The document provides an overview of the Mahindra & Mahindra Group, an Indian multinational conglomerate. Some key points:

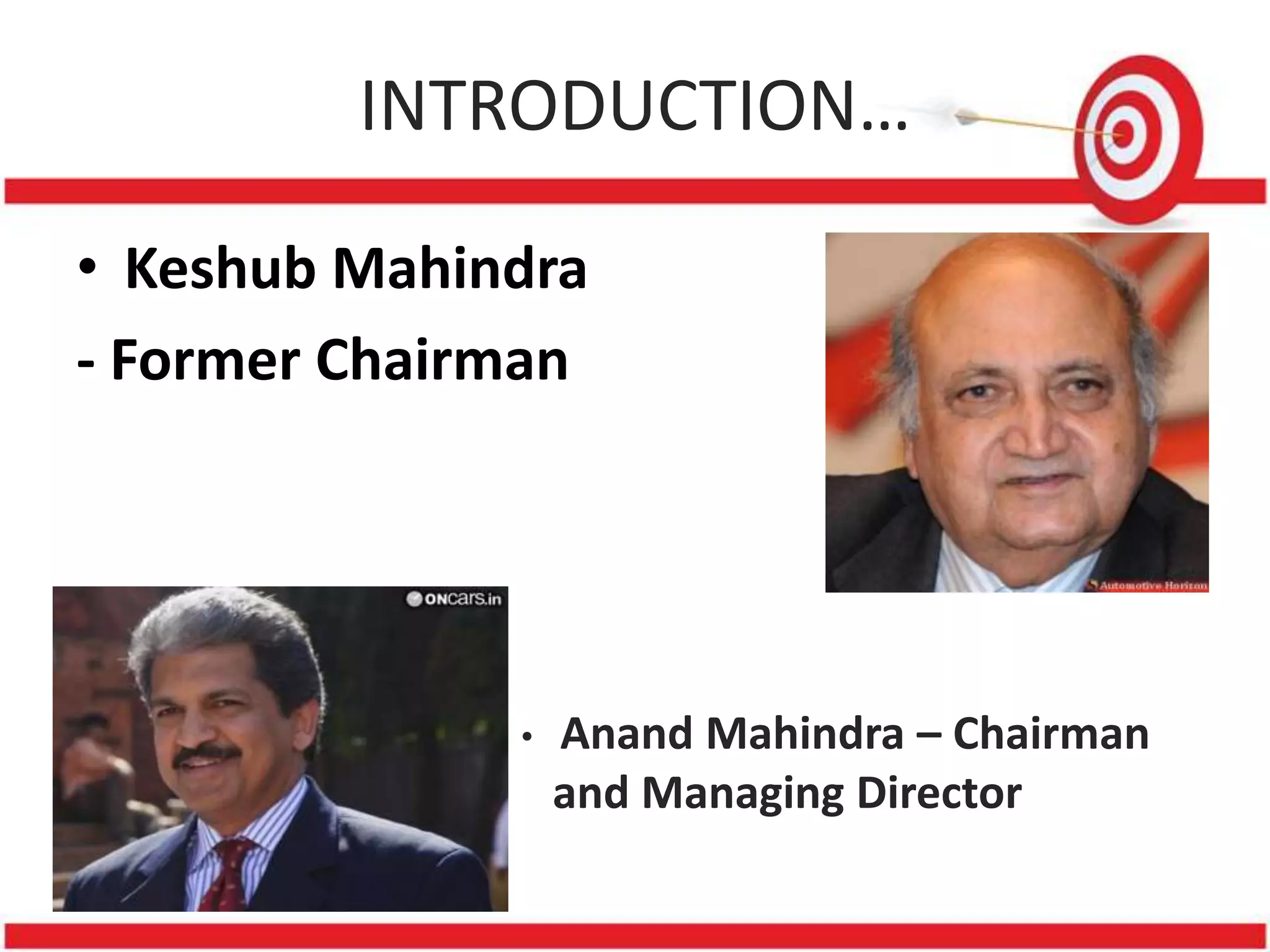

