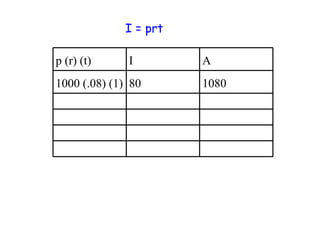

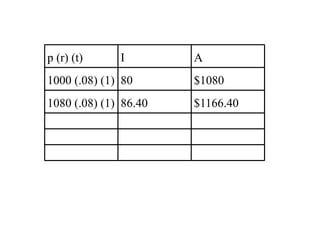

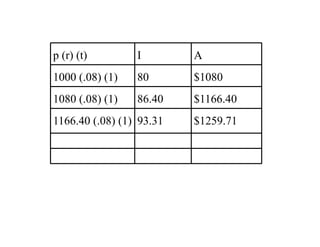

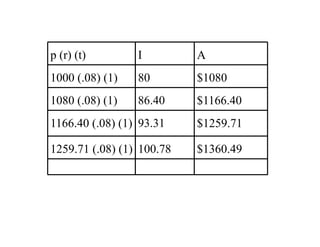

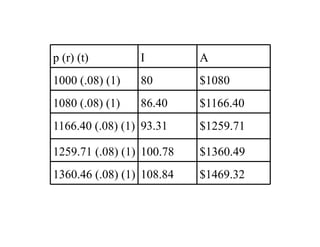

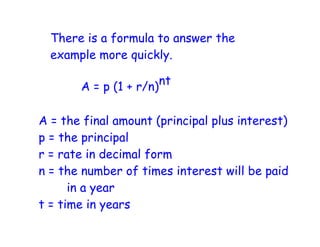

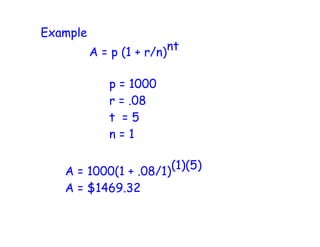

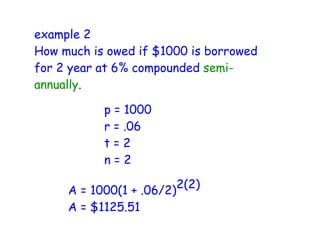

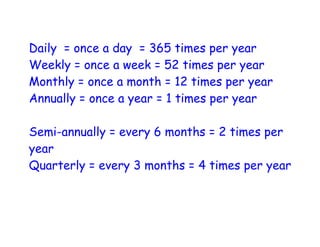

The document explains compound interest using examples of borrowing $1000 at 8% interest for 1 year, and then not paying it back for additional years. It shows how the interest builds on itself each year, with the borrower paying interest on accumulated interest. A formula is provided to calculate the final amount for any principal, interest rate, number of compounding periods per year, and term of years. An example calculates the amount owed after 2 years at 6% interest compounded semi-annually.