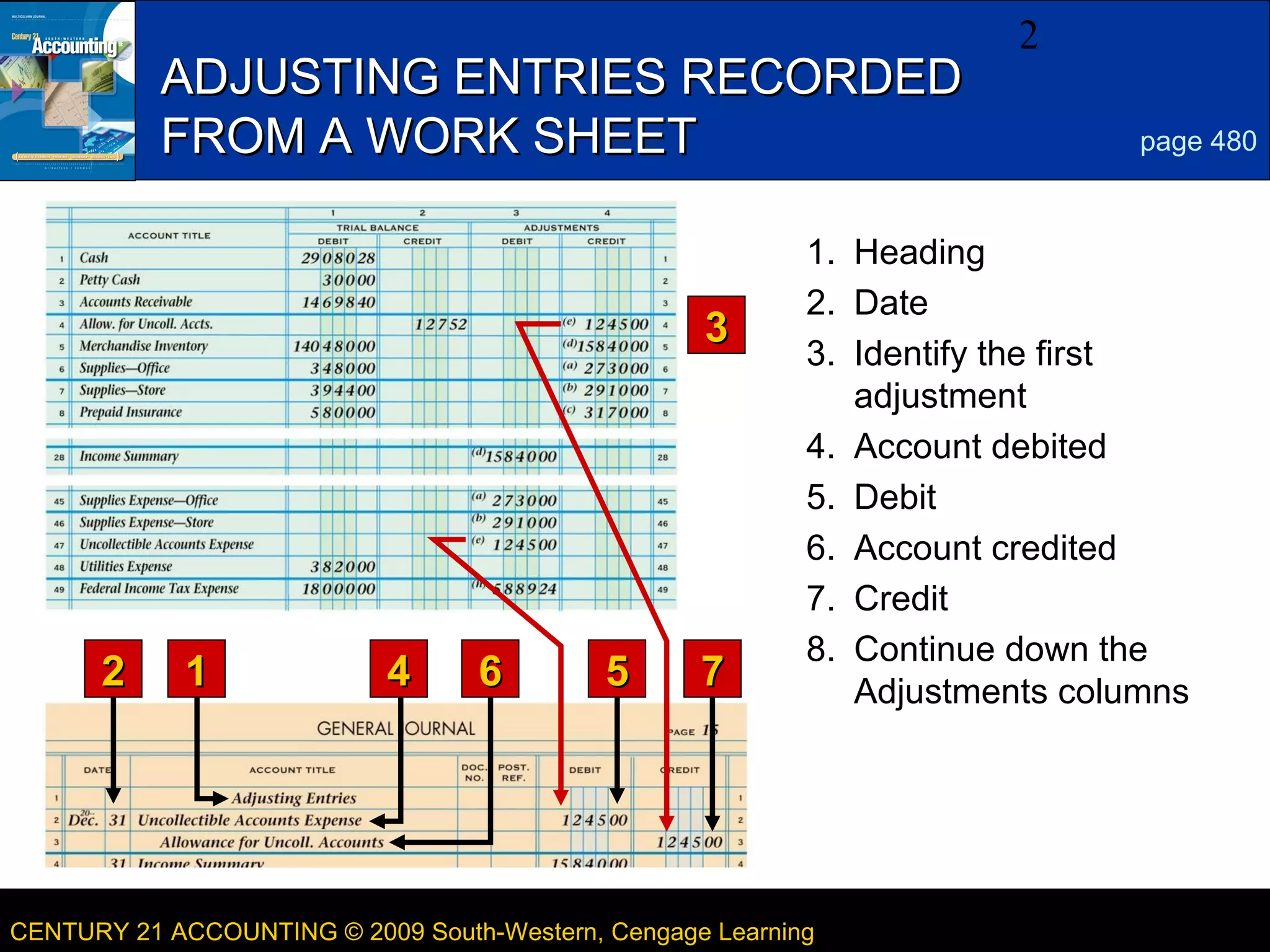

