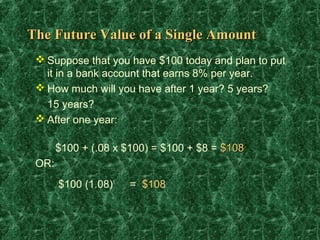

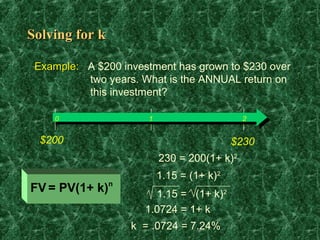

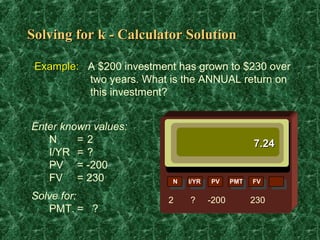

Let k = annual rate of return

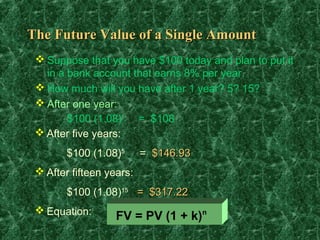

FV = PV(1+k)n

230 = 200(1+k)2

1.15 = (1+k)2

1.075 = 1+k

.075 = k

k = 7.5% annual return

Therefore, the annual return on this investment is 7.5%

�Solving for k

Example: You invest $1,000 today and want it to grow to

$1,500 in 5 years. What rate of return is needed?

0 1 2

$1,000 $1,500