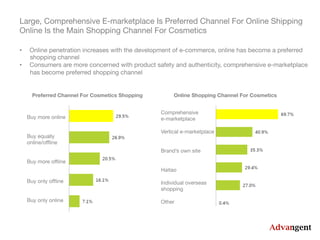

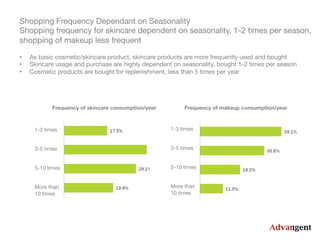

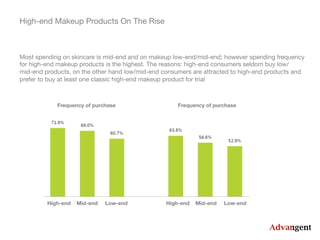

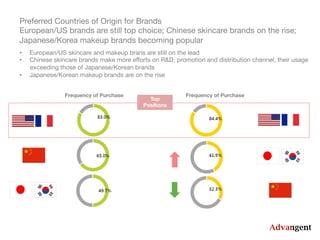

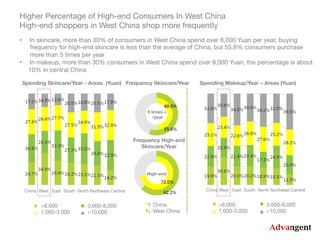

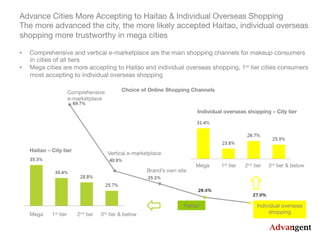

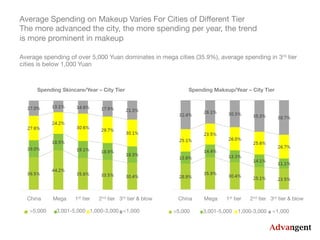

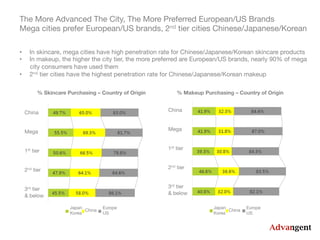

China's cosmetics consumption behavior is diversifying as online shopping increases. While online has become the main shopping channel, consumers prefer comprehensive e-marketplaces for safety and authenticity. Shopping frequency depends on seasonality and location - skincare is purchased 1-2 times per season whereas makeup less frequently. Spending levels vary across China, with higher spending on skincare and makeup in more developed cities and regions like West China. European/US brands remain popular but Chinese skincare brands are rising along with Japanese/Korean makeup brands.