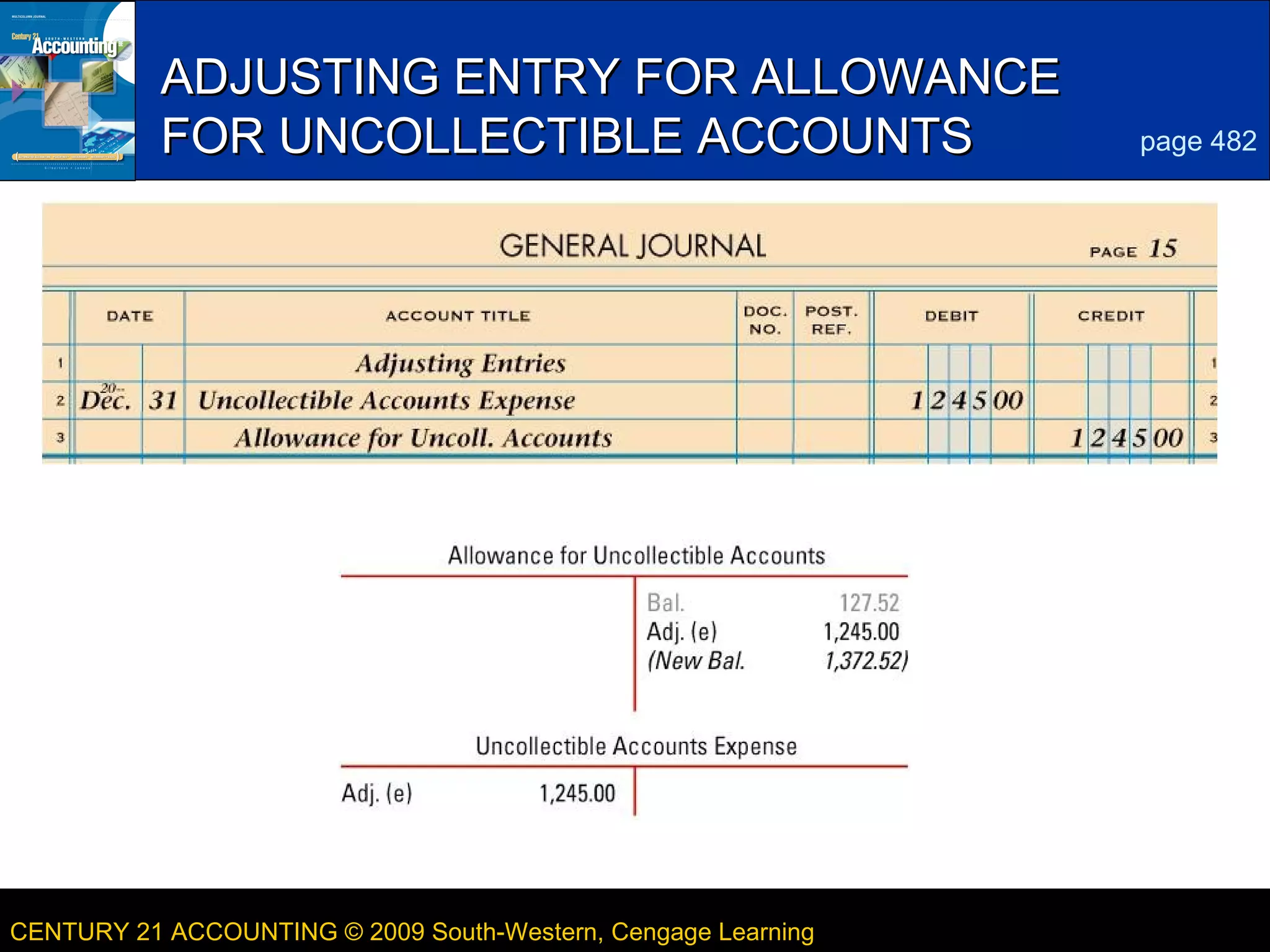

