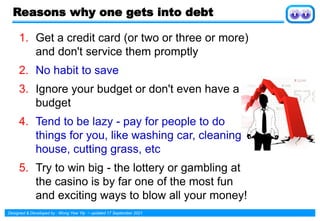

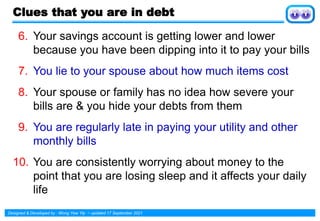

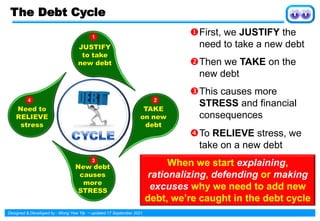

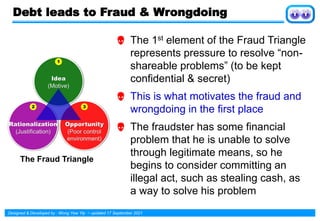

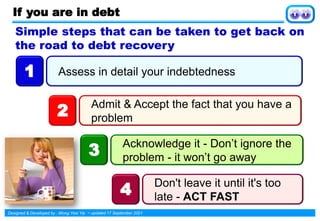

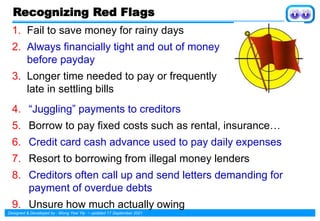

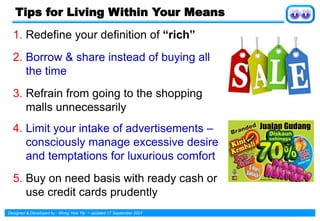

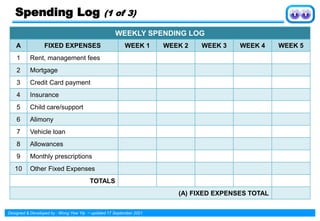

This document provides information about managing personal finances. It discusses the importance of managing finances to know where money goes and avoid undesirable debt. It outlines four modules on managing finances, getting into debt, staying out of debt, and applying financial techniques. It discusses will and skill in managing finances, with those high in both being free from debt. It defines undesirable debt and provides reasons why people get into debt, as well as tips to stay out of debt like having an emergency fund and living within one's means. The document provides a spending log template and tips for managing spending habits.