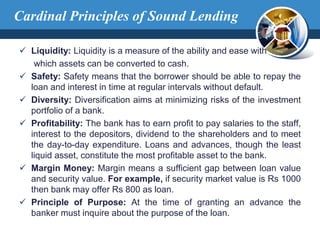

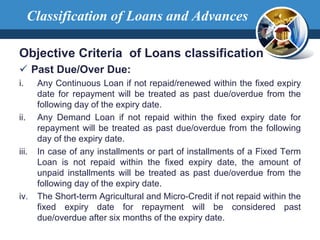

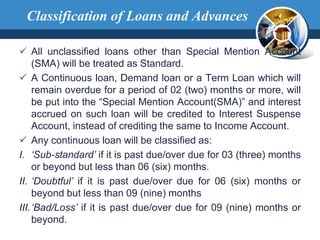

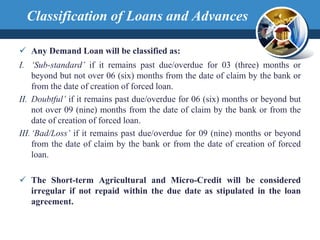

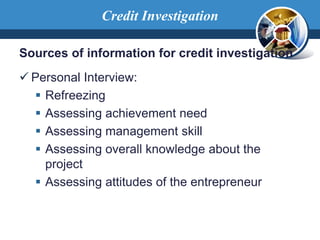

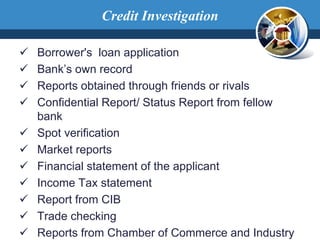

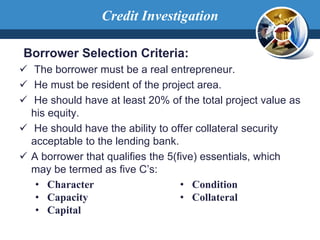

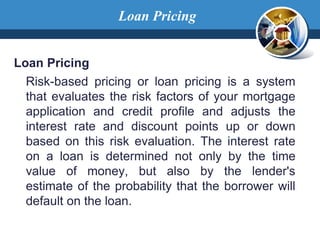

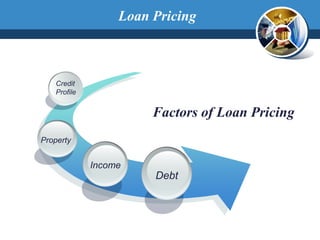

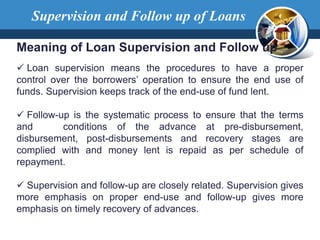

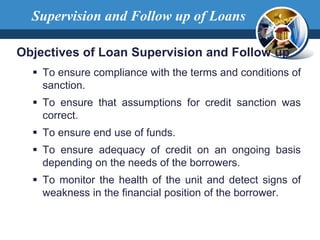

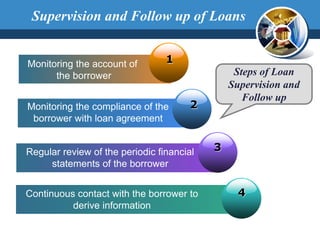

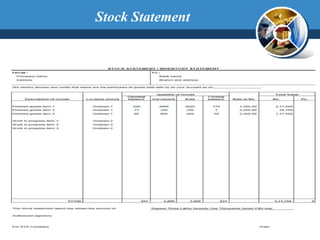

This document discusses key principles of sound lending for banks. It outlines cardinal principles like liquidity, safety, diversity and profitability. It also describes loan classification criteria, credit investigation process, loan pricing factors, importance of loan supervision and follow up. Security of loans can include mortgages, guarantees or liens. Banks typically require stock statements from business loan customers to monitor inventory levels.