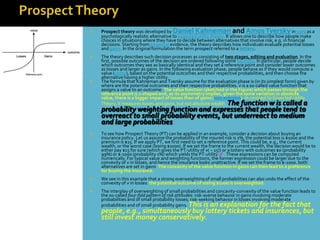

Daniel Kahneman and Amos Tversky developed prospect theory in 1979 as a psychologically realistic alternative to expected utility theory to describe how people make choices involving risk. Prospect theory incorporates cognitive biases like loss aversion and probability weighting to account for behaviors that contradict economic models' assumptions. Kahneman later explored hedonic psychology and found people's remembered well-being differs from their actual experienced well-being over time. His work established the foundations for behavioral economics by revealing unconscious errors in human judgment.

![ An important paper in the development of the behavioral finance and

economics fields was written by Kahneman and Tversky in 1979. This

paper, 'Prospect theory: An Analysis of Decision Under Risk', used

cognitive psychological techniques to explain a number of documented

divergences of economic decision making from neo-classical theory.

Over time many other psychological effects have been incorporated into

behavioral finance, such as overconfidence and the effects of limited

attention.

Further milestones in the development of the field include a well

attended and diverse conference at the University of Chicago,[4] a

special 1997 edition of the Quarterly Journal of Economics ('In Memory of

Amos Tversky') devoted to the topic of behavioral economics and the

award of the Nobel prize to Daniel Kahneman in 2002 "for having

integrated insights from psychological research into economic science,

especially concerning human judgment and decision-making under

uncertainty"](https://image.slidesharecdn.com/thinkingfastandslow3-120814141142-phpapp01/85/Thinking-fast-and_slow-11-320.jpg)

![ Financial - Rule of 72 A rule of thumb for exponential growth at a constant rate. An

approximation of the "doubling time" formula used in population growth, which says divide 70 by

the percent growth rate (the actual number is 69.3147181 from the natural logarithm of 2, if the

percent growth is much much less than 1%). In terms of money, it is frequently easier to use 72

(rather than 70) because it works better in the 4%-10% range where interest rates often lie.

Therefore, divide 72 by the percent interest rate to determine the approximate amount of time to

double your money in an investment. For example, at 8% interest, your money will double in

approximately 9 years (72/8 = 9).

Tailors' Rule of Thumb A simple approximation that was used by tailors to determine the

wrist, neck, and waist circumferences of a person through one single measurement of the

circumference of that person's thumb. The rule states, typically, that twice the circumference of a

person's thumb is the circumference of their wrist, twice the circumference of the wrist is the

circumference of the neck, and twice around the neck is the person's waist. For example, if the

circumference of the thumb is 4 inches, then the wrist circumference is 8 inches, the neck is 16

and the waist is 32. An interesting consequence of this is that — for those to whom the rule applies

— this simple method can be used to determine if trousers will fit: the trousers are wrapped

around the neck, and if the two ends barely touch, then they will fit. Any overlap or lack thereof

corresponds to the trousers being too loose or tight, respectively.

Marine Navigation A ship's captain should navigate to keep the ship more than a thumb's width

from the shore, as shown on the nautical chart being used. Thus, with a coarse scale chart, that

provides few details of near shore hazards such as rocks, a thumb's width would represent a great

distance, and the ship would be steered far from shore; whereas on a fine scale chart, in which

more detail is provided, a ship could be brought closer to shore.[1]

Statistics The Statistical Rule of Thumb says that for most large data sets, 68% of data points will

occur within one standard deviation from the mean, and 95% will occur within two standard

deviations. Chebyshev's inequality is a more general rule along these same lines and applies to all

data sets.](https://image.slidesharecdn.com/thinkingfastandslow3-120814141142-phpapp01/85/Thinking-fast-and_slow-53-320.jpg)

![ In 9 out of 10 transport infrastructure projects, costs are underestimated, resulting in cost overrun;

For rail, actual costs are, on the average, 45% higher than estimated costs (standard deviation, S.D. = 38);

For fixed links (tunnels and bridges), actual costs are, on the average, 34% higher than estimated costs (S.D. = 62);

For roads, actual costs are, on the average, 20% higher than estimated costs (S.D. = 30);

For all project types, actual costs are, on the average, 28% higher than estimated costs (S.D. = 39);

Cost underestimation and overrun exist across 20 nations and five continents; it appears to be a global phenomenon;

Cost underestimation and overrun appear to be more pronounced in developing nations than in North America and

Europe (data for rail only);

Cost underestimation and overrun have not decreased over the past 70 years. No learning seems to take place;

Cost underestimation and overrun cannot be explained by error and seem to be best explained by strategic

misrepresentation, namely, lying, with a view to getting projects started [5].](https://image.slidesharecdn.com/thinkingfastandslow3-120814141142-phpapp01/85/Thinking-fast-and_slow-73-320.jpg)

![ The Dunning–Kruger effect is a cognitive bias in which unskilled people make

poor decisions and reach erroneous conclusions, but their incompetence

denies them the metacognitive ability to recognize their mistakes.[1]

The unskilled therefore suffer from illusory superiority, rating their ability as

above average, much higher than it actually is, while the highly skilled

underrate their own abilities, suffering from illusory inferiority.

Actual competence may weaken self-confidence, as competent individuals

may falsely assume that others have an equivalent understanding.

As Kruger and Dunning conclude, "the miscalibration of the incompetent

stems from an error about the self, whereas the miscalibration of the highly

competent stems from an error about others" (p. 1127).[2] The effect is about

paradoxical defects in cognitive ability, both in oneself and as one compares

oneself to others.](https://image.slidesharecdn.com/thinkingfastandslow3-120814141142-phpapp01/85/Thinking-fast-and_slow-78-320.jpg)