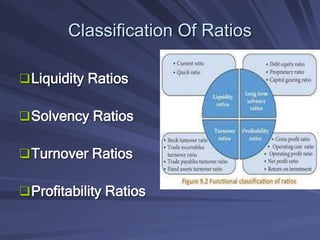

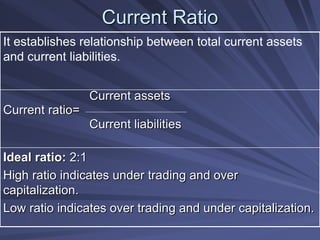

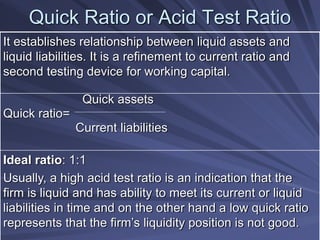

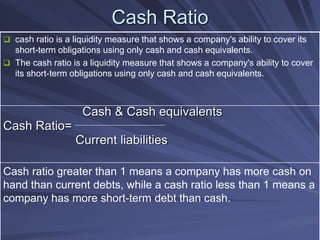

This document discusses ratio analysis and various liquidity ratios used to evaluate a company's short-term financial health and ability to meet current obligations. It defines key liquidity ratios like current ratio, quick ratio, and cash ratio and provides the ideal ratios. Current ratio compares current assets to current liabilities. Quick ratio looks at more liquid current assets. Cash ratio only considers the most liquid assets. The document also provides tips to improve liquidity ratios if they are low, such as selling assets, postponing investments, or raising capital.