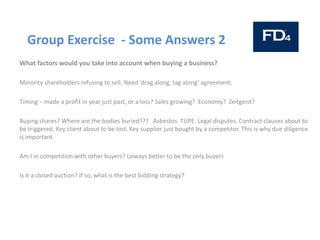

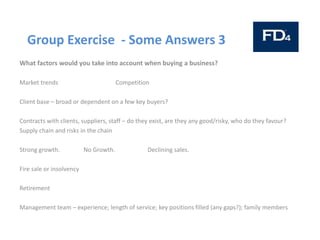

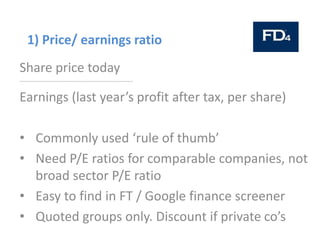

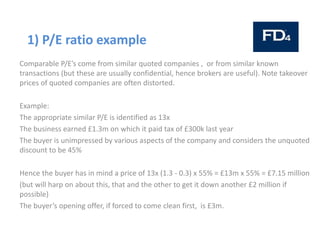

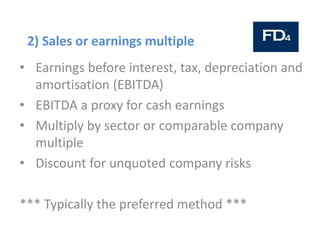

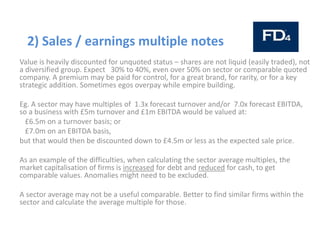

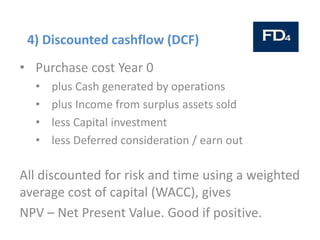

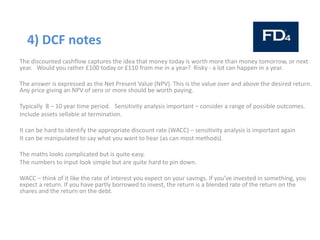

This document provides an overview of how to value a business for purchase. It discusses that valuation is complex and only one part of the larger process of buying and selling a business. Common valuation methods are discussed, including price/earnings ratio, sales or earnings multiples, return on investment, discounted cashflow, and net asset value. Additional factors to consider include tax implications, management team, market trends, client base, contracts, and supply chain. Due diligence is important to understand potential risks and opportunities. Psychology and managing expectations are also key aspects of negotiating a deal. The overall process can take many months to complete.