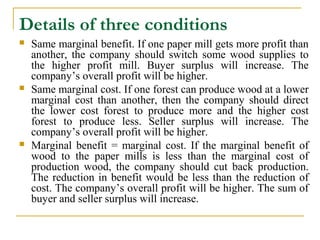

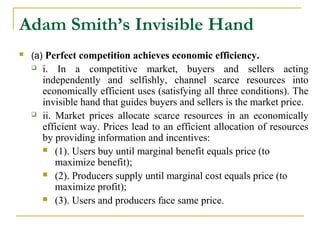

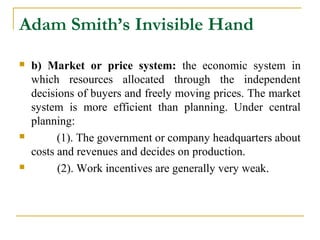

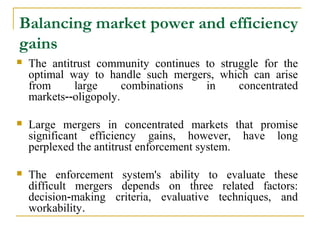

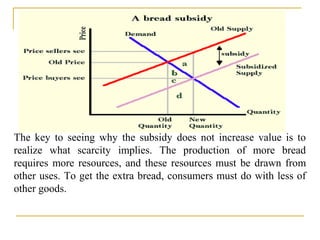

This presentation discusses market efficiency. It begins by defining a market as a mechanism where buyers and sellers can meet and potentially transact. Efficiency is defined as using resources effectively to satisfy needs at minimum cost. Economic efficiency exists when resources are allocated such that no one can be made better off without making another worse off. Three conditions for efficiency are that all users receive equal marginal benefit, all suppliers have equal marginal costs, and marginal benefit equals marginal cost. Adam Smith's invisible hand theory holds that perfect competition achieves efficiency. The presentation provides examples and concludes by discussing how governments can promote efficiency through policies like reducing trade barriers.