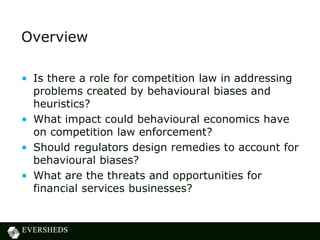

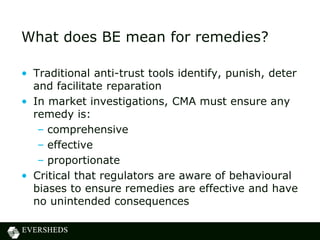

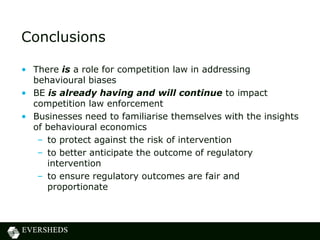

The document discusses the rise of behavioral economics (BE) and its applications in financial services, emphasizing how it provides insights into consumer decision-making that traditional economic theories fail to account for. It explores evidence of behavioral biases such as loss aversion, status quo bias, and heuristics, which influence judgments and choices in predictable ways. Additionally, the implications of BE on competition law and regulation are examined, highlighting the need for regulators to consider these biases to effectively address market competition and ensure fair outcomes.