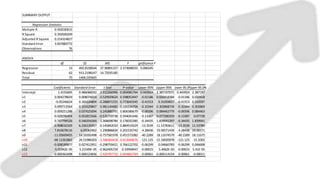

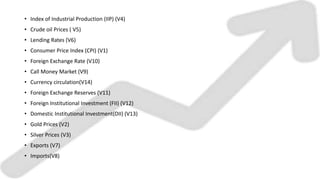

This document analyzes the relationship between macroeconomic variables and stock market performance in India. It uses monthly data from 2011-2017 on factors like exports, imports, commodity prices, exchange rates, industrial production, lending rates, inflation and foreign investment. Statistical analysis through correlation, regression and error analysis finds that domestic investment, exchange rates and foreign exchange reserves are the most significant determinants of stock prices on the Bombay Stock Exchange. While some macro factors influence the market, emotions and non-public information also impact stock prices, limiting perfect predictability.

![Macro economic Variable and Stock Market

By: Vinu Arpitha KS [16dm020]](https://image.slidesharecdn.com/sapm-macroeconomicfactors-210622153447/75/Macro-economic-factors-1-2048.jpg)