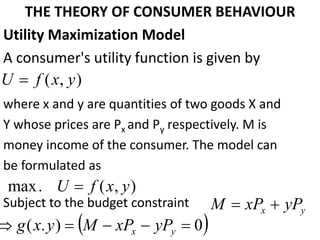

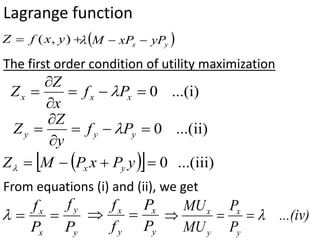

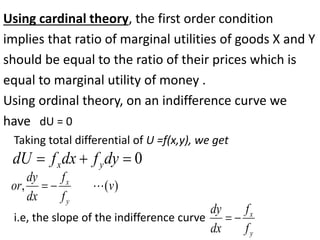

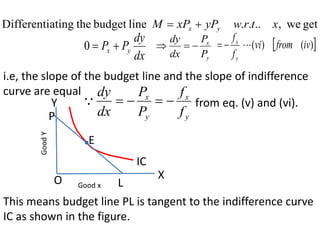

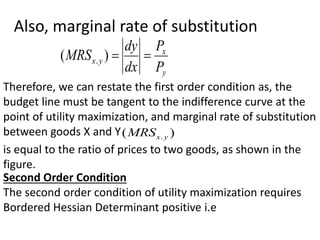

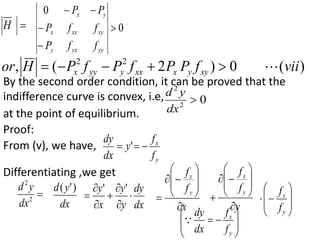

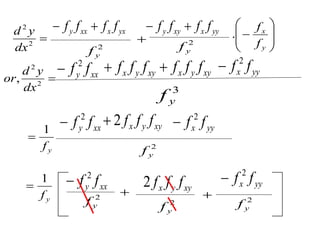

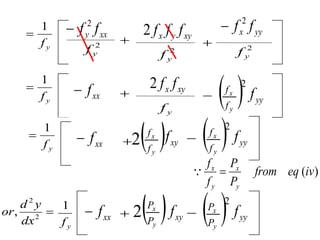

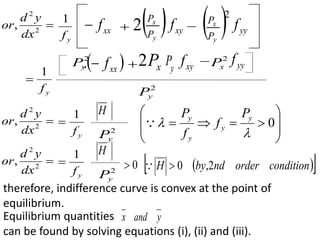

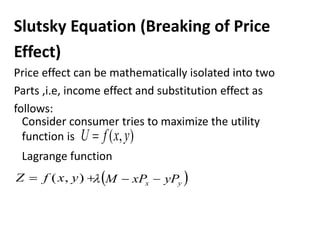

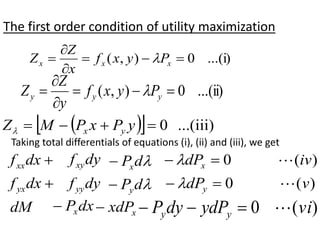

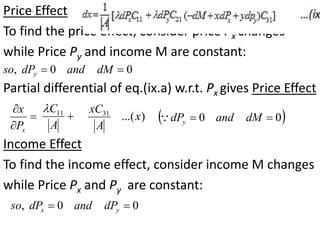

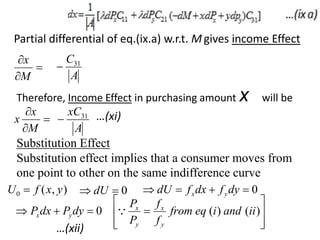

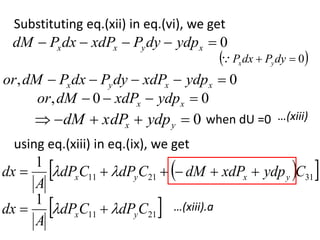

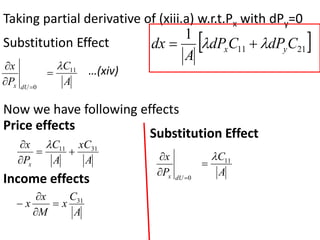

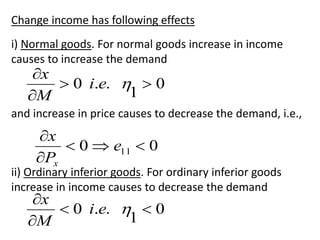

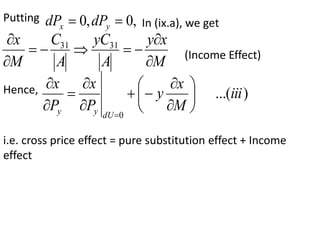

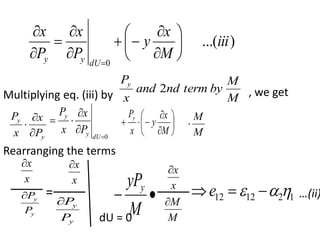

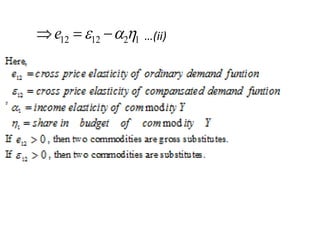

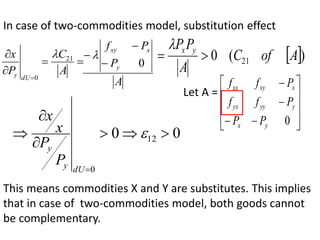

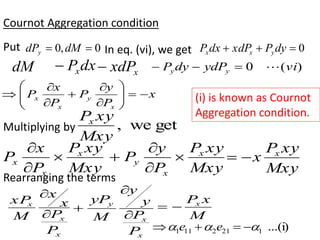

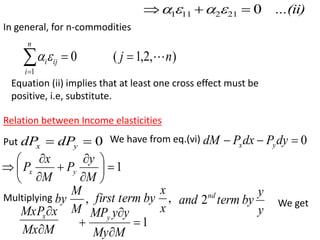

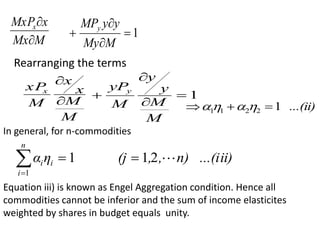

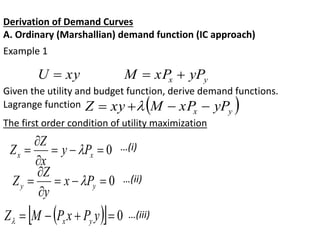

