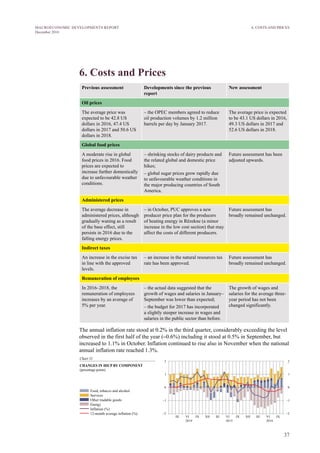

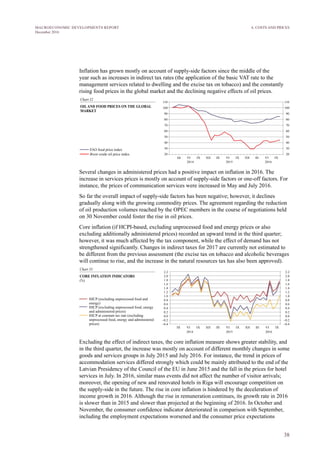

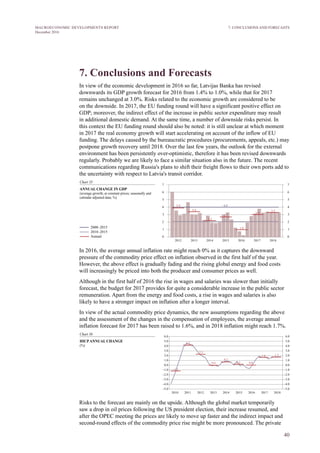

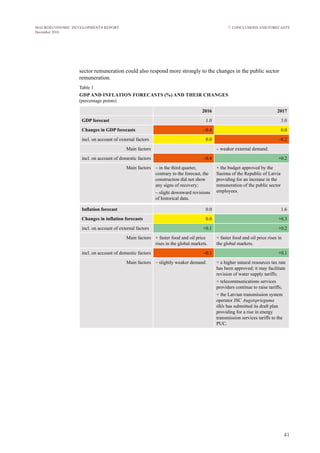

The December 2016 Macroeconomic Developments Report from Latvijas Banka presents a pessimistic economic outlook for Latvia due to stagnant GDP growth, weak external demand, and uncertainties following geopolitical developments, including the UK's EU referendum. It forecasts potential improvements in 2017 driven by EU funding and increased domestic consumption, yet warns of ongoing risks from external economic factors. The report discusses various economic sectors, financial conditions, labor market insights, and inflation expectations, emphasizing the need for structural reforms to enhance competitiveness and GDP growth.

![44

MACROECONOMIC DEVELOPMENTS REPORT

December 2016

Bibliography

1. BOKAN, Nikola, GERALI, Andrea, GOMES, Sandra, JACQUINOT, Pascal, PISANI,

Massimiliano. EAGLE-FLI. A Macroeconomic Model of Banking and Financial

Interdependence in the Euro Area. European Central Bank Working Paper Series, No. 1923,

June 2016. 65 p.

2. BUŠS, Ginters (2015). Search-and-Matching Frictions and Labour Market Dynamics in

Latvia. Latvijas Banka Working Paper, No. 4/2015. 73 p.

3. HM Government UK. HM Treasury Analysis: the Immediate Economic Impact of Leaving

the EU. HM Treasury, 23 May 2016 [skatīts 2016. gada 30. novembrī]. Pieejams: https://

www.gov.uk/government/publications/hm-treasury-analysis-the-immediate-economic-

impact-of-leaving-the-eu.

4. Independent, 2016. 'Hard Brexit' could Cost up to £66bn and Slash UK GDP by almost

10%, Treasury Warns. Independent, 11 October 2016 [skatīts 2016. gada 30. novembrī].

Pieejams: http://www.independent.co.uk/news/uk/politics/brexit-latest-hard-brexit-uk-

economy-66bn-cost-leaving-eu-a7354996.html.

5. International Monetary Fund. Country Report No. 16/169: United Kingdom. International

Monetary Fund, June 2016. 65 p.

8.2 Russia's cargo traffic diverted from Latvian ports

The year 2016 saw a steep contraction in freight transport by rail and via ports, because the

transported volumes of coal and oil, two key product groups, shrank. It is associated with

falling global demand for coal, sanctions against a number of freight owners, depreciation

of the Russian rouble, and higher transit costs through Latvia. In addition, for a long time

now, Russia has been aiming at reducing the share of neighbouring ports (in Latvia and

Ukraine) in its export deliveries. This share is planned to have been reduced to 5%5

by 2020.

