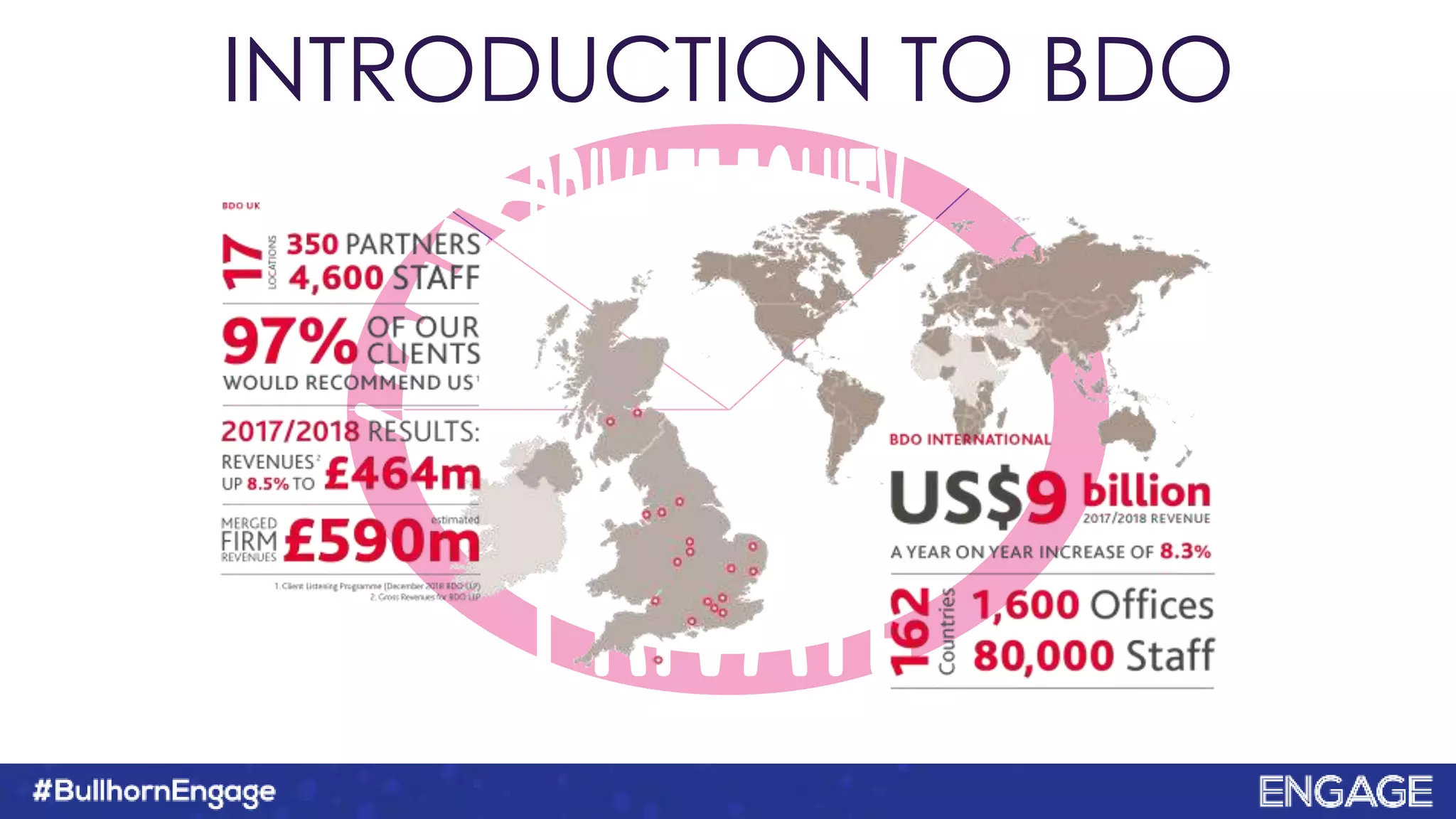

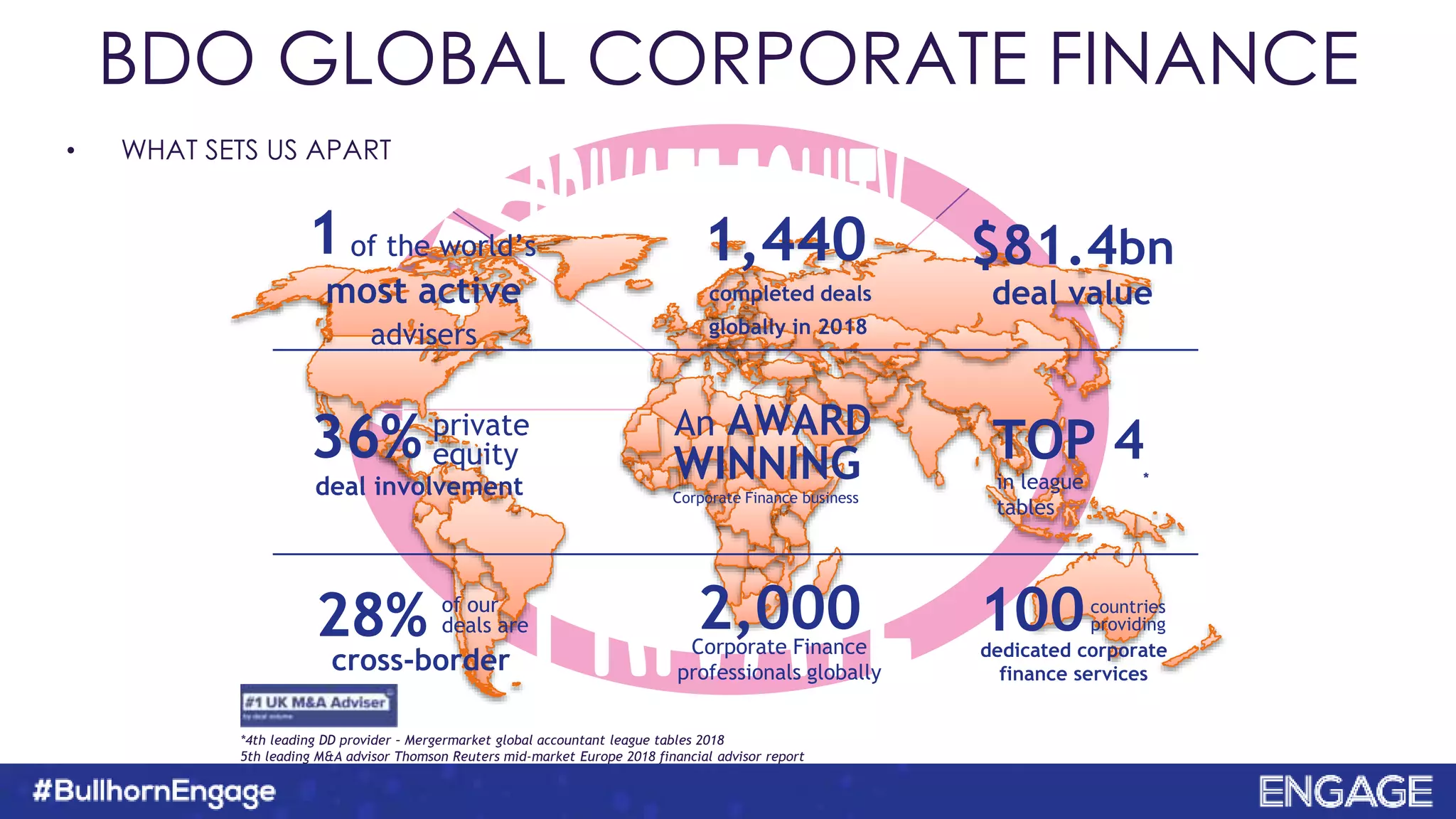

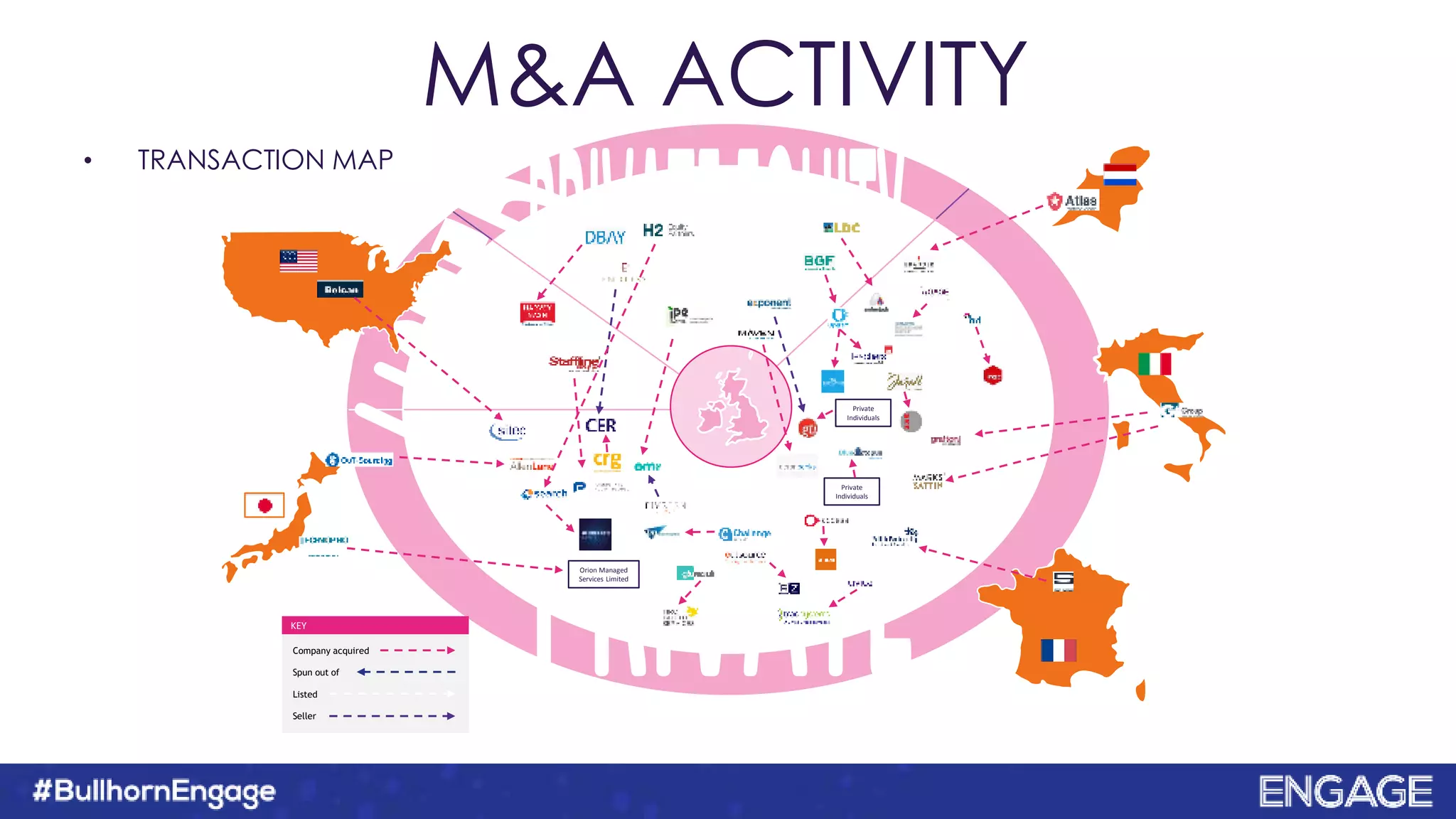

