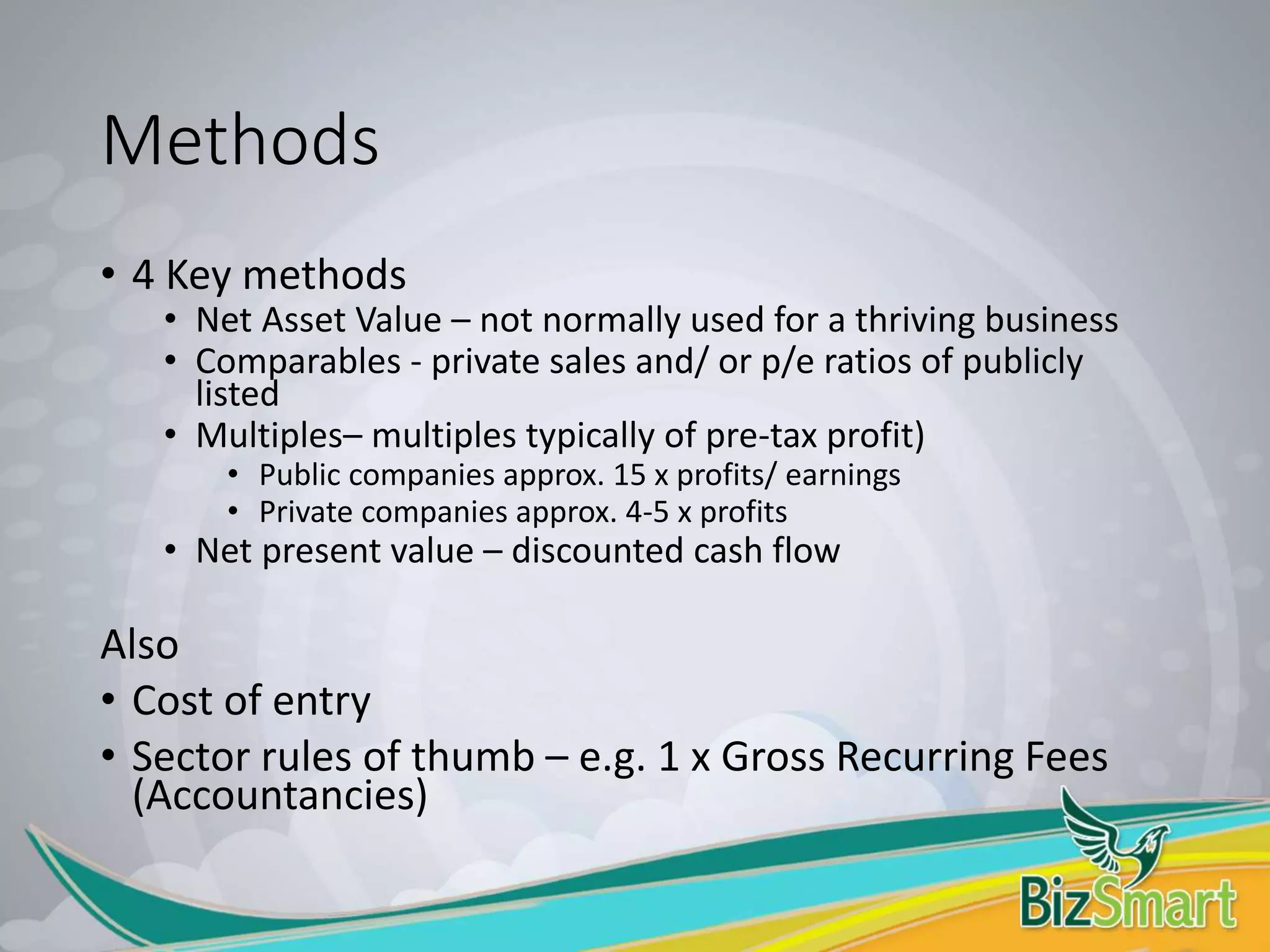

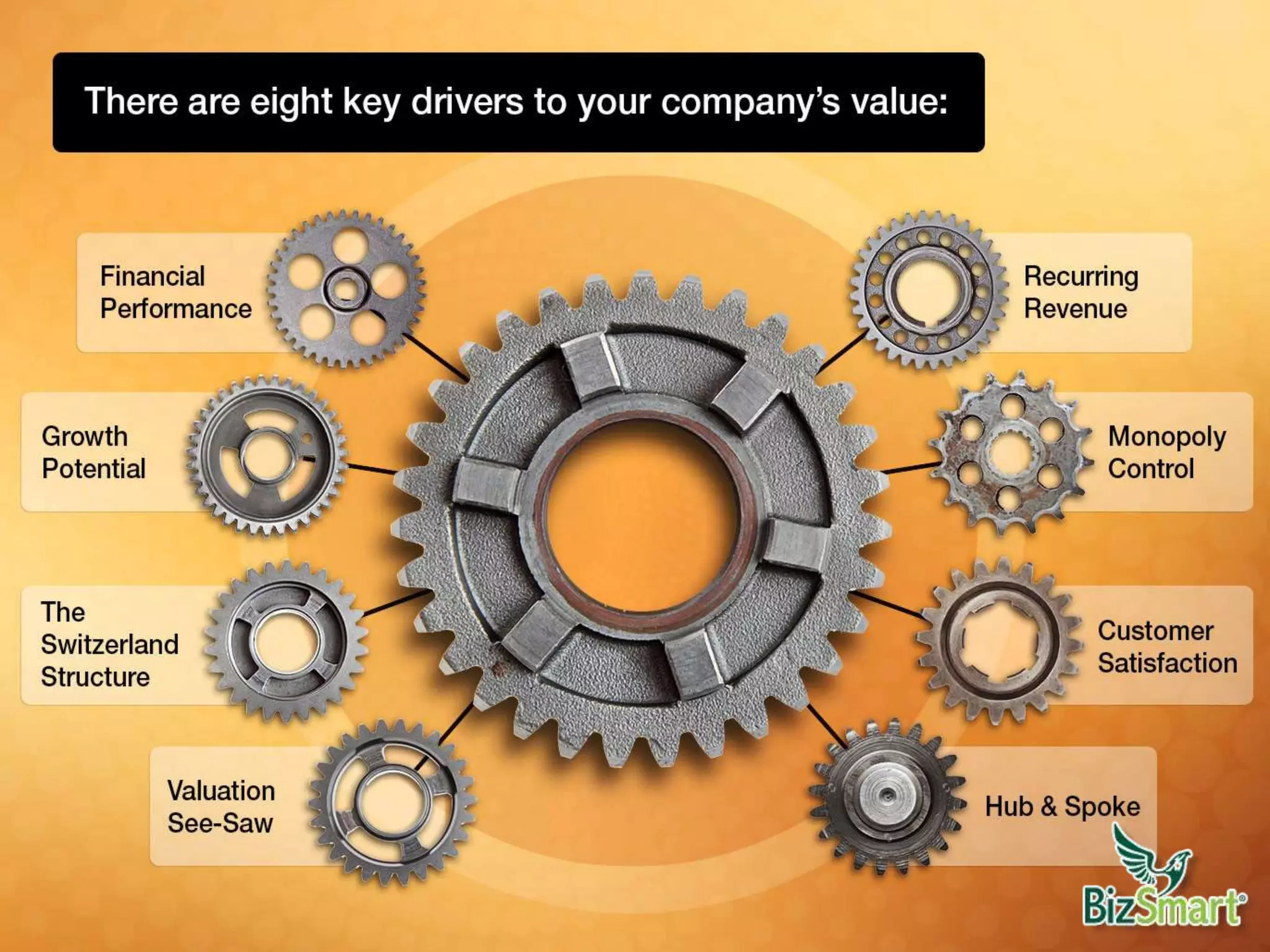

The document discusses the importance of planning for an exit strategy in business, highlighting various methods and reasons for exiting such as retirement or personal circumstances. It emphasizes the need for valuation assessment and potential purchasers, while providing insights into maximizing sale price and the exit process. Additionally, it offers guidance on when to start planning, types of buyers, and the role of intermediaries like brokers and lawyers in ensuring a successful transaction.