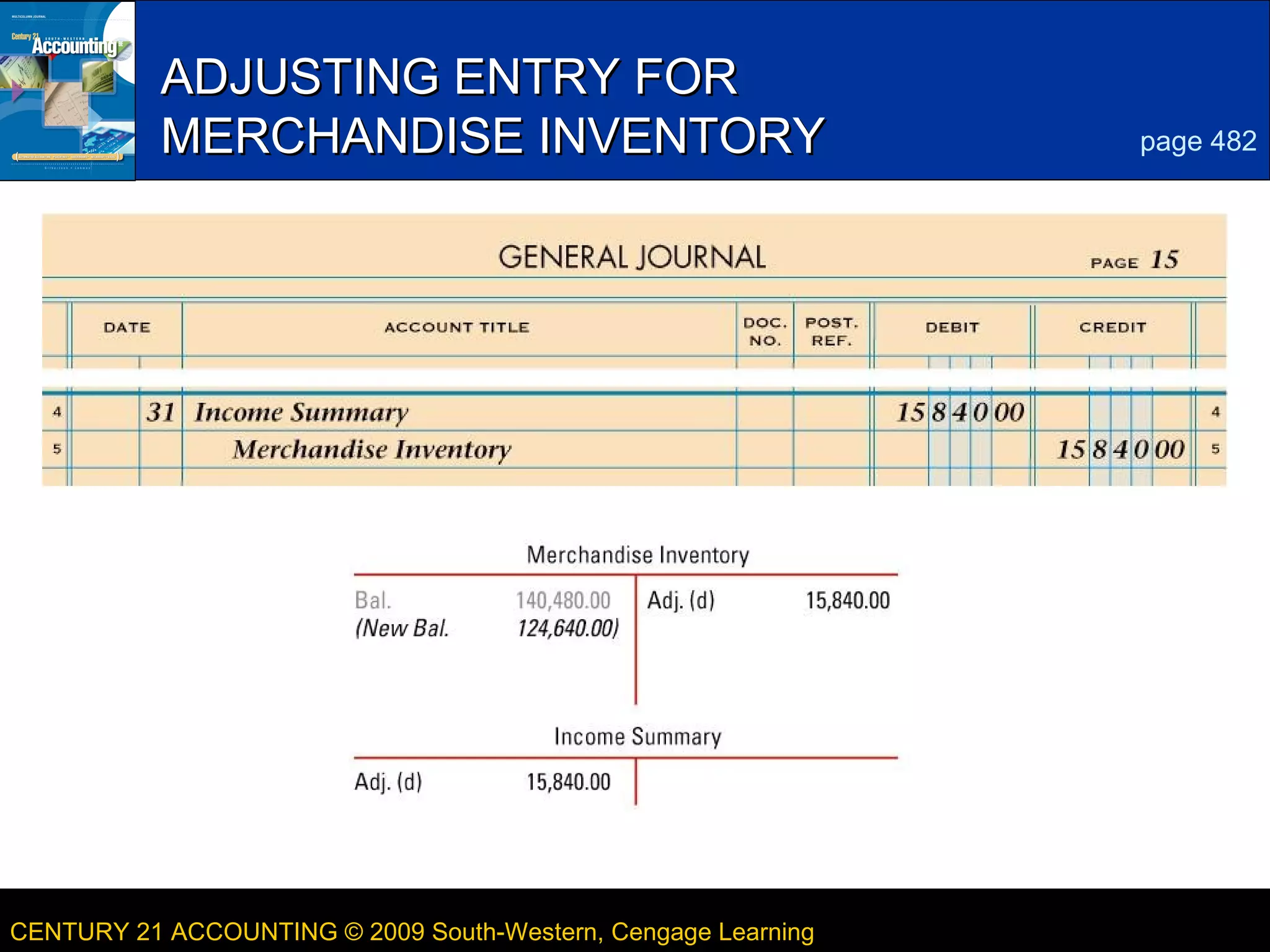

