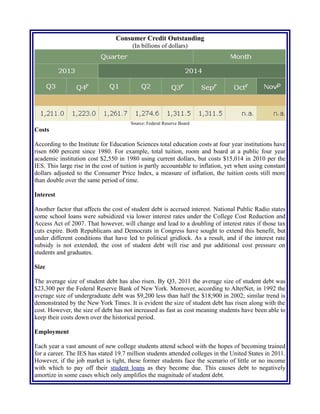

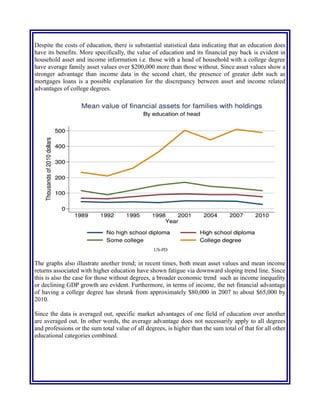

The document discusses rising education costs, highlighting that average tuition at public universities is increasing faster than general inflation, with state funding cuts contributing to this trend. It notes a decline in college enrollment, primarily among older students, which may reflect improvements in the job market. Additionally, it examines the impact of student debt, which has surpassed total revolving credit in the U.S., and explores financial instruments like Coverdell accounts and 529 plans to mitigate educational expenses.