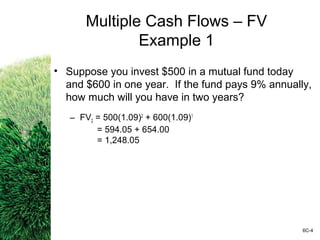

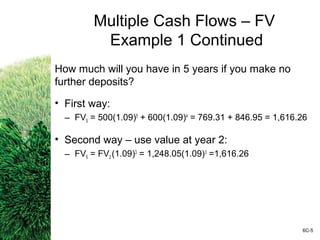

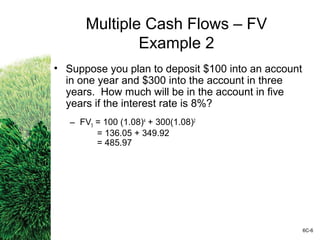

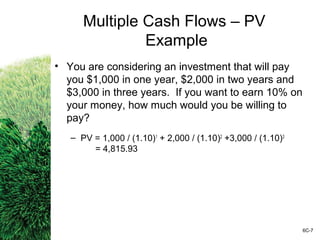

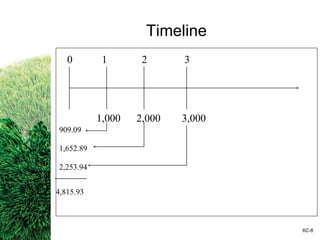

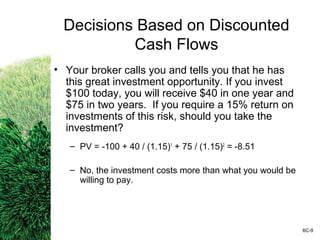

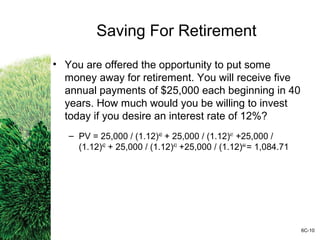

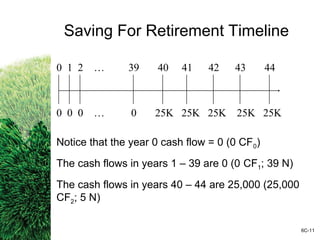

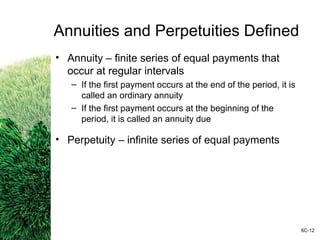

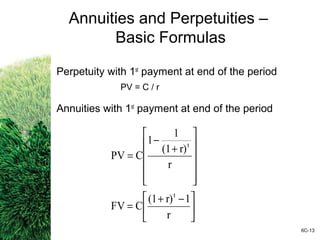

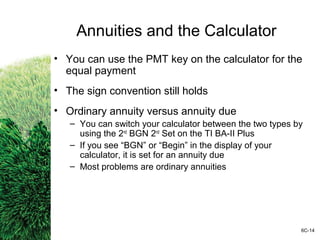

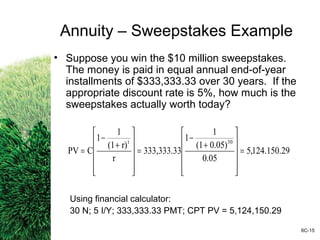

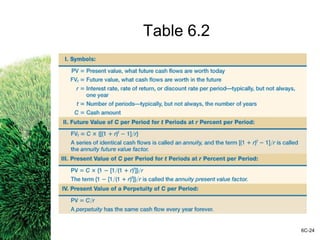

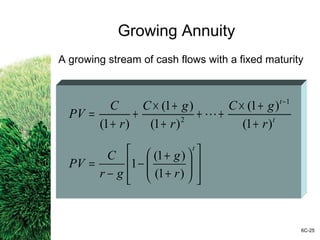

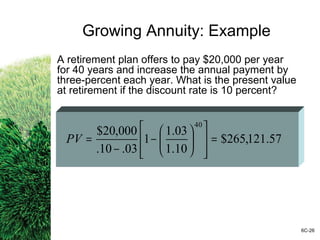

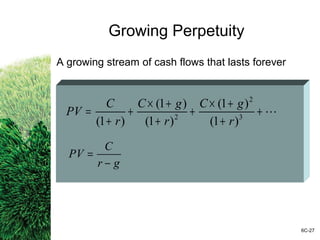

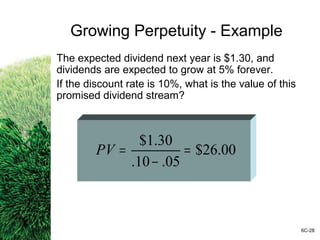

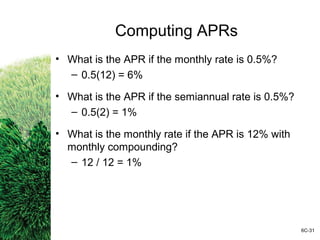

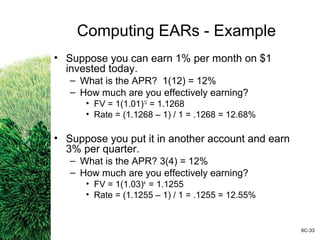

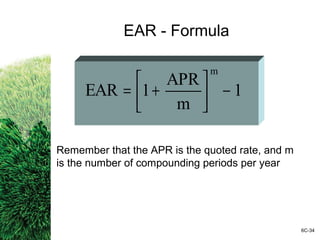

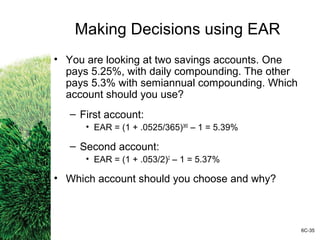

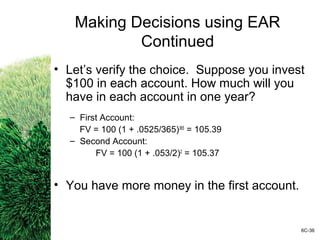

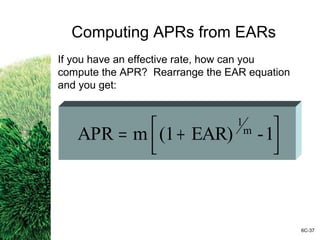

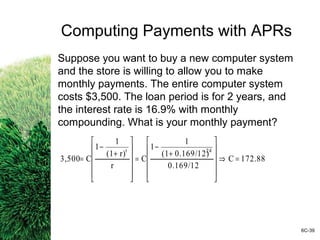

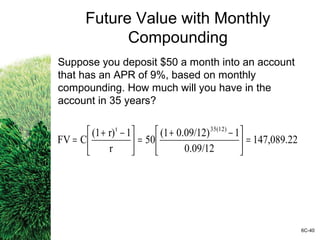

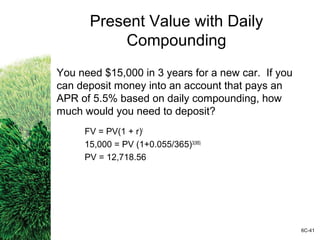

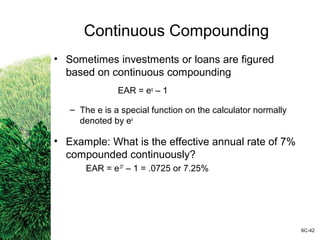

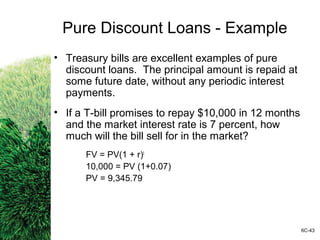

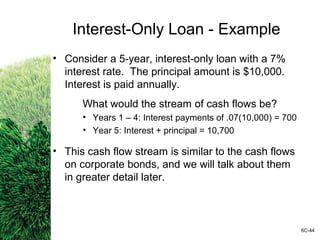

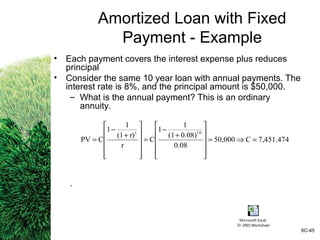

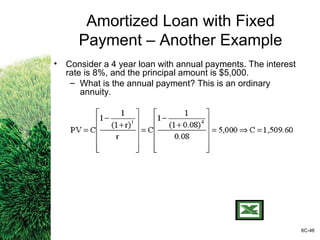