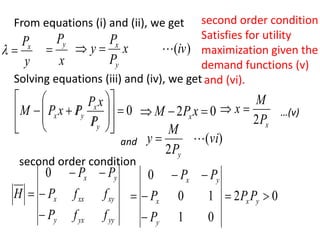

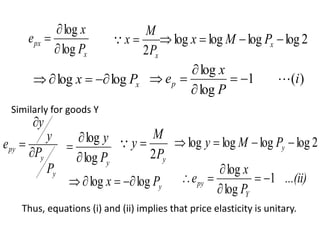

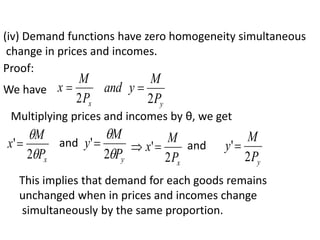

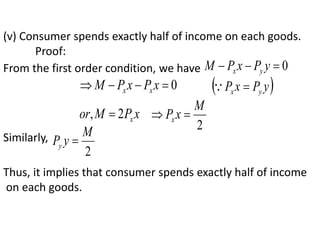

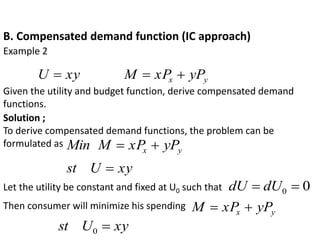

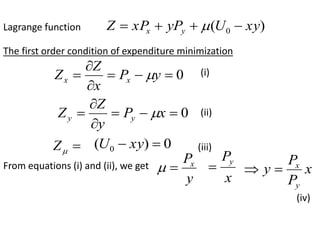

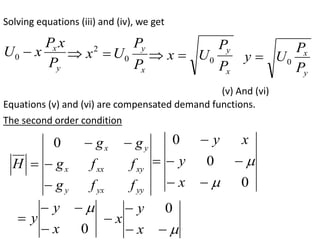

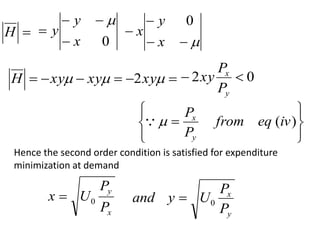

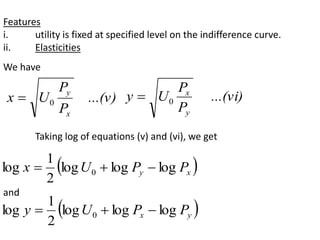

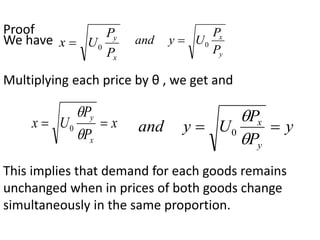

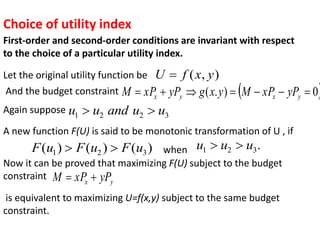

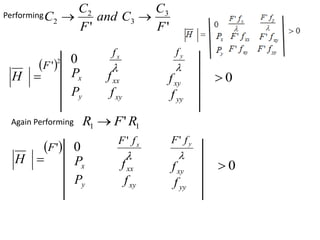

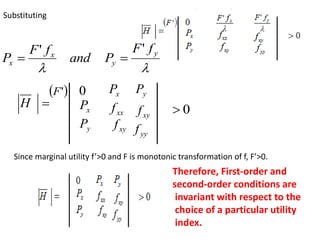

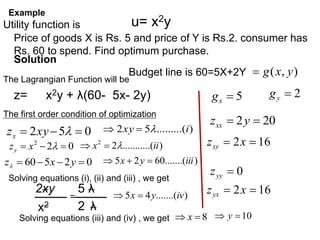

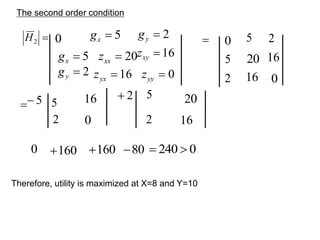

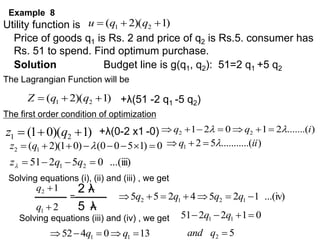

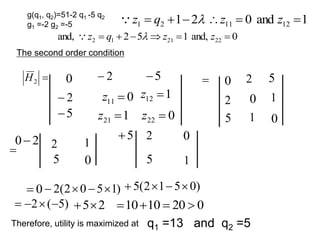

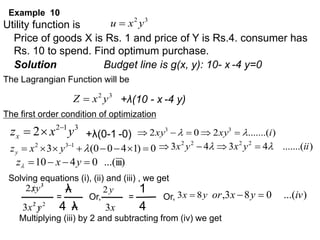

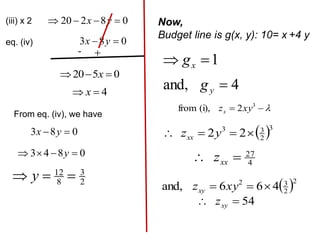

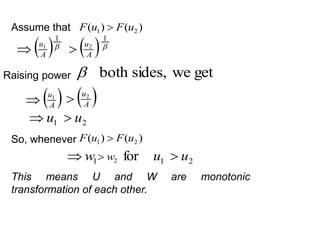

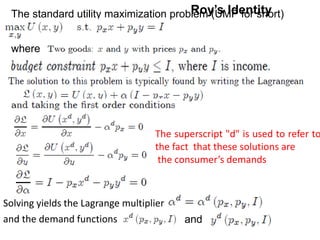

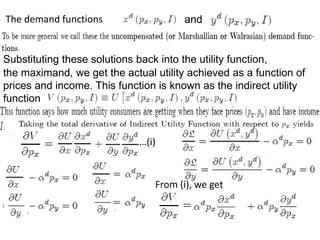

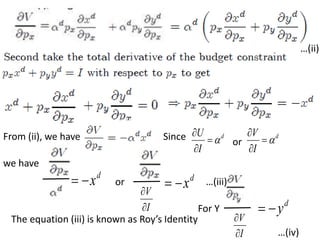

