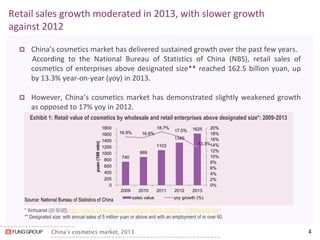

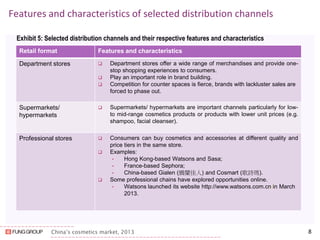

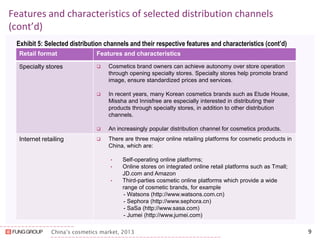

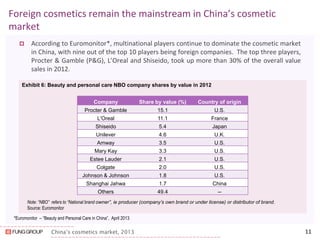

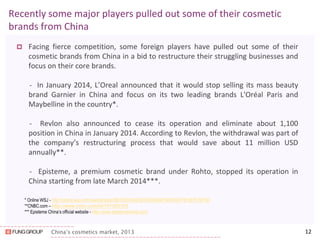

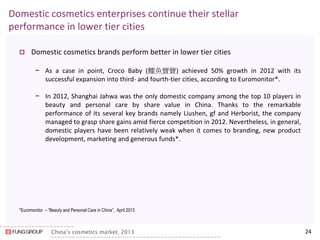

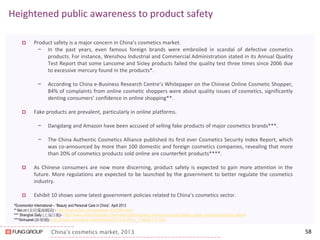

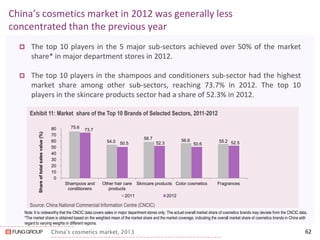

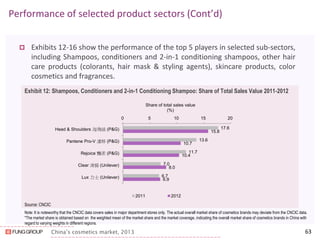

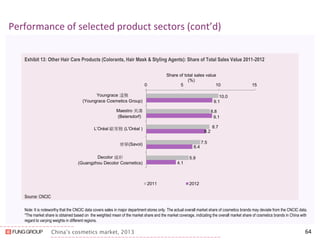

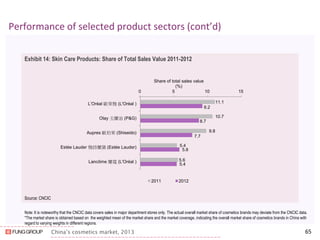

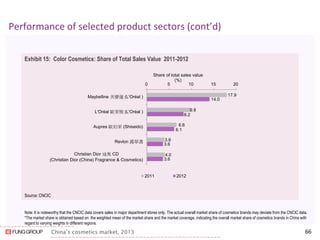

China's cosmetics market grew 13.3% in 2013, a slower rate than the previous year. Skin care and hair care products make up over half of sales. Department stores and hypermarkets were previously major sales channels but are declining, while health/beauty stores and online retailing are growing. Foreign brands still dominate the market, with L'Oreal, P&G and Shiseido comprising over 30% of sales. Some foreign brands are exiting China to focus on core brands.