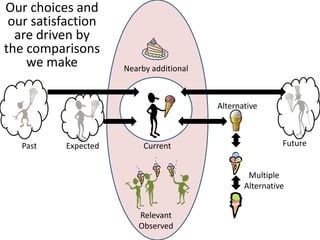

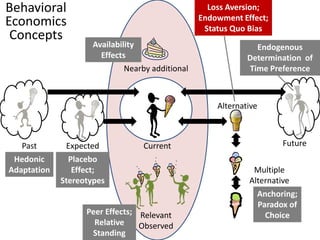

This document summarizes research on loss aversion and the endowment effect from behavioral economics. It discusses several key findings:

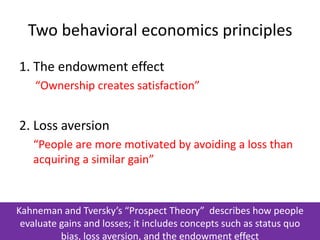

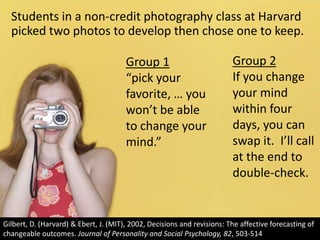

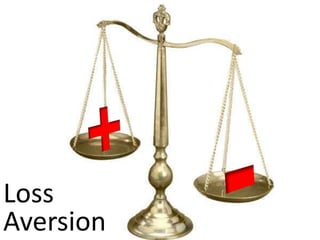

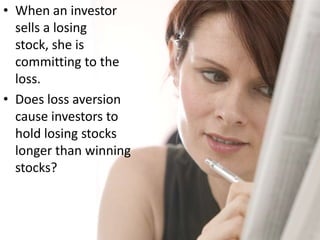

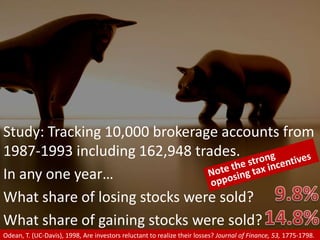

1. People strongly prefer to avoid losses rather than acquire equivalent gains. This loss aversion is greater than what would be expected based on pure economic utility.

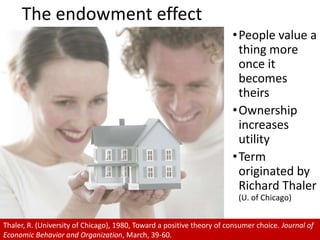

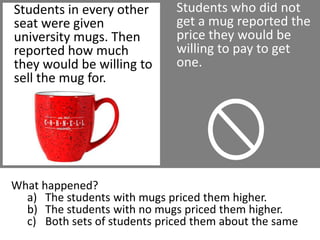

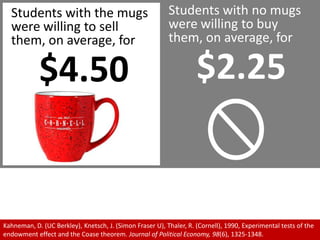

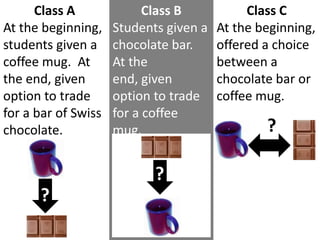

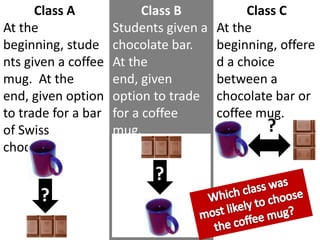

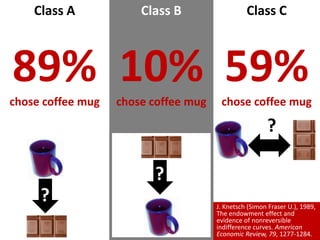

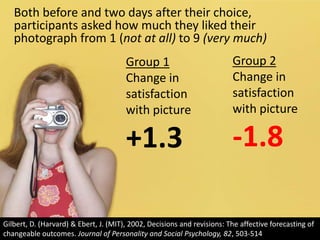

2. The endowment effect shows that people value things more once they own them. Ownership increases satisfaction and willingness to pay.

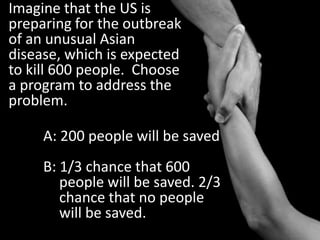

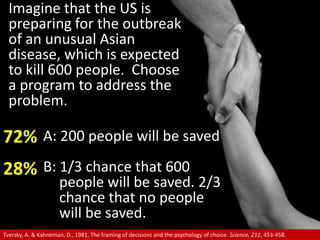

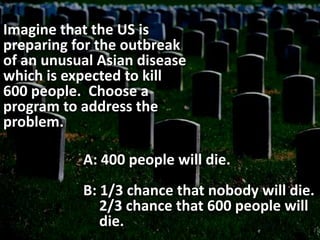

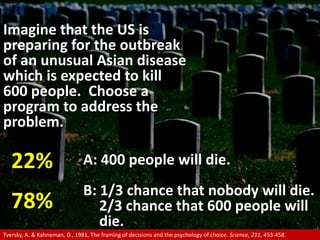

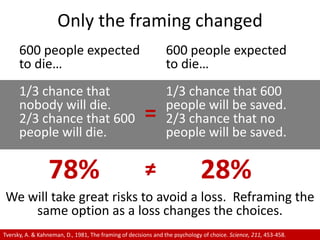

3. Framing choices as losses or gains significantly impacts decisions through loss aversion even if the economic substance is unchanged. People will accept greater risks to avoid losses than acquire gains.