Public statements relative to these long-standing plans of Russia came out at an increasing

frequency in 2016. Nikolay Tokarev, Head of the Russian oil transport and pipeline PJSC

Transneft announced in September, for instance, that Russia's exports of oil products through

the Baltic ports would have been completely redirected to Russia by 2018. Moreover, Russia

is creating preconditions also for diverting freight of other states away from the Baltic ports.

Thus, at the end of October came the news that the Board of OAO Rossijskije železnije

dorogi had resolved on a 25% discount on the oil product transit from Belarus to Russian

ports, which could make the cost of Belorussian shipments to Russian ports comparable with

the tariffs in the ports of Klaipeda and Ventspils.

This risk scenario assumes an extremely adverse development of events, i.e. the Russian

cargo business is completely diverted away from the Latvian ports. It is understood that due

to the absence of freight of Russian origin, cargoes by rail would decrease by about 70% and

via ports by about 60%6

. The effects of the shock (diverting Russian freight) are estimated by

using the computable general equilibrium (CGE) model, capturing 32 industries, 55 products

and seven categories of final users. The model is based on Latvia's supply and use tables for

2011 from the World Input-Output Database (WIOD). To simulate the effect from freight

diverting, exports of affected sectors (domestic transport and storage, and auxiliary transport

services) are subject to shock.

The model shows that on account of the loss of Russian cargo traffic GDP would decrease by

4.3% from its current level in the year the shock applies. Difficulties in the transport industry

would push up unemployment, while wages and salaries would go down. Consequently,

purchasing power and private consumption would also deteriorate. Weak economic activity

would put investment flows under pressure as well.

5

In 2015, around 9% of Russia's export cargoes were loaded and unloaded at the Baltic and Ukrainian ports.

6

The assumption is based on an approximate share of Russian energy resource cargoes in total cargoes.

8. ANALYSIS OF SCENARIOS](https://image.slidesharecdn.com/mnp2016decembrisen-170106123506/85/Macroeconomic-Developments-Report-December-2016-45-320.jpg)

![45

MACROECONOMIC DEVELOPMENTS REPORT

December 2016

The CGE model provides an insight not only into the effects of a shock on the economy

overall but also on individual sectors. Effects are negative for shock-affected sectors and

the related transport sectors; industries with more sensitive response to overall domestic

economic activity are also impacted. Employment and output decreases are posted by

construction, financial and insurance activities, real estate operations, the energy sector,

and trade. On account of cheaper and easily available workforce, some positive impact is

recorded for manufacturing (in particular, manufacture of transport vehicles, machinery

and equipment, products of wood and textile articles, all export-oriented subsectors), and

agriculture.

Despite Russia's enormous investment to finance its port and railway infrastructure, it will

fall short of the capacity to service all freight redirected to its ports. And what is more,

recently (in September and October) the situation in Latvia's transit sector has somewhat

improved. It particularly refers to the coal freight segment where due to coal price rises

and the beginning of the heating season in Europe the demand for and exports of coal from

Russia are concurrently growing. The expanding volumes of Russian exports aggravate

capacity problems at its local ports, hence a complete withdrawal of freight traffic from

the Baltic ports without making new large investments domestically seems unlikely in

the nearest future. Nevertheless, the lack of diversity in Latvian rail- and port-transported

cargoes as well as Russia's potential to influence transporters' transit route options imply

that downside risks are in place and alternative cargoes to Russia's energy resources shall be

looked for.

Bibliography

1. BEŅKOVSKIS, Konstantīns, GOLUZINS, Eduards, TKAČEVS, Oļegs (2016). CGE

Model with Fiscal Sector for Latvia. Latvijas Banka Working Paper, No. 1/2016. 62 p.

2. Морская коллегия при Правительстве Российской Федерации. Стратегия развития

морской портовой инфраструктуры России до 2030 года. Москва: 2015 [skatīts

2016. gada 6. decembrī]. Pieejams: http://www.rosmorport.ru/media/File/seastrategy/

strategy_150430.pdf.

8. ANALYSIS OF SCENARIOS](https://image.slidesharecdn.com/mnp2016decembrisen-170106123506/85/Macroeconomic-Developments-Report-December-2016-46-320.jpg)