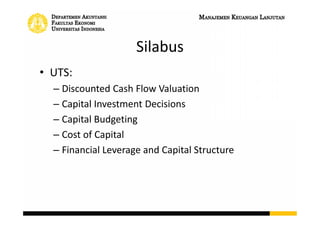

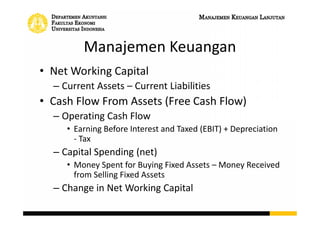

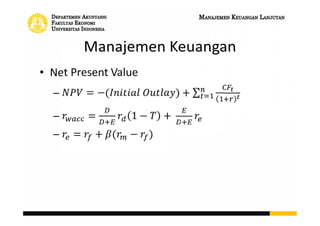

This document outlines the topics that will be covered in an Advanced Financial Management course. The course will include 14 lectures from the professor and 12 meetings with assistants. There will be a midterm exam covering discounted cash flow valuation, capital investment decisions, capital budgeting, and cost of capital. The final exam will cover dividends and policy, raising capital, leasing, international finance, and mergers and acquisitions. Key concepts that will be discussed include the three areas of financial management, net present value calculations, weighted average cost of capital, free cash flows, and the time value of money.

![Time Value of Money

• Effective Annual Rate

– Bunga efektif 1 tahun

• Annual Percentage Rate

– Bunga yang dicompound beberapa kali daam satu

tahun

𝐸𝐴𝑅 = [ 1 +

𝐴𝑃𝑅

𝑚

] 𝑚 −1 Atau 1 + 𝑟 𝑛 = 1 + 𝑟 𝑚](https://image.slidesharecdn.com/materi-discountedcashflow-130606085357-phpapp01/85/Discounted-Cash-Flow-11-320.jpg)