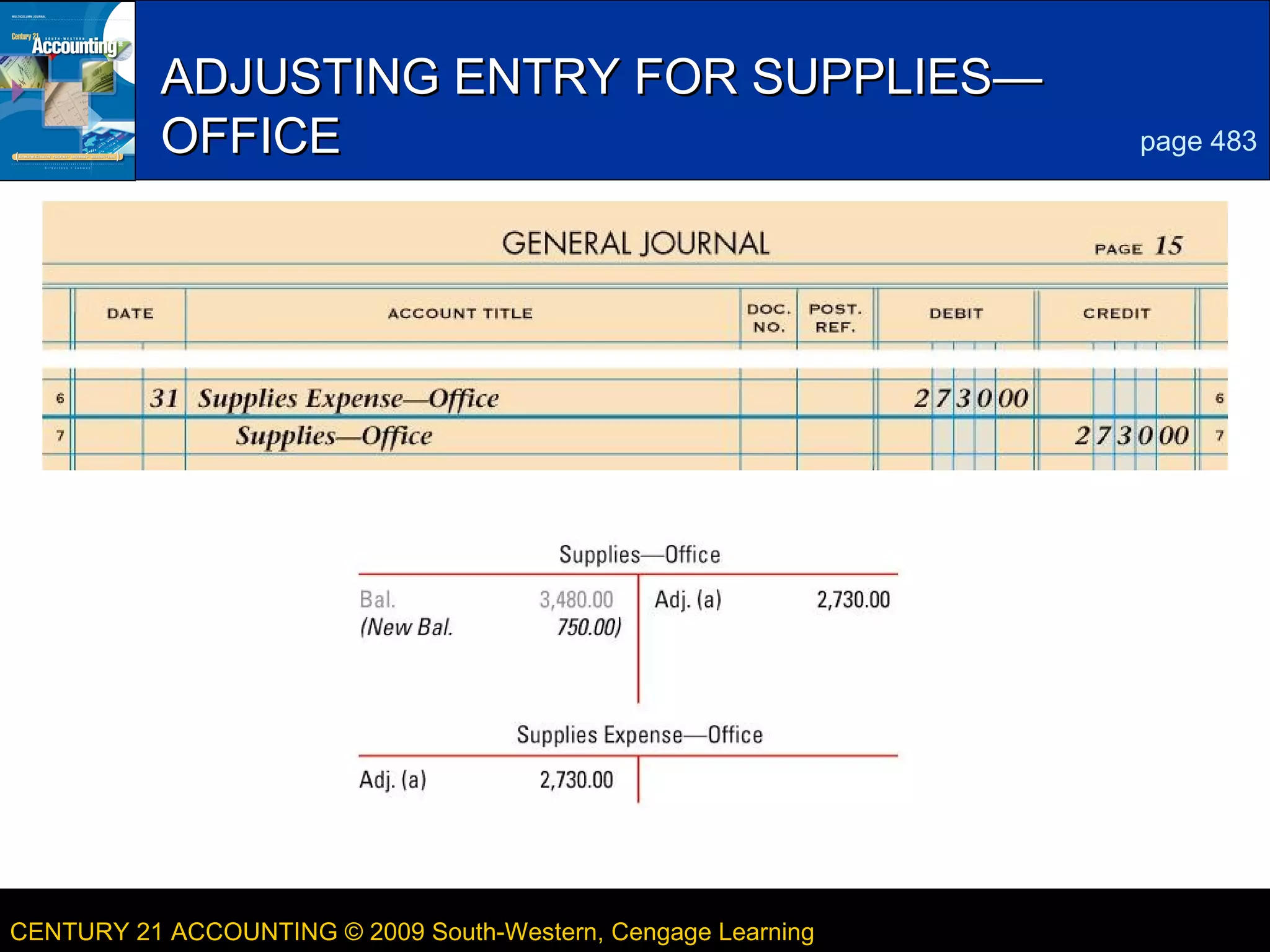

