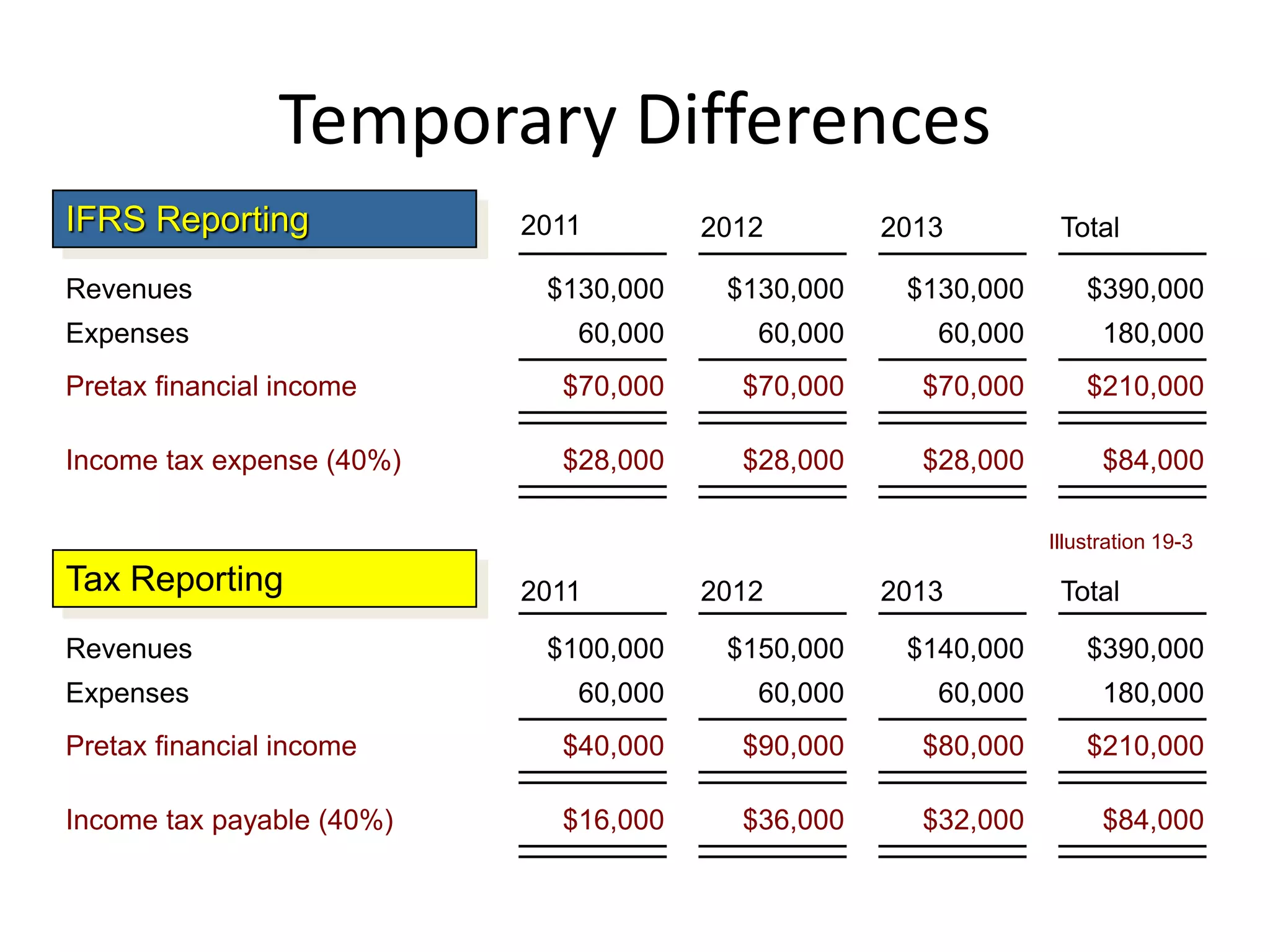

This document summarizes key points from a lecture on accounting for income tax in accordance with PSAK 46. It discusses temporary and permanent differences between pre-tax income and taxable income, and how these lead to deferred tax assets or liabilities. Examples are provided to illustrate deferred tax calculations for temporary differences that arise over multiple years. The document also covers topics like current and deferred tax expense/revenue, loss carryforwards, and implications of changes in tax rates.