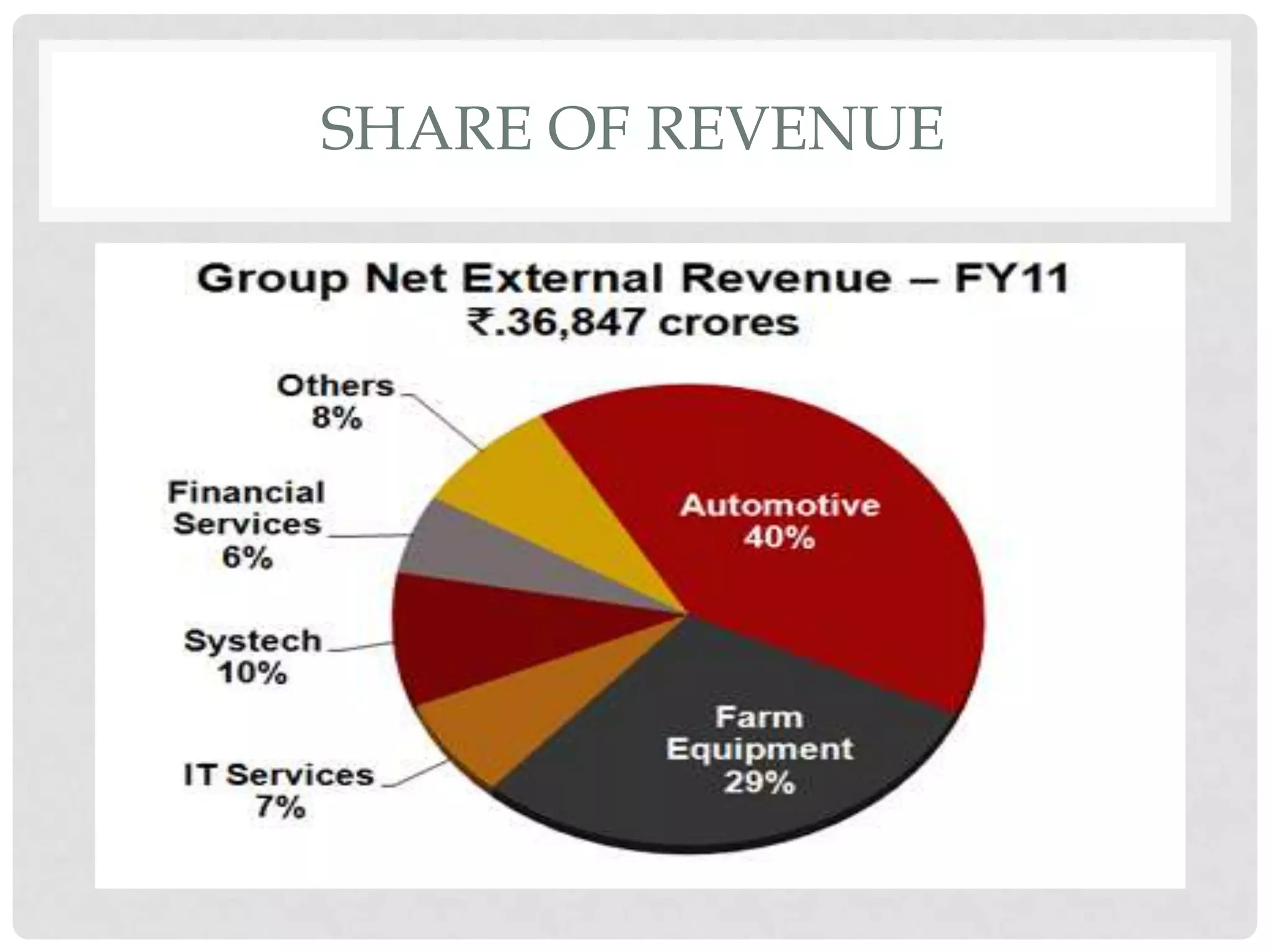

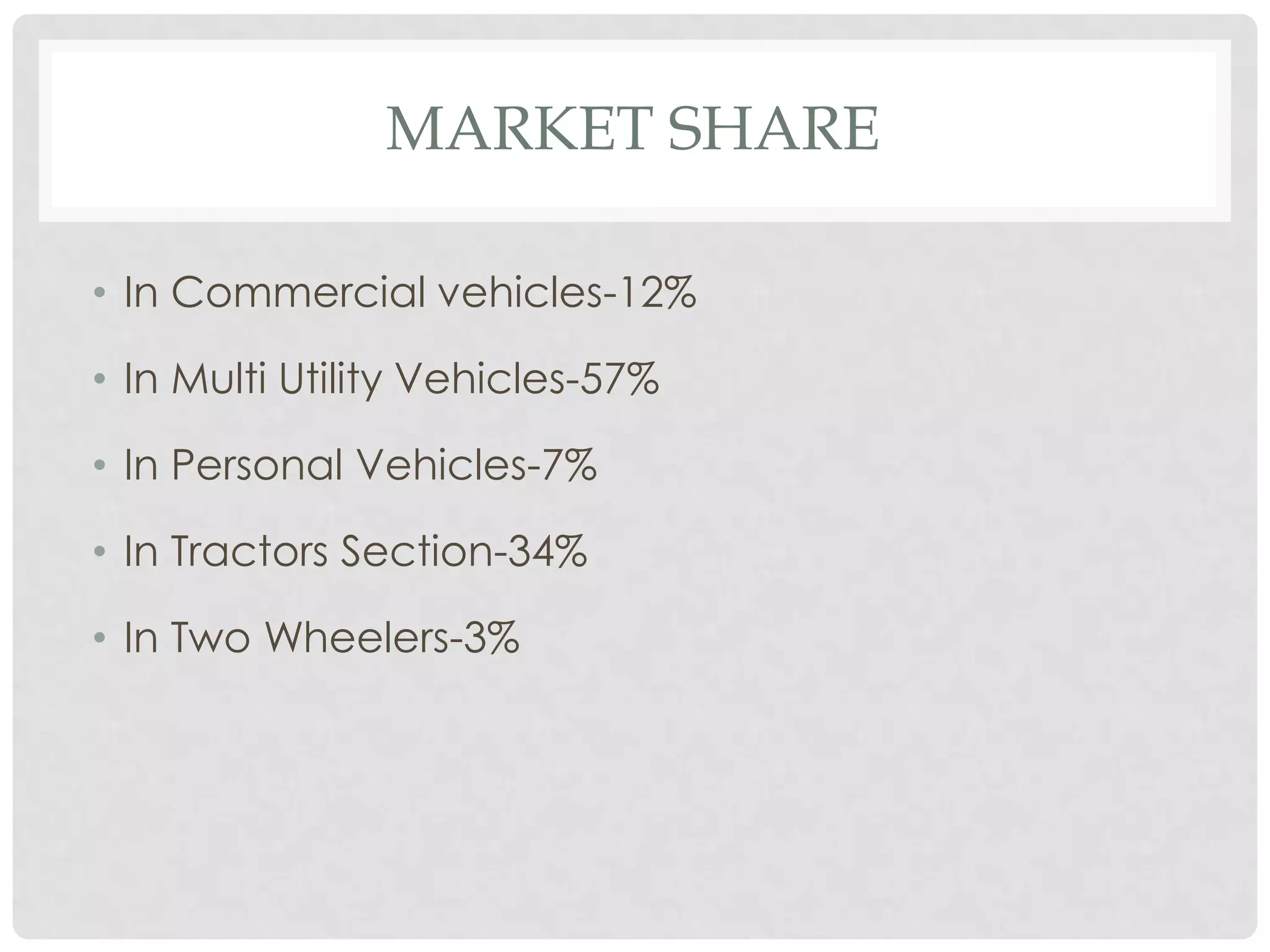

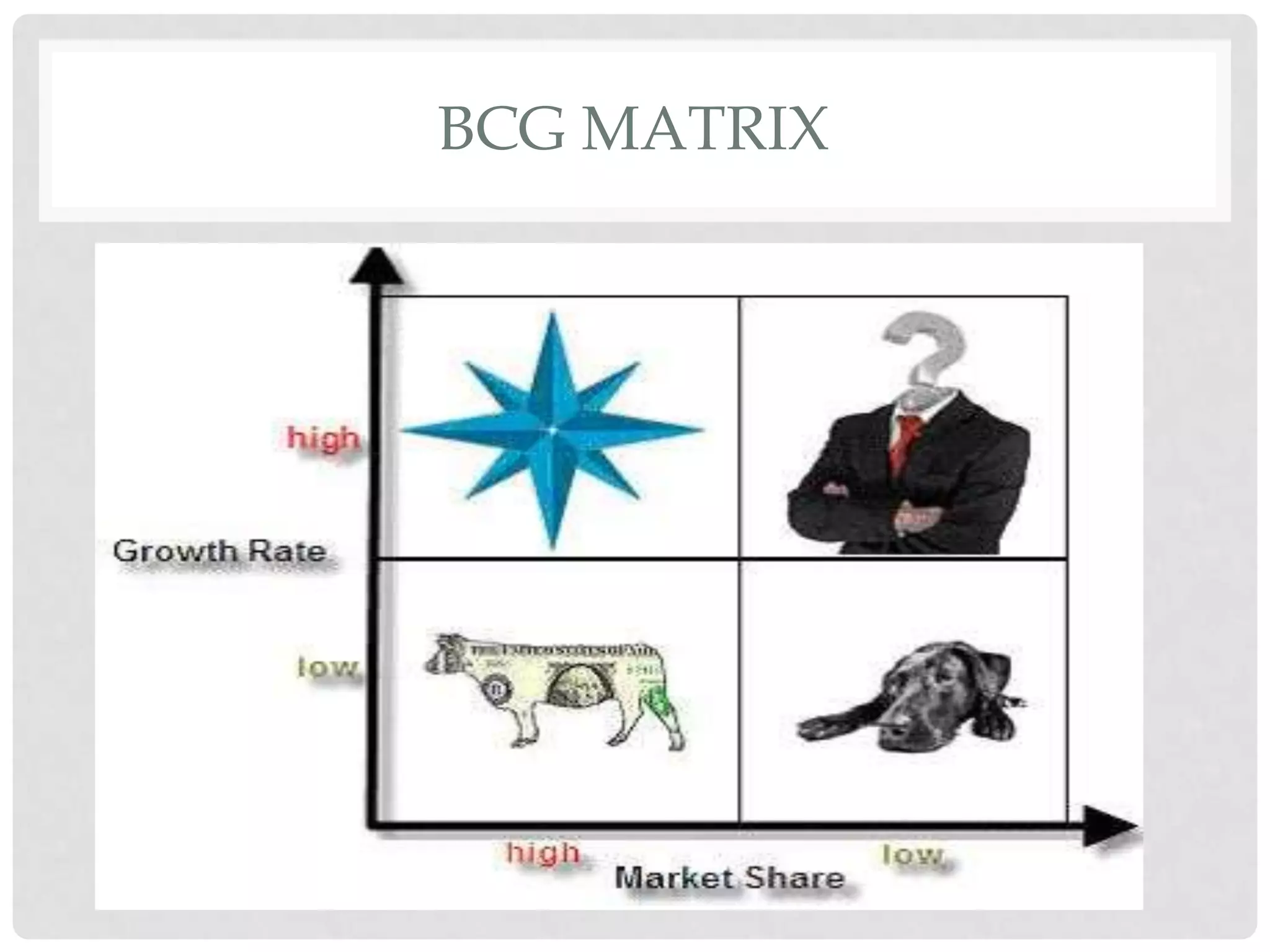

Mahindra & Mahindra Limited is an Indian multinational conglomerate company based in Mumbai, India. It operates in key industries like automotive, farm equipment, information technology, and infrastructure development. Some of its core business activities include automotive, farm equipment, financial services, and information technology. M&M is India's largest SUV maker and has a global presence with subsidiaries around the world.