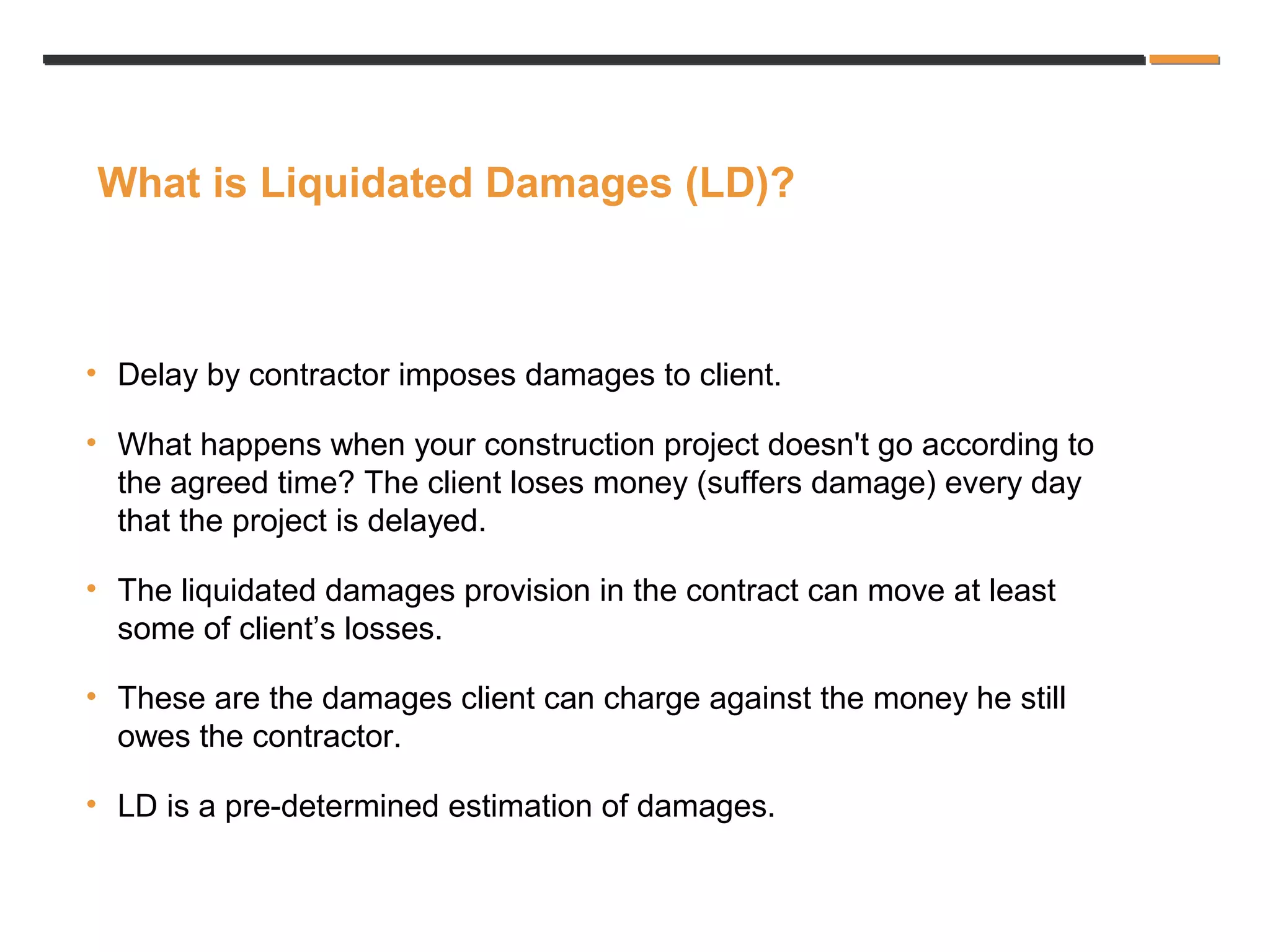

The document discusses the concept of liquidated damages in the construction industry, emphasizing the importance of defining completion times to avoid disputes over what constitutes a 'reasonable' delay. It explains that liquidated damages are predetermined compensation for losses incurred by clients due to delays, covering various costs related to project overruns. Additionally, it outlines factors for determining liquidated damages, the distinction between damages and penalties, and the benefits for both clients and contractors.