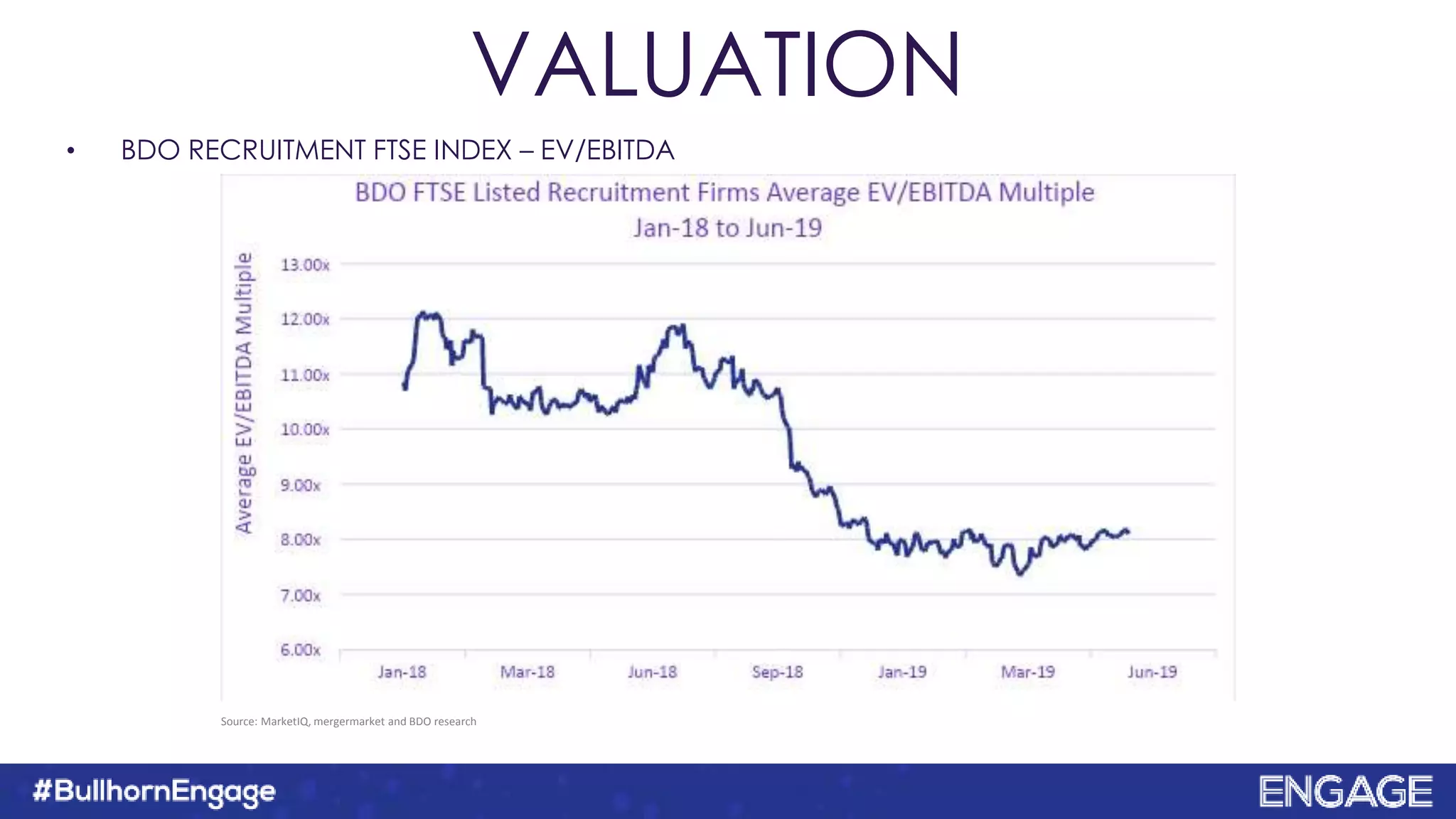

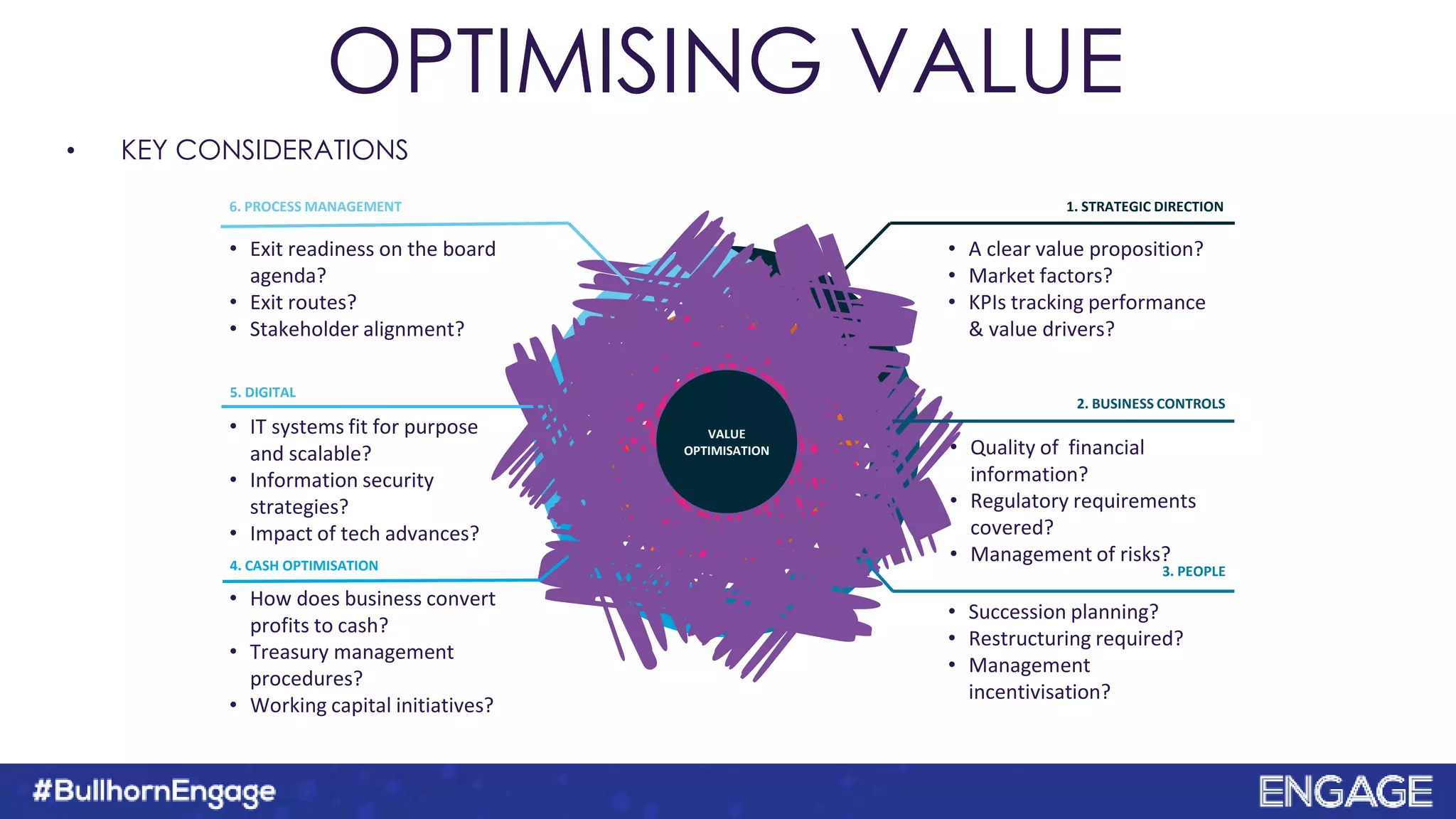

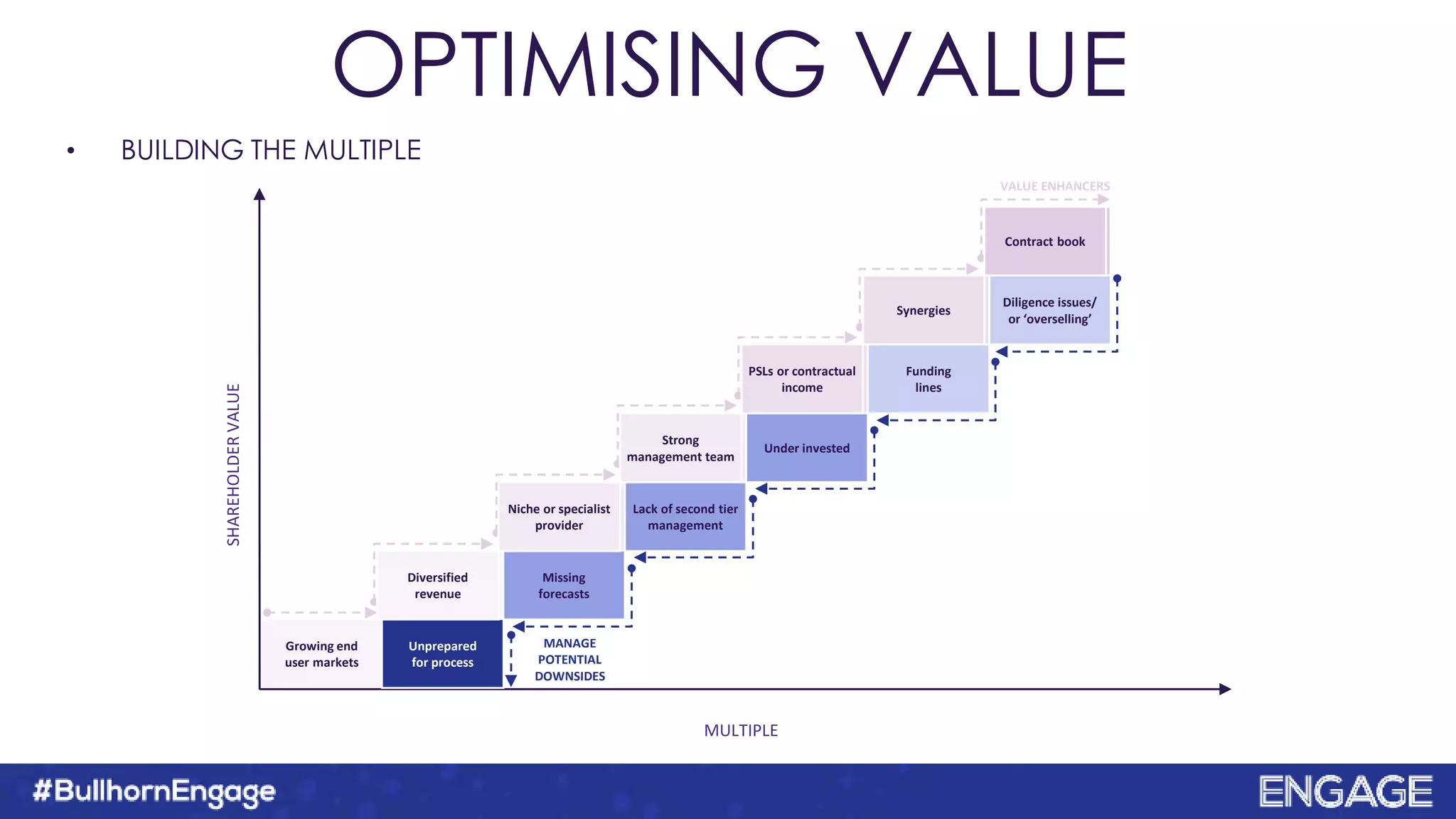

