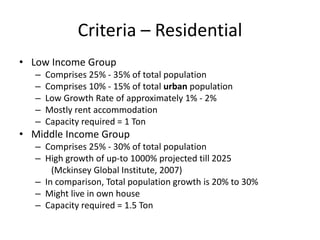

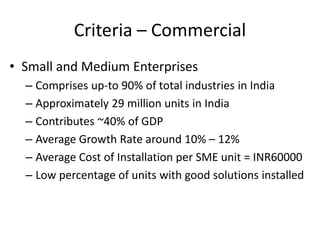

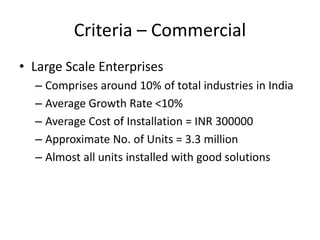

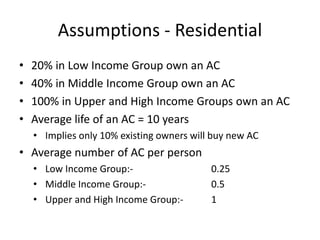

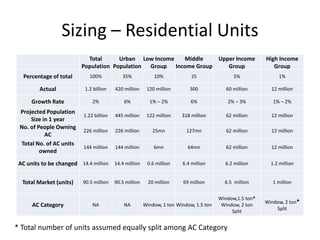

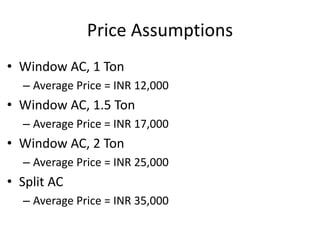

The document analyzes the market segmentation for air conditioning solutions in India. It segments the market by income group, accommodation type, and AC type and capacity for residential use. For commercial, it segments by business size. The largest residential opportunity is for 1.5 ton window ACs, targeting the middle income group. Small and medium enterprises present a sizeable commercial opportunity. Overall, the AC market in India is in the early stages with high growth potential, particularly for mid-range residential units and solutions for small businesses.