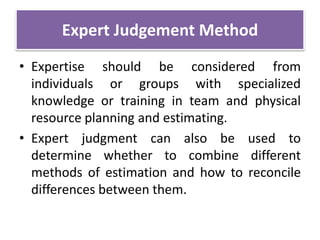

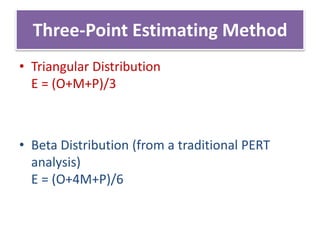

The document outlines methods for managing project costs and calculating financial metrics such as ROI, payback period, and NPV. It discusses various estimation techniques including expert judgment, three-point estimating, comparative estimation, parametric estimation, and bottom-up estimating. The importance of considering the time value of money in NPV calculations and decision-making criteria for project investments are also highlighted.