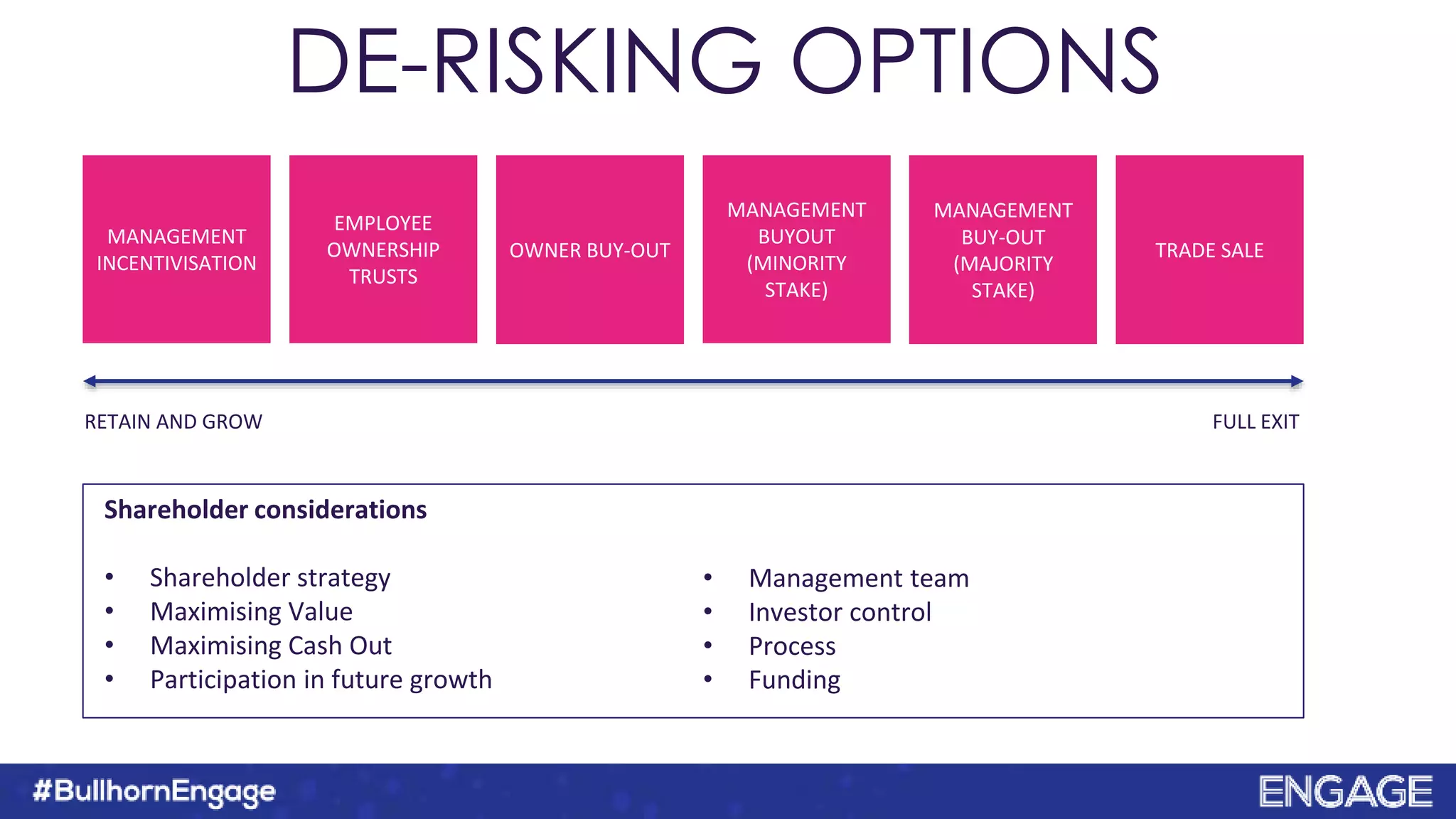

This document provides an overview and agenda for a presentation on pursuing a profitable exit from a recruitment business through mergers and acquisitions (M&A). The presentation will cover recent M&A activity in the recruitment sector, methods for valuing a recruitment business, optimizing value before an exit, and strategies for de-risking the exit process such as management buyouts. The presentation is delivered by James Fieldhouse, a managing director from consulting firm BDO with 16 years of experience advising entrepreneurial businesses.