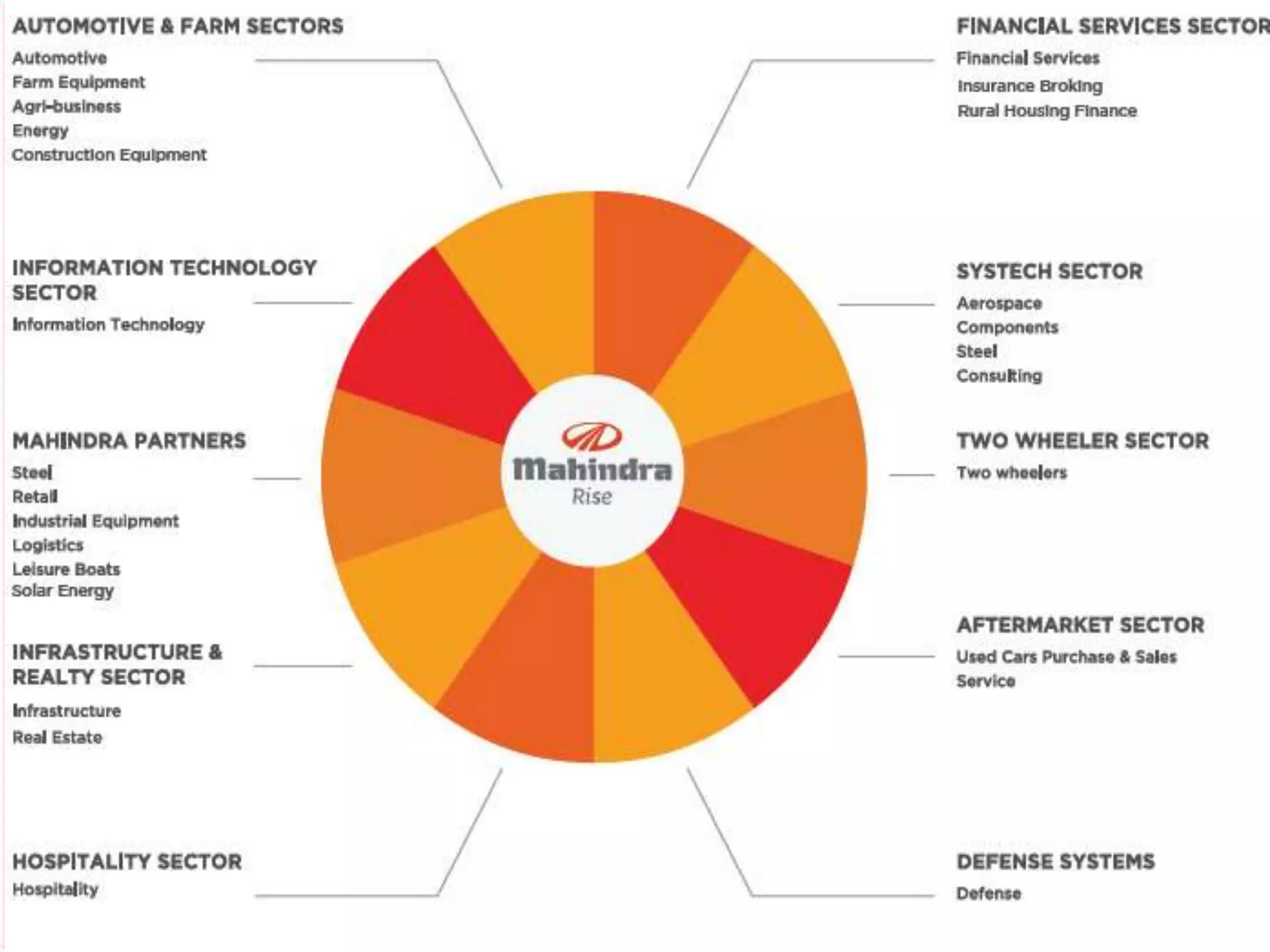

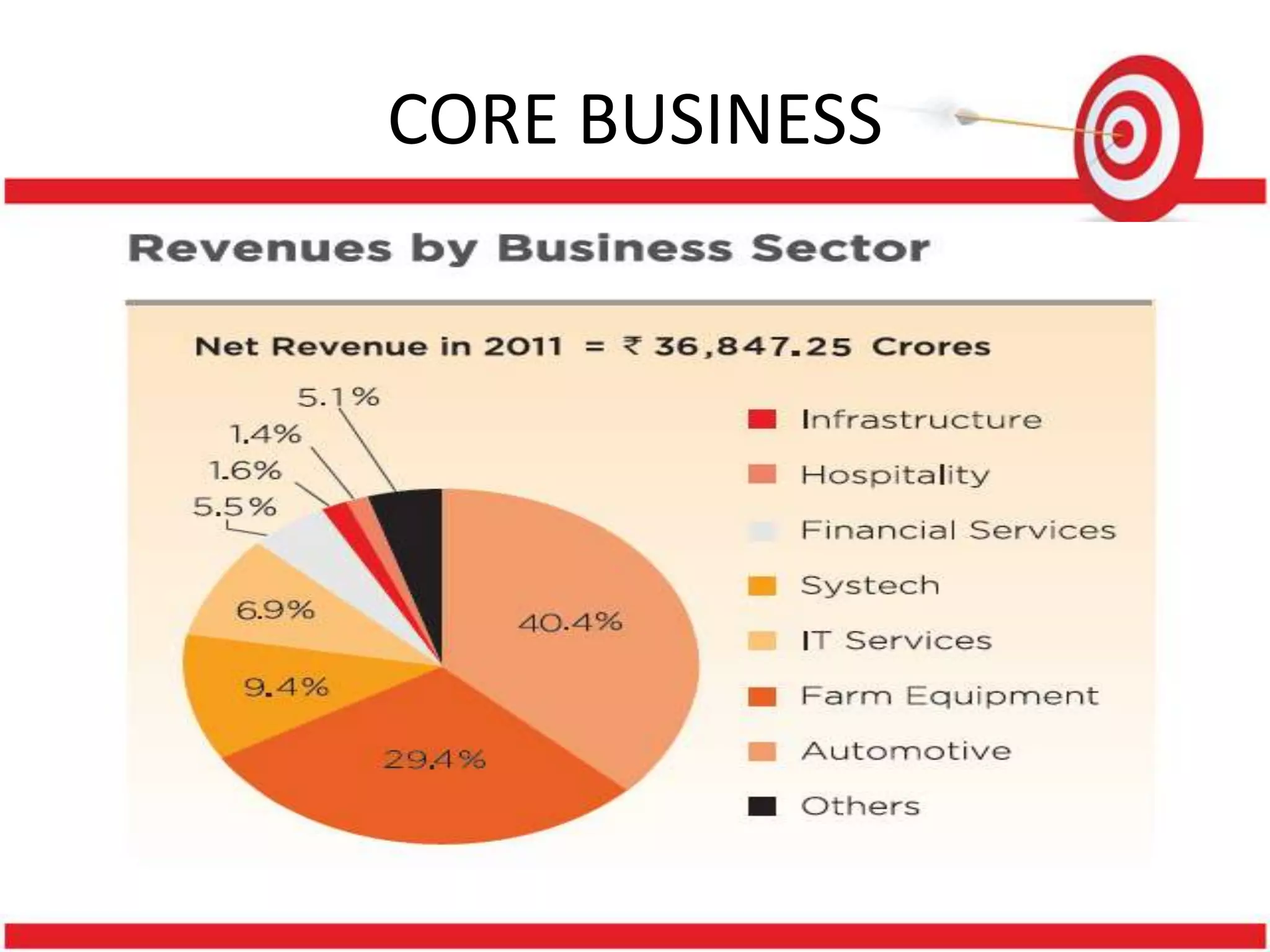

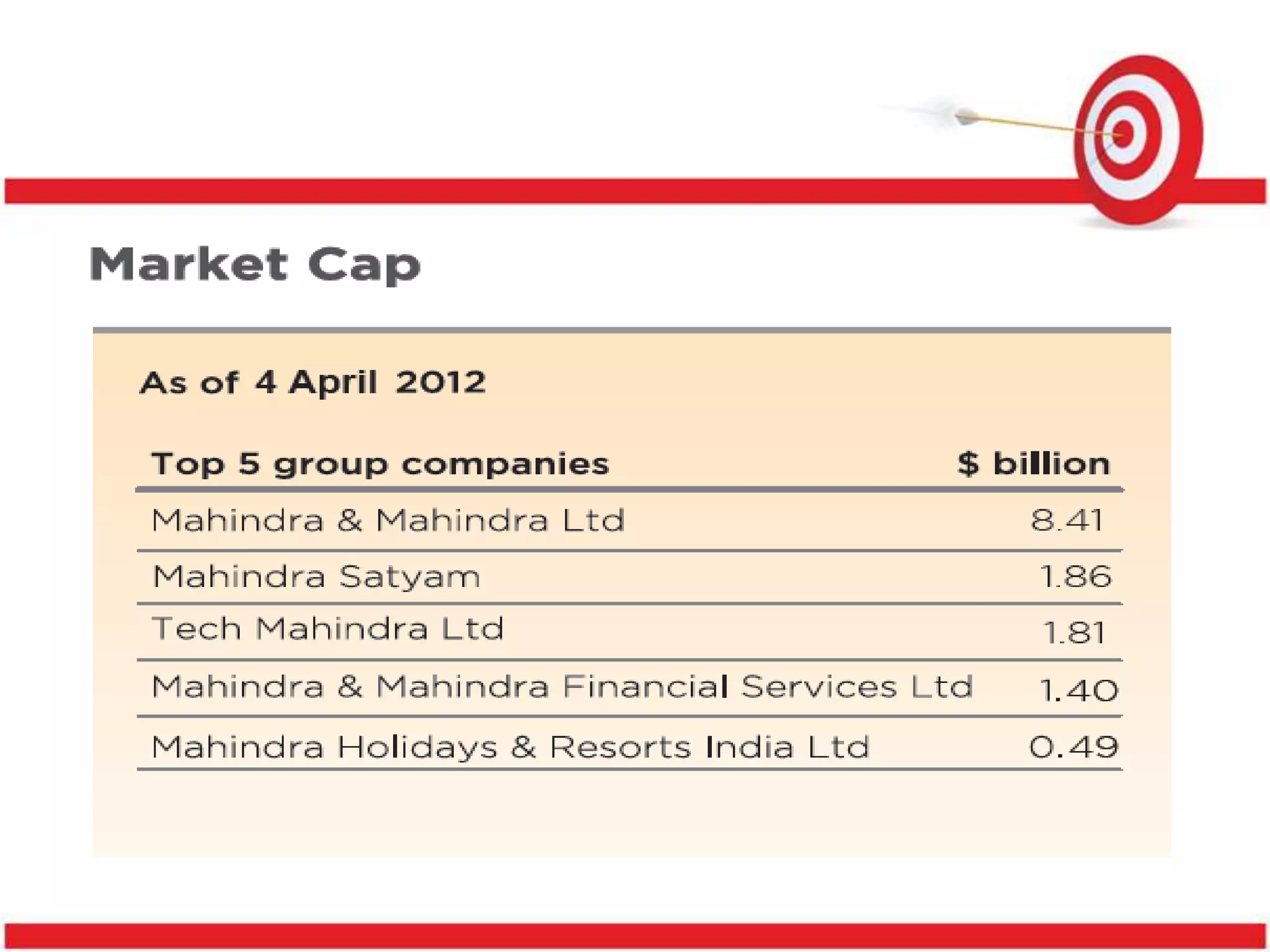

- Founded in 1945, Mahindra has grown to a $15.4 billion business with over 144,000 employees across multiple sectors including automobiles, technology, energy, finance, and more.