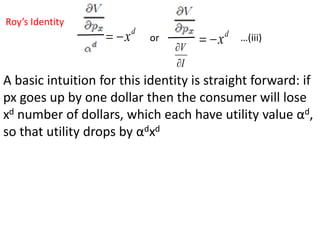

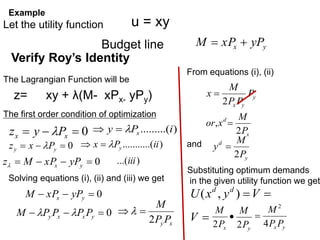

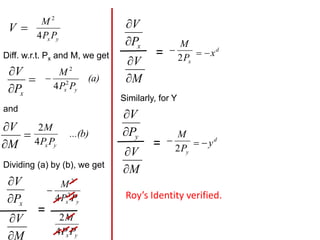

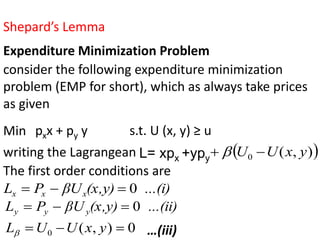

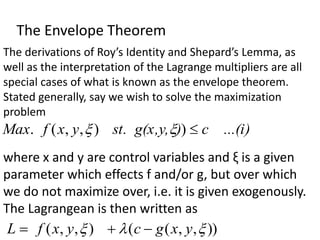

The document outlines the mathematical economics principles related to consumer behavior, focusing on utility maximization under budget constraints and key concepts such as the Slutsky equation, substitution and income effects. It discusses the Lagrange function for maximizing utility, along with necessary conditions for equilibrium and convexity of indifference curves. Additionally, it presents mathematical formulations guiding consumer choice and the decomposition of price effects into substitution and income effects.

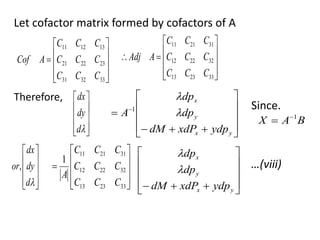

![

d

dy

dx

or,

33

23

13

32

22

12

31

21

11

1

C

C

C

C

C

C

C

C

C

A

y

x

y

x

ydp

xdP

dM

dp

dp

So,

A

dx

1

11

[ C

dPx

21

C

dPy

]

)

( 31

C

ydp

xdP

dM y

x

A

dy

1

12

[ C

