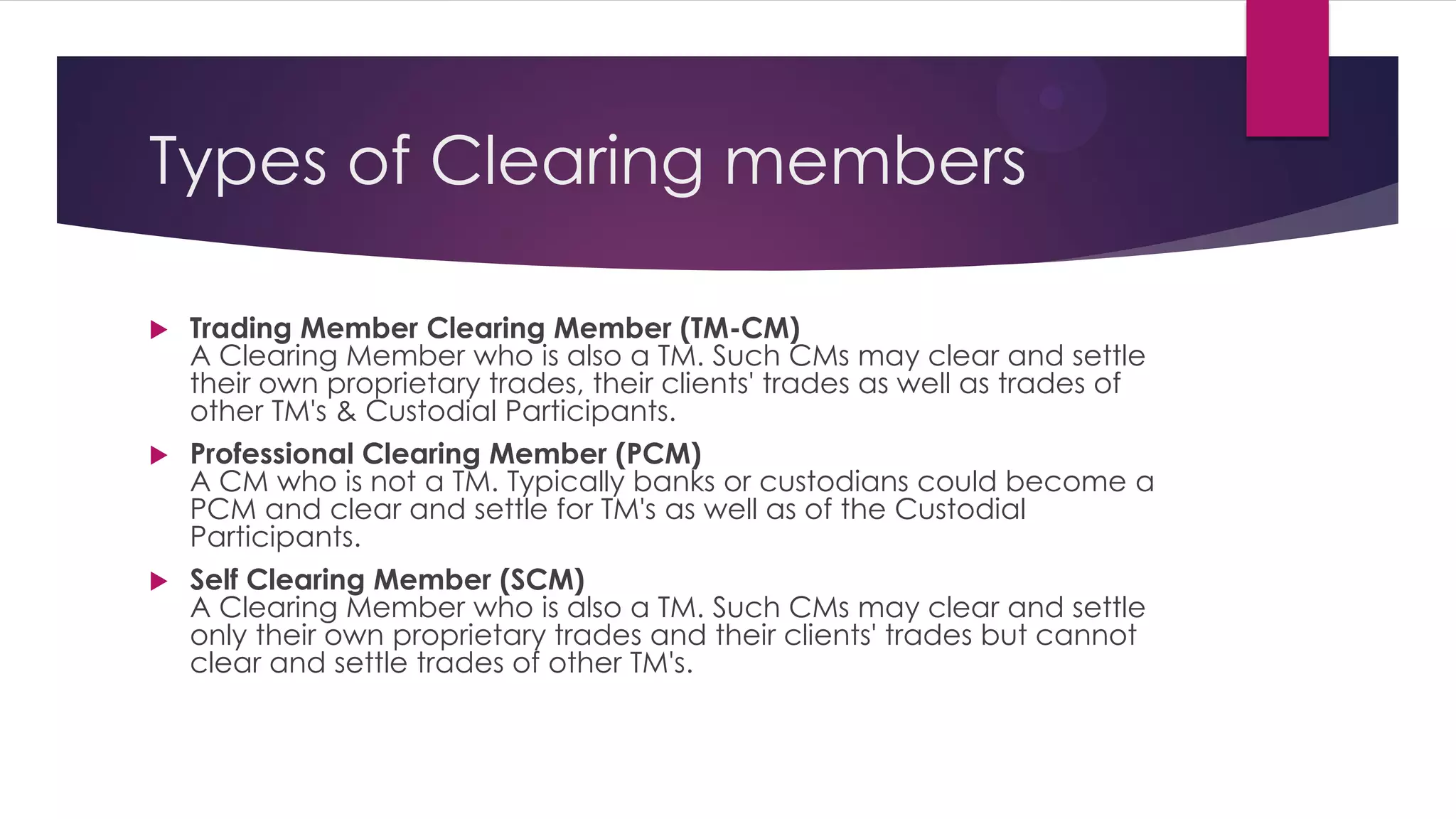

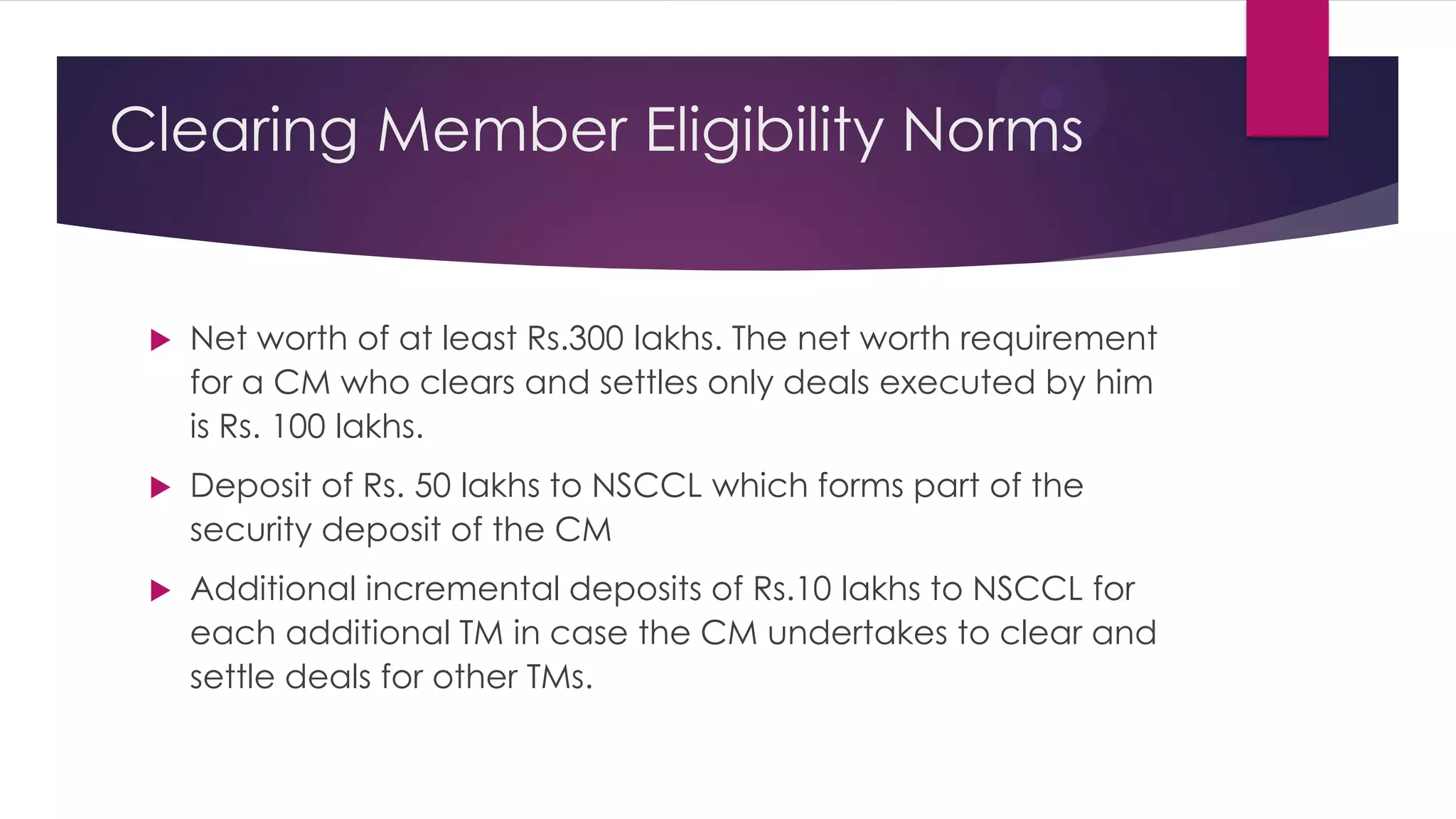

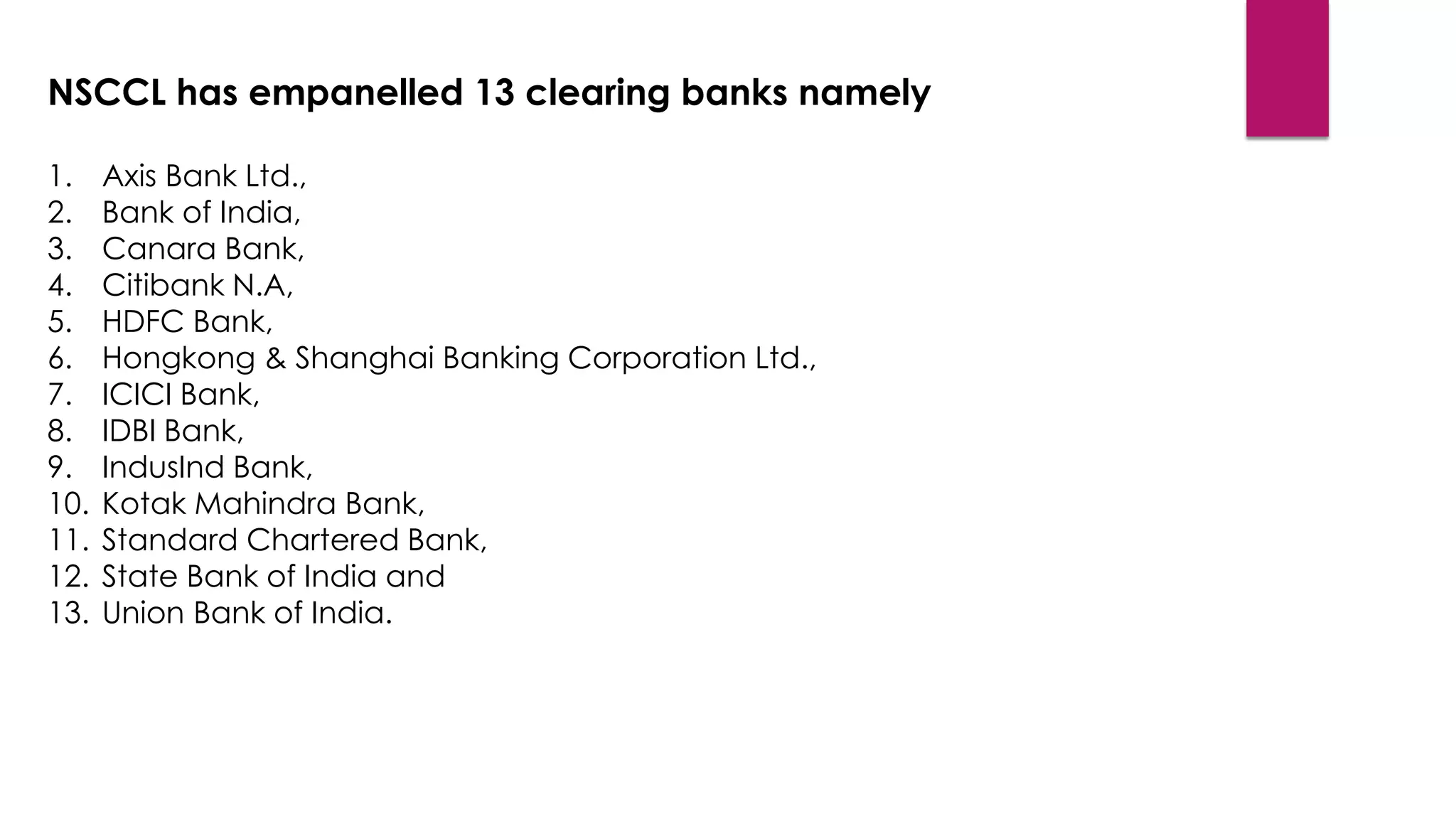

Clearing and settlement involves matching trades, determining obligations, and exchanging securities for cash. It is facilitated by clearing members, clearing banks, depositories, and the clearing corporation. Key risks include counterparty default and liquidity issues. The clearing corporation manages these risks through activities like trade confirmation, multilateral netting to determine obligations, collecting margins, and imposing limits. It acts as the central counterparty to assume default risk and ensure settlement is completed as required by market rules.