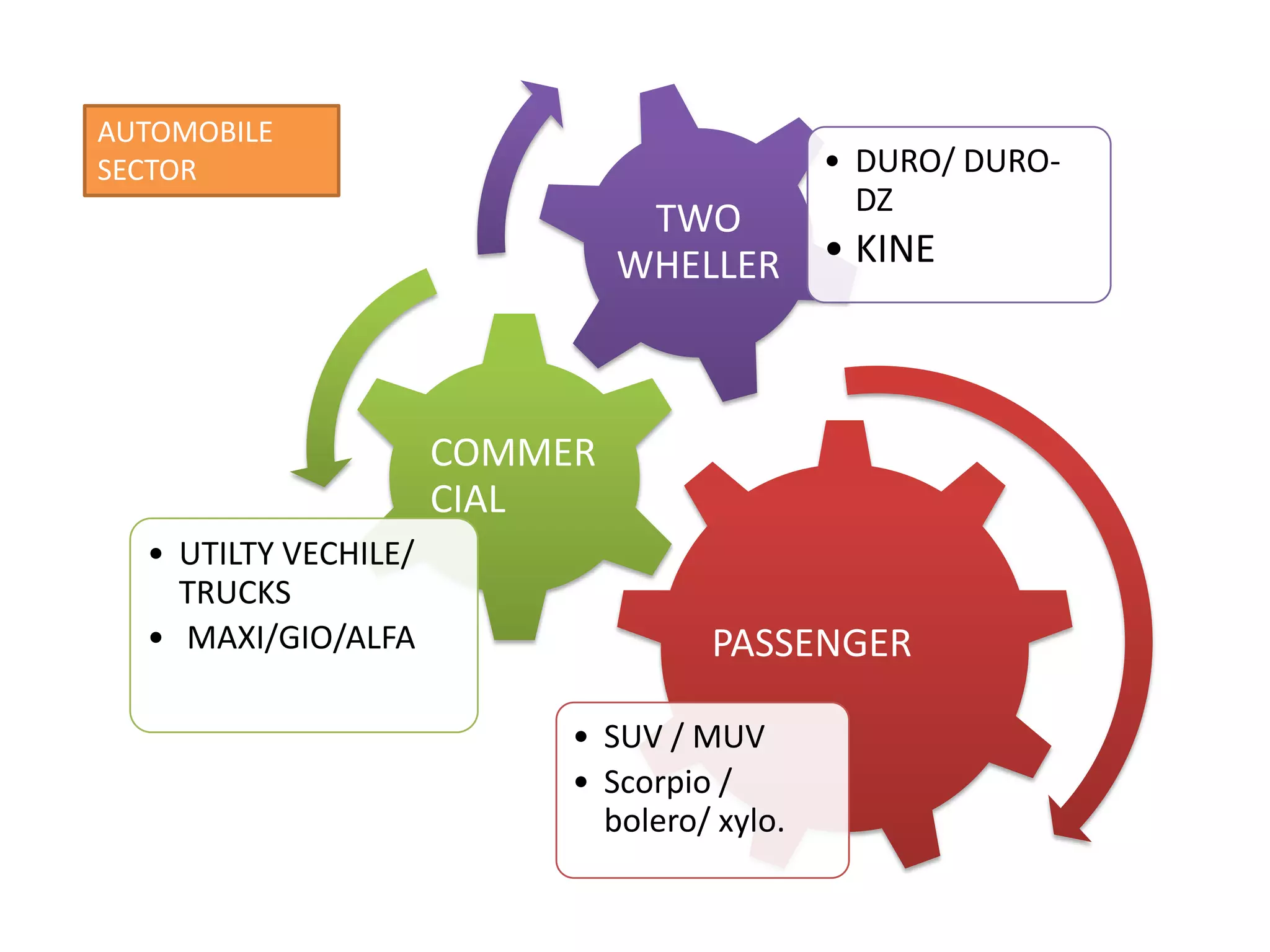

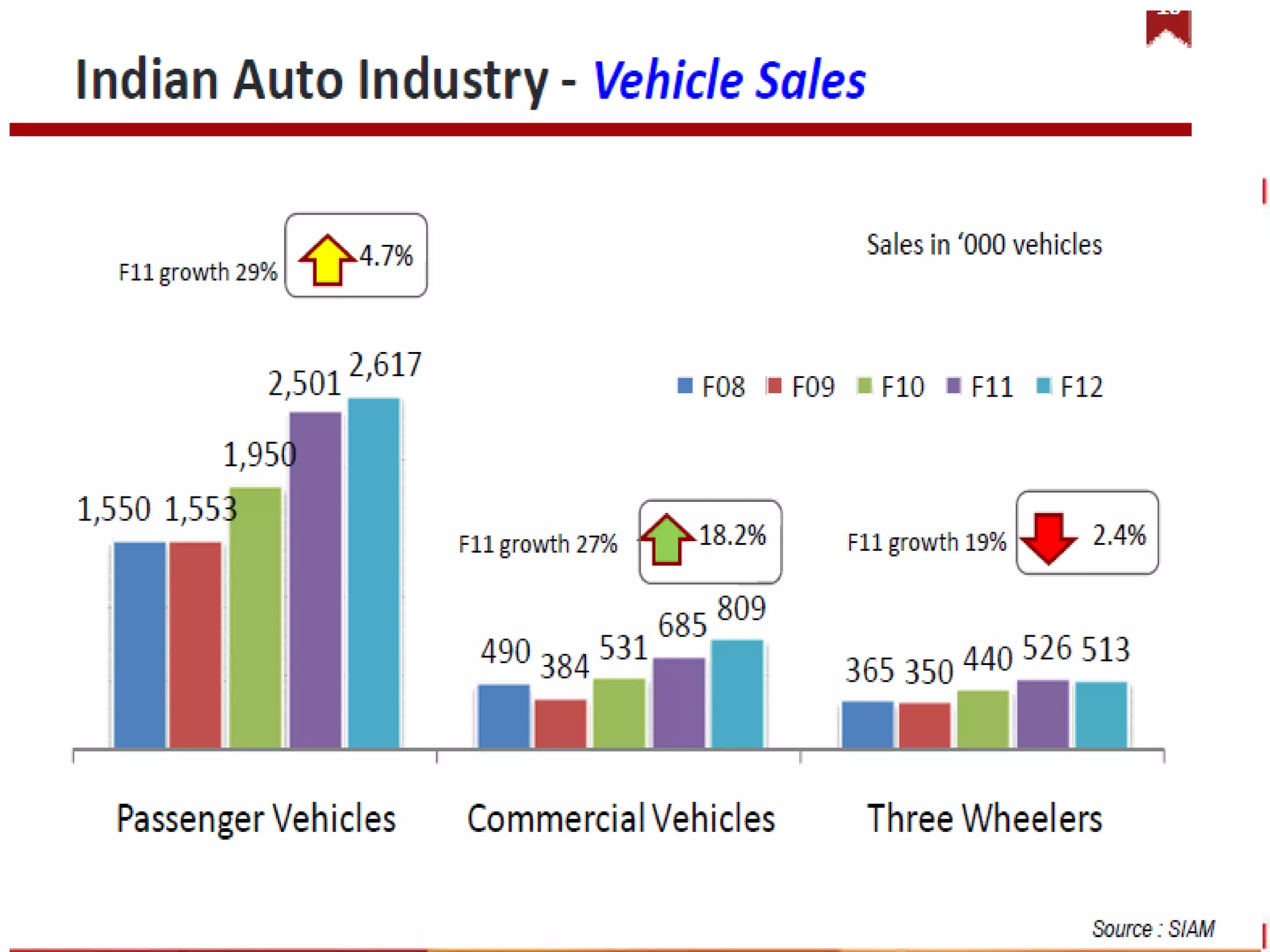

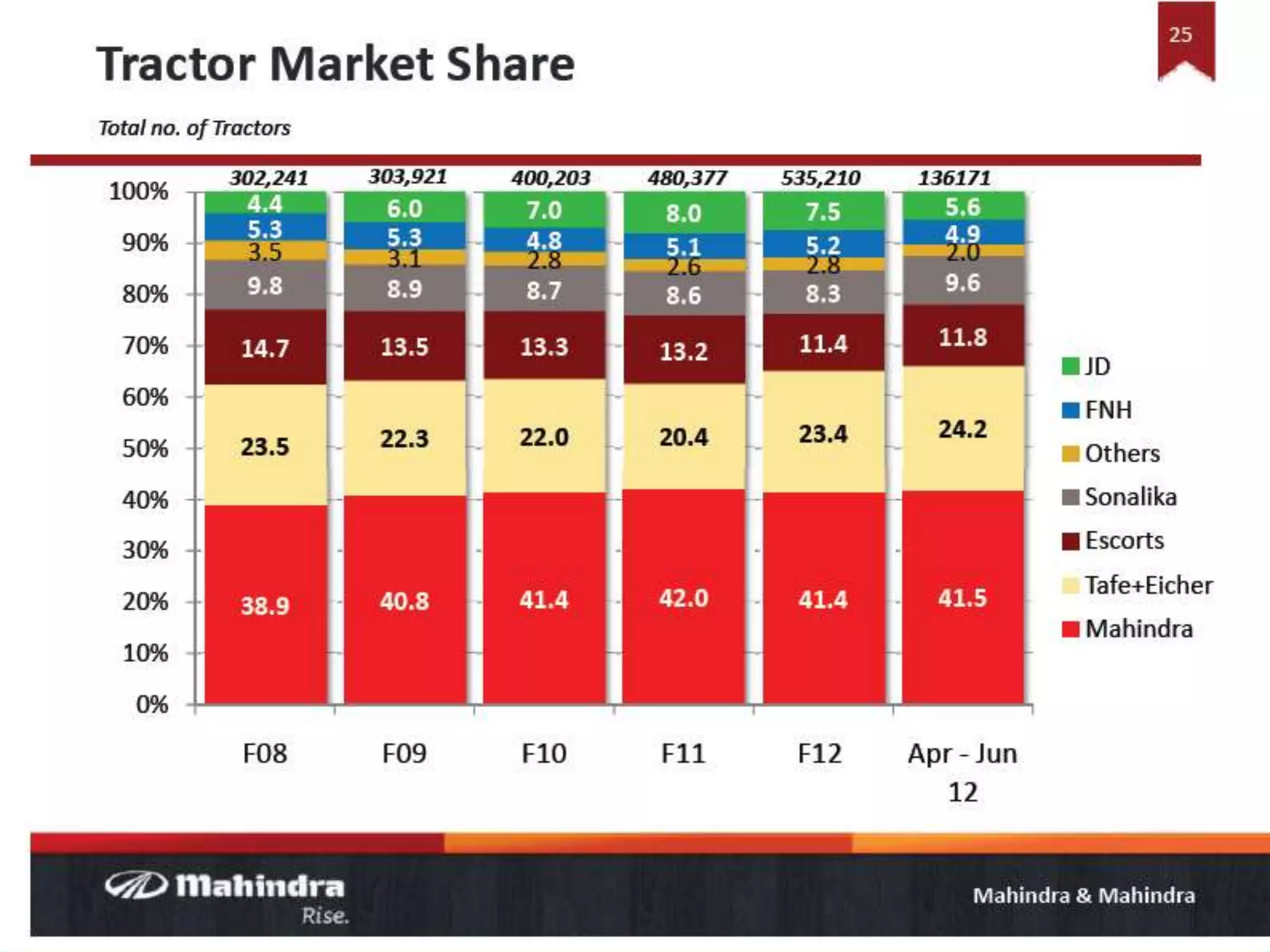

- Its core automobile business includes production of passenger and commercial vehicles, tractors, and two-wheelers. It has a 6.5% market share in passenger vehicles in India.

