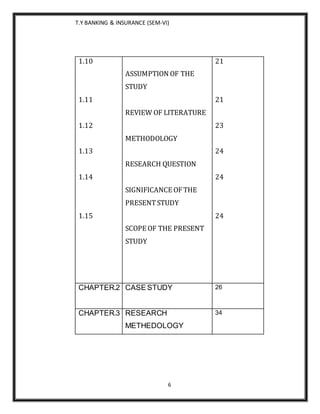

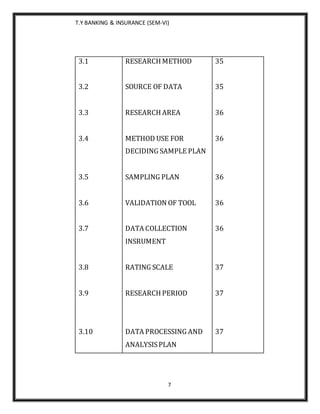

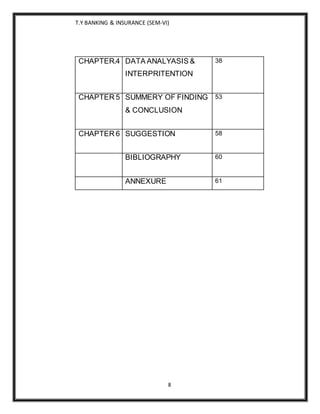

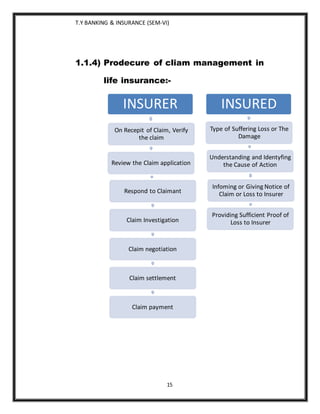

This document is a project report on studying claim management in life insurance. It includes an introduction that provides background on insurance, life insurance, and claim management processes. It then outlines the report structure which includes chapters on introduction, case study, research methodology, data analysis, findings, suggestions, and references. The objectives are to study claim management in life insurance and understand problems with taking out policies and settling claims. It assumes most customers are aware of claim management processes.