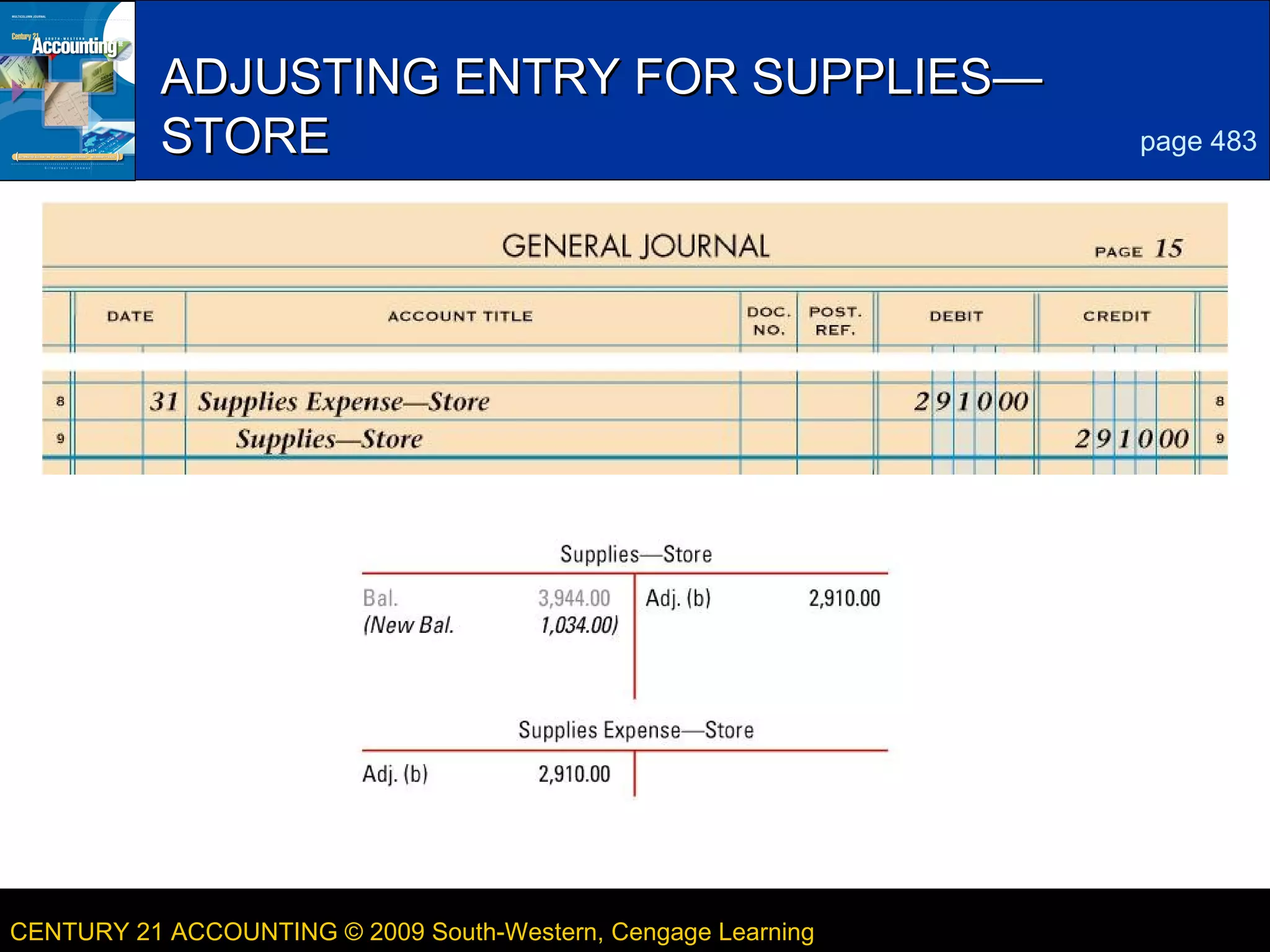