This chapter discusses discounted cash flow valuation and concepts related to future and present value of multiple cash flows. It covers annuities, perpetuities, loan amortization, and effective annual rates. Examples are provided to illustrate computing future and present values of cash flows occurring at different times, as well as growing annuities and perpetuities. Key formulas and the distinctions between annual percentage rates, effective annual rates, and stated interest rates are also explained.

![APR - Example

Suppose you want to earn an effective rate of 12%

and you are looking at an account that compounds

on a monthly basis. What APR must they pay?

[ ]

11.39%or

8655152113.1)12.1(12 12/1

=−+=APR

6C-38](https://image.slidesharecdn.com/chapter6-140702191456-phpapp02/85/Chapter-6-microeconomics-38-320.jpg)

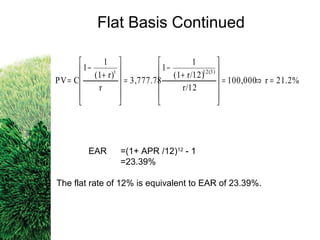

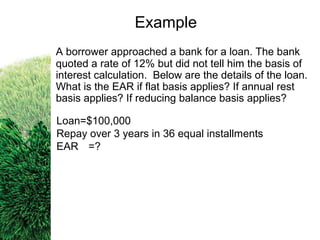

![• For interest calculations, the principal of the

loan is not reduced by the installment payments

• Interest is charged on the full sum of the

principal over 3 yrs.

Monthly payments

= [100,000 + (100,000 X 0.12 X 3)] / 36

= 3777.78

Flat Basis](https://image.slidesharecdn.com/chapter6-140702191456-phpapp02/85/Chapter-6-microeconomics-49-320.jpg)