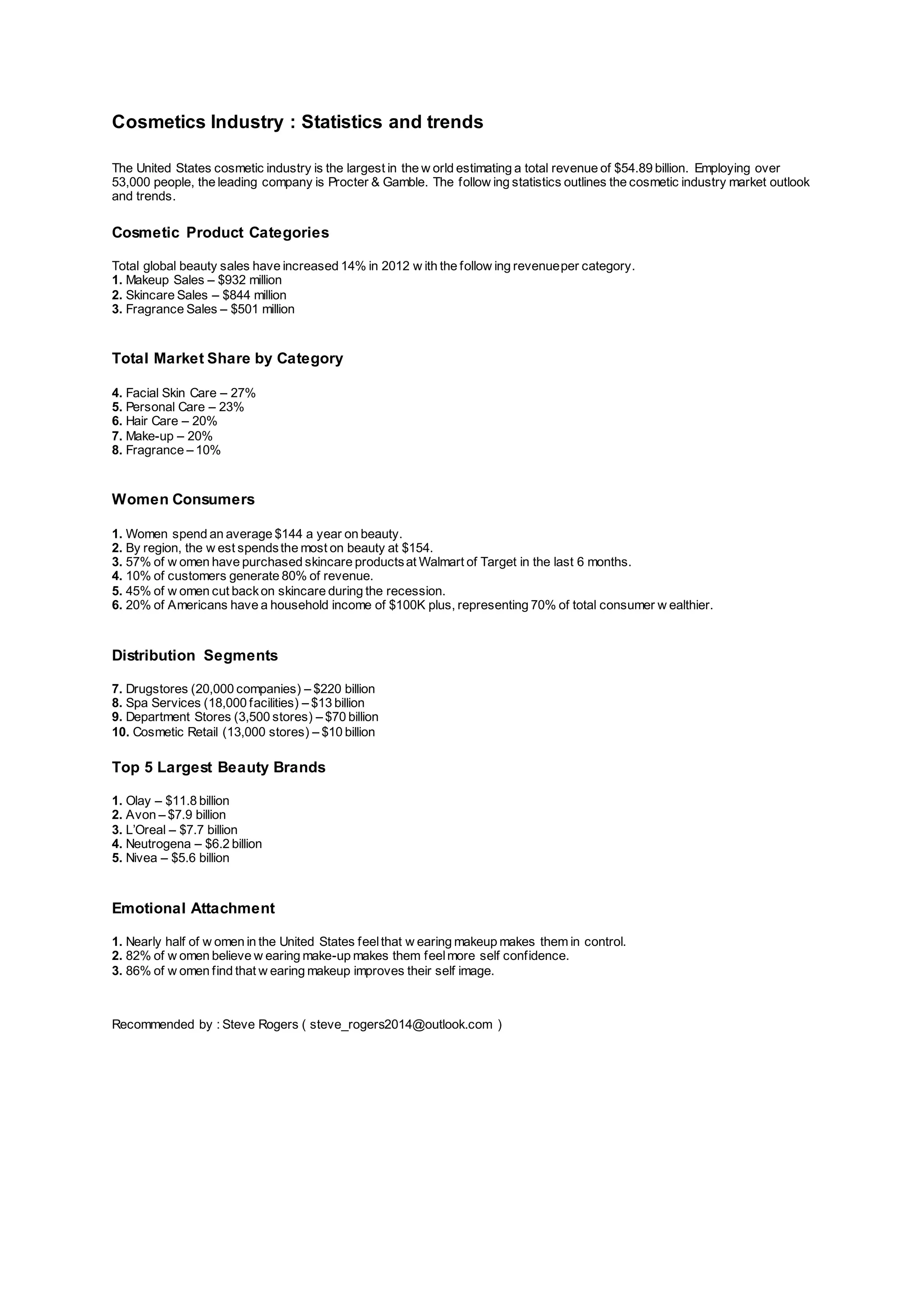

The U.S. cosmetics industry is the largest globally, generating $54.89 billion in revenue and employing over 53,000 people, with Procter & Gamble as the leading company. Key trends show significant growth in beauty sales, particularly in makeup and skincare, with women averaging $144 annually on beauty products. Emotional factors play a crucial role, as many women feel that makeup enhances their confidence and self-image.