dPx

22

C

dPy

]

)

( 32

C

ydp

xdP

dM y

x

A

d

1

13

[ C

dPx

23

C

dPy

]

)

( 33

C

ydp

xdP

dM y

x

…(ix a)

…(ix b)

…(ix c)

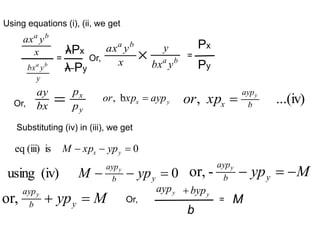

Consumer's equilibrium can change with the change

in income, prices, and relative prices. In order to find

the effect of change in price or income, all variables

are allowed to vary simultaneously.](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-16-320.jpg)

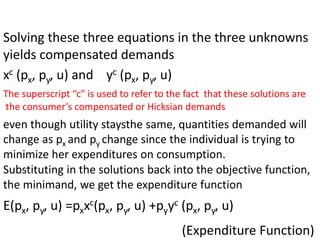

![Interpretation of Lagrange Multiplier

We have utility function )

,

( y

x

f

U

Diff. w.r.t.M, we get

M

U

M

x

fx

M

y

fy

Substituting y

y

x

x P

f

and

P

f

)

(

&

)

( ii

i

eq

from s

We get

M

U

M

x

Px

M

y

Py

M

U

or,

M

x

Px

[

]

M

y

Py

…(a)

We have budget line y

x yP

xP

M

M

M

1

M

y

P

M

x

P y

x

…(b)

Therefore, from (a) and (b),

M

U

= marginal utility of money.](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-24-320.jpg)