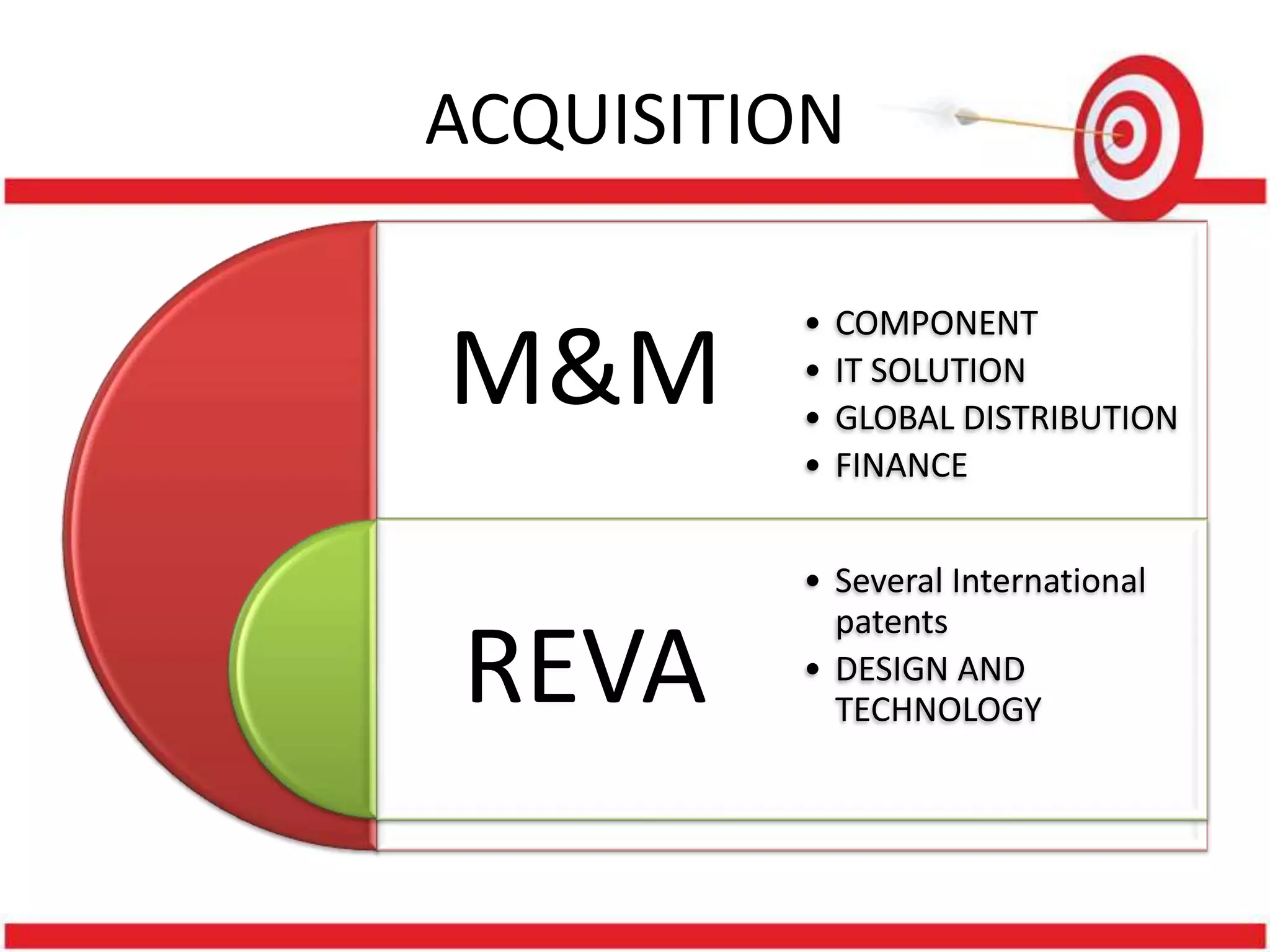

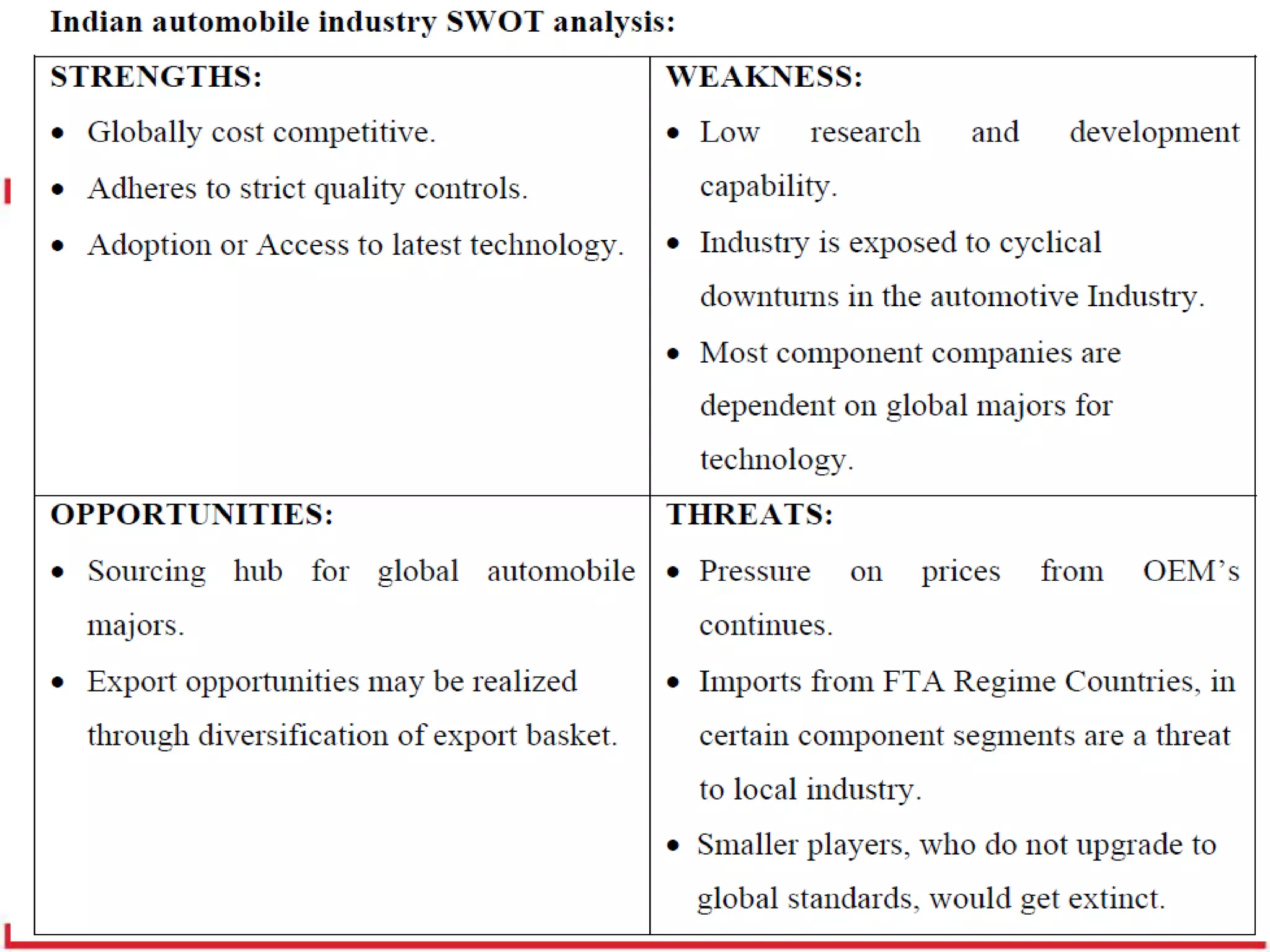

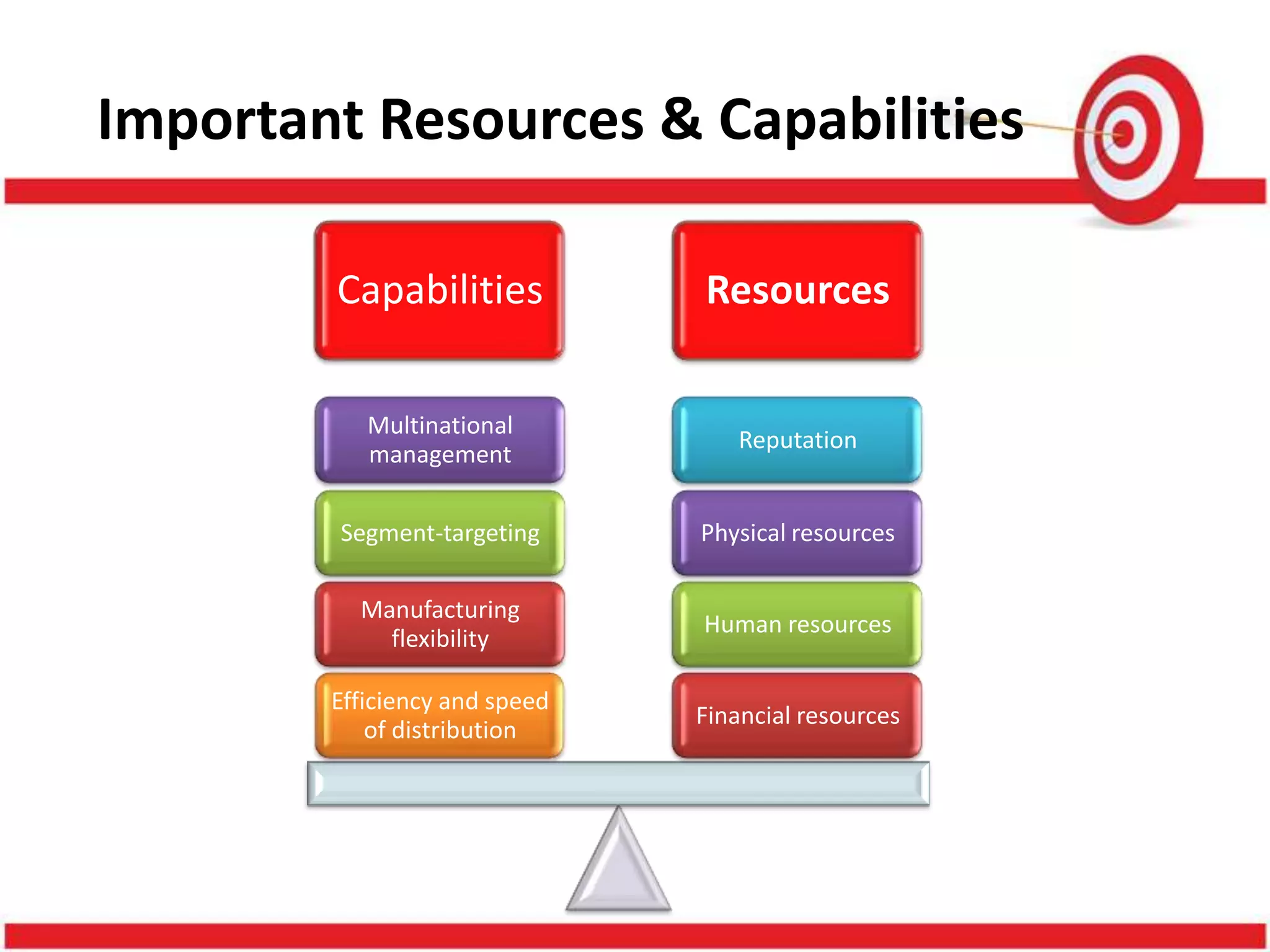

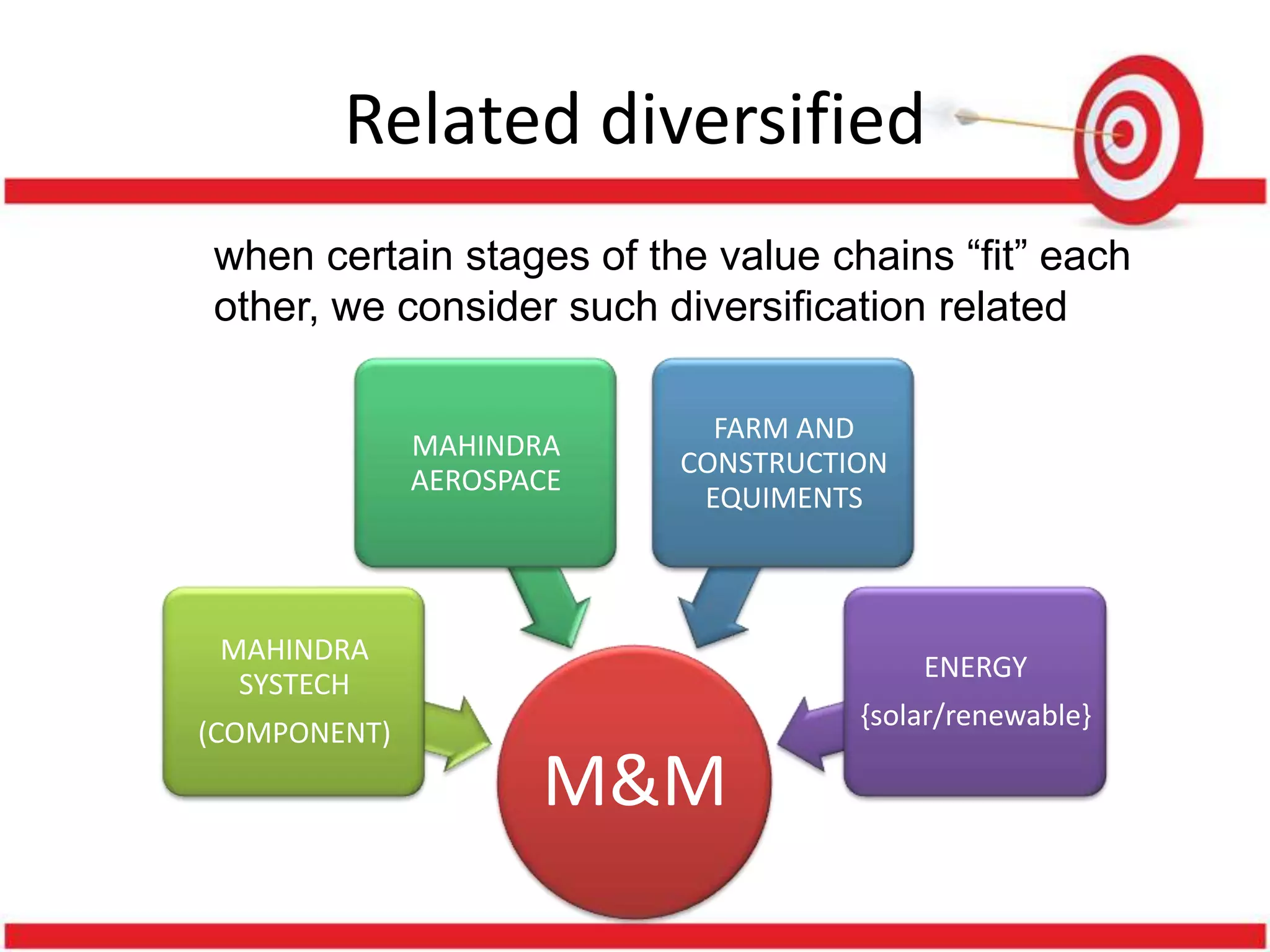

- Mahindra has pursued diversification through both related diversification leveraging synergies across sectors, and unrelated diversification into new sectors like IT, infrastructure, hospitality

![UNRELATED DIVERSIFICATION

INFORMATION LEISURE & RETAIL

TECHNOLOGY HOSPITALITY • MOM & ME.

[IT] • MAHINDRA

HOLIDAY • REAL ESTATE

• TECH MAHINDRA &RESORTS INDIA • SEZ

• MAHINDRA • MAHINDRA • LIVING SPACES

SATYAM OCEAN BLUE

• CANVAS-M MARINE](https://image.slidesharecdn.com/mahindramahindra-130224105418-phpapp02/75/Mahindra-mahindra-26-2048.jpg)