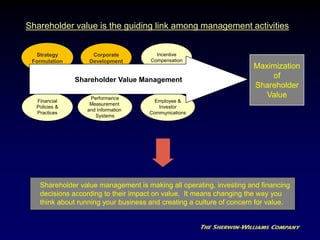

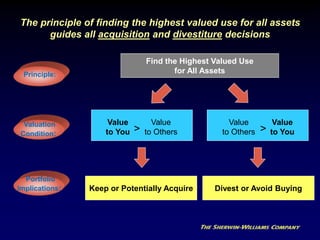

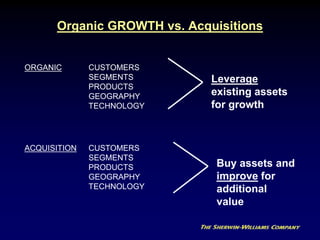

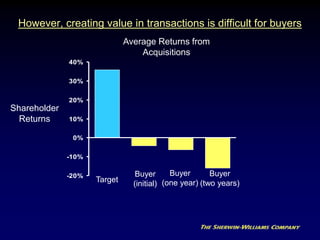

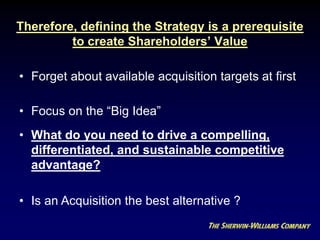

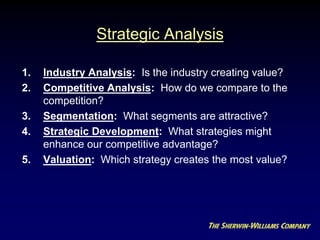

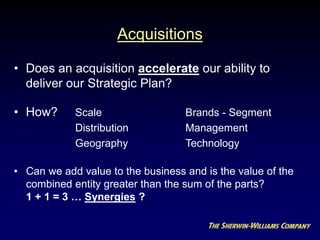

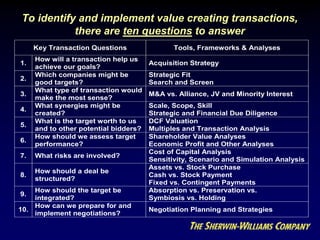

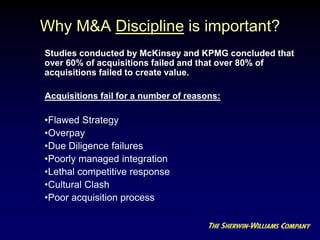

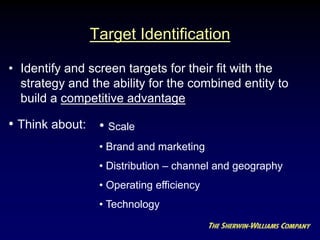

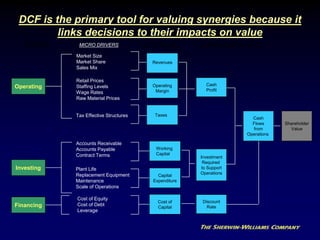

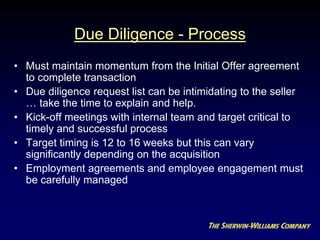

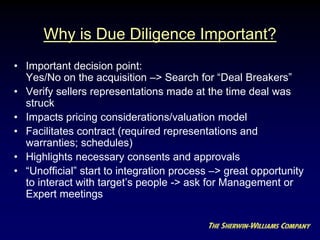

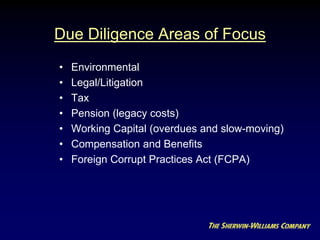

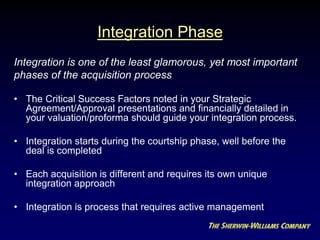

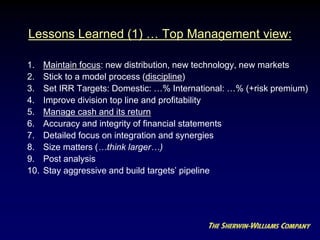

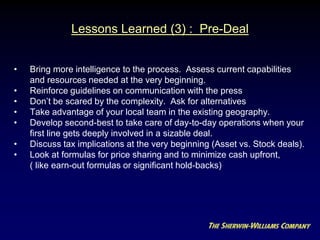

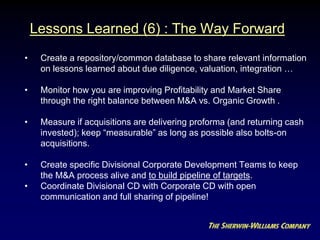

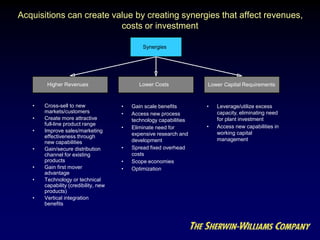

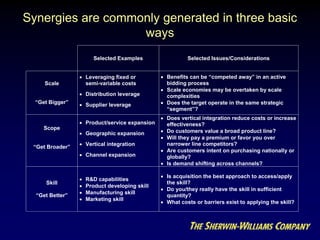

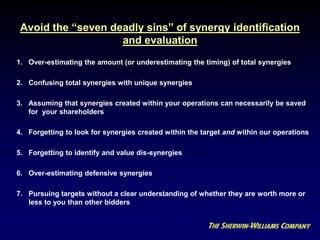

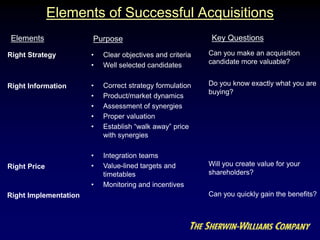

The document discusses navigating mergers and acquisitions to facilitate smooth integration. It explores organic growth versus inorganic growth through acquisition, and reviews the post-merger integration process. The presentation focuses on selecting the right growth method, reviewing integration, and devising ongoing improvement. It emphasizes that the goal is to build shareholder value through maximizing the value of all assets.