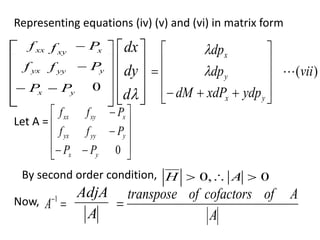

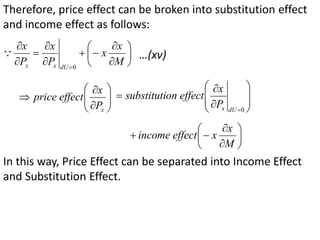

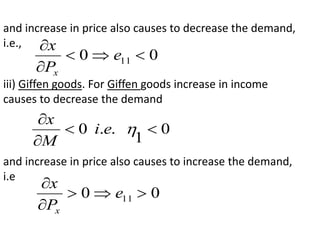

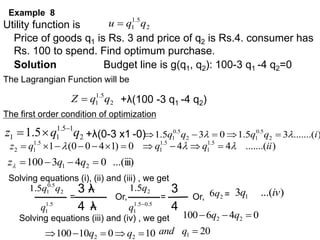

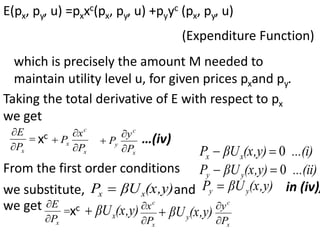

![Cross Effect

Cross effect deals with the effect of change in price of one

commodity on the demand for other commodity.

To find the effect of a change in price Py of goods Y on quantity ,

we keep price Px and money income M constant so

,

0

,

0

dM

dPx

From eq. (ix.a), we get

A

dx

1

11

[ C

dPx

21

C

dPy

]

)

( 31

C

ydp

xdP

dM y

x

…(ix a)

A

yC

A

C

P

x

y

31

21

,

0

,

0

since,

dM

dPx

(Price Effect)

when and

dU 0

0

y

x ydp

xdP

dM

we get from (ix.a)

A

C

P

x

y

21

(Substitution Effect)

(Substitution Effect)](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-27-320.jpg)

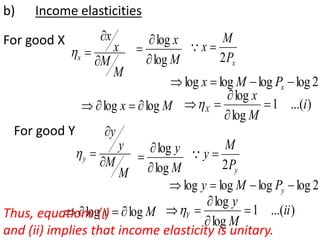

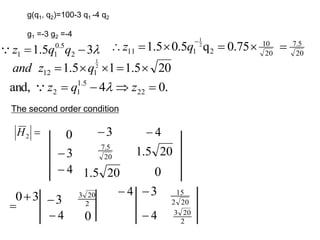

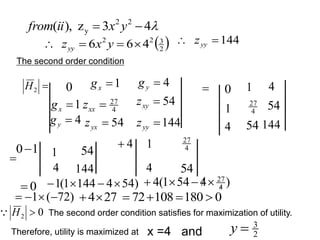

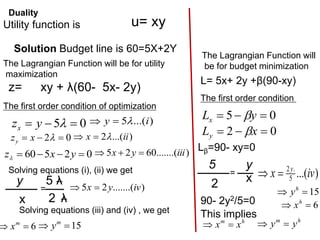

![Or, y

ayp y

byp

= bM Or, b]

[a

ypy = bM

y

=

Mb

b]

[a

py

Now using (iv)

b

ayp

x

y

xp y

or,

x

y

bp

ap

x

or, x

y

p

b

p

a

x

x

Mb

b]

[a

py

or, )

( b

a

p

Ma

x

x

….(v)

….(vi)

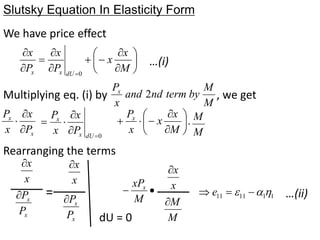

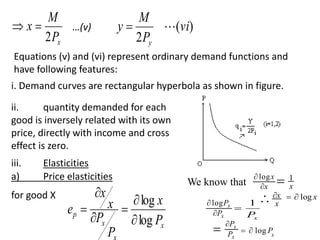

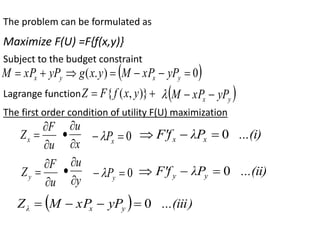

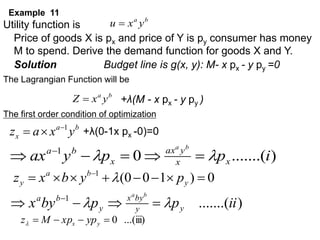

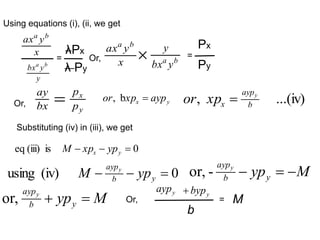

Equations (v) and (vi) represent demand function for goods Y and X

Respectively.](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-70-320.jpg)

