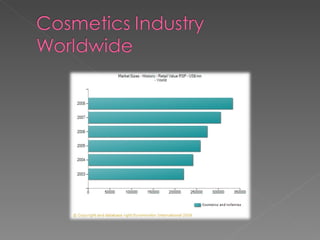

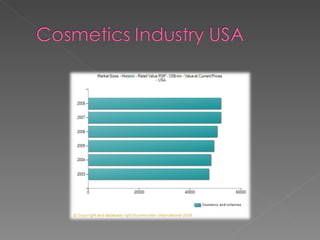

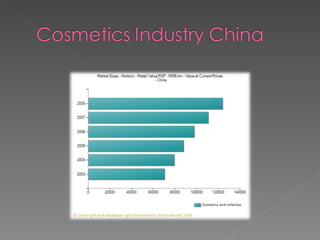

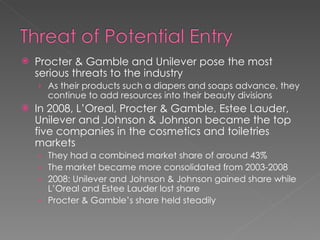

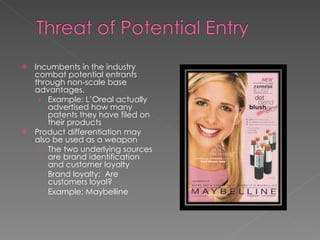

The cosmetics industry has grown significantly over time from ancient Egypt and Rome to a $160 billion global industry today. Major companies like L'Oreal, Procter & Gamble, and Unilever have consolidated market share. While the industry faces threats from large retailers like Walmart, competitors differentiate through new products and brand loyalty to maintain dominance. The future of the industry depends on expansions in emerging markets and growth areas like men's products and anti-aging.