![Or, y

ayp y

byp

= bM Or, b]

[a

ypy = bM

y

=

Mb

b]

[a

py

Now using (iv)

b

ayp

x

y

xp y

or,

x

y

bp

ap

x

or, x

y

p

b

p

a

x

x

Mb

b]

[a

py

or, )

( b

a

p

Ma

x

x

….(v)

….(vi)

Equations (v) and (vi) represent demand function for goods Y and X

Respectively.](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-73-320.jpg)

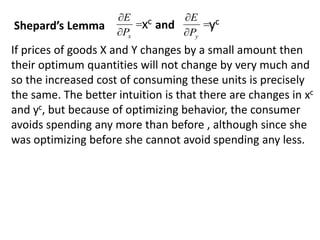

![

x

P

E

xc (x,y)

βUx

x

c

P

x

(x,y)

βUy

x

c

P

y

x

P

E

xc (x,y)

U

β x

[

x

c

P

x

(x,y)

Uy

]

x

c

P

y

…(v)

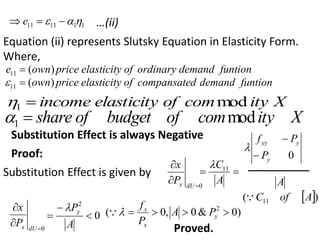

we differentiate the constraint U (xc, Yc) = u totally

with respect to px to get

x

U

x

c

P

x

y

U

x

c

P

y

= 0 Since utility u is fixed.

So from (v), we get

x

P

E

xc …(vi)

Similarly, taking the total derivative of E with

respect to py we get

y

P

E

yc …(vii)

The results (vi) and (vii) are known as Shepard’s Lemma](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-85-320.jpg)

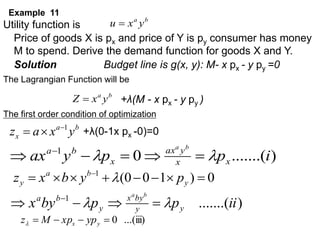

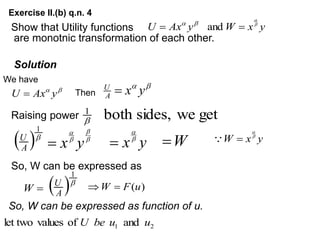

![for which the first two first order conditions are given

by

x

L

x

y

x

f )

,

,

(

...(ii)

x

)

g(x,y

λ 0

,

y

L

y

y

x

f )

,

,

(

)

...(iii

y

)

g(x,y

λ 0

,

Let optimum values be x* and y*

Substituting the solutions into the function f gives the

value function

)

(

F .(iv)

ξ),ξ] ..

y

(

f[x *

*

(

),

which is the maximized value of f , which ultimately

depends on ξ. Taking the total derivative of F (ξ) we

get](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-89-320.jpg)

![

)

(

F ]

),

(

),

(

[ *

*

y

x

f

)

(

F

x

f

d

dx*

y

f

d

dy*

...(v)

ξ

f

The last term represents the direct effect of ξ on f , while the

first two terms represent the indirect effect of ξ on f by

changing x∗ and y∗. This expression can be simplified in two

steps. First substituting in the first order conditions

∂f /∂x = λ∂g/∂x and ∂f /∂y = λ∂g/∂y into (v) gives

x

y

x

f )

,

,

(

0

x

g(x,y,ξ(

λ

y

y

x

f )

,

,

(

0

y

g(x,y,ξ(

λ

)

(

F

x

g

*

d

dx*

y

g

*

d

dy*

ξ

f

](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-90-320.jpg)

![

)

(

F

x

g

*

d

dx*

y

g

*

d

dy*

ξ

f

)

(

,

F

or

x

g

[

*

d

dx*

y

g

]

*

d

dy

...(vi)

ξ

f

Second, differentiating the constraint g (x∗, y∗, ξ) = c totally

with respect to ξ gives

x

g

d

dx*

y

g

0

*

g

d

dy

x

g

d

dx*

y

g

g

d

dy*

which substituting into (vi) and rearranging gives the envelope theorem

)

(

F

ξ

f

g

*

ξ

L

(Envelope Theorem)](https://image.slidesharecdn.com/mathematicaleconomicsunit1-231105151144-851fcf68/85/Mathematical-Economics-unit-1-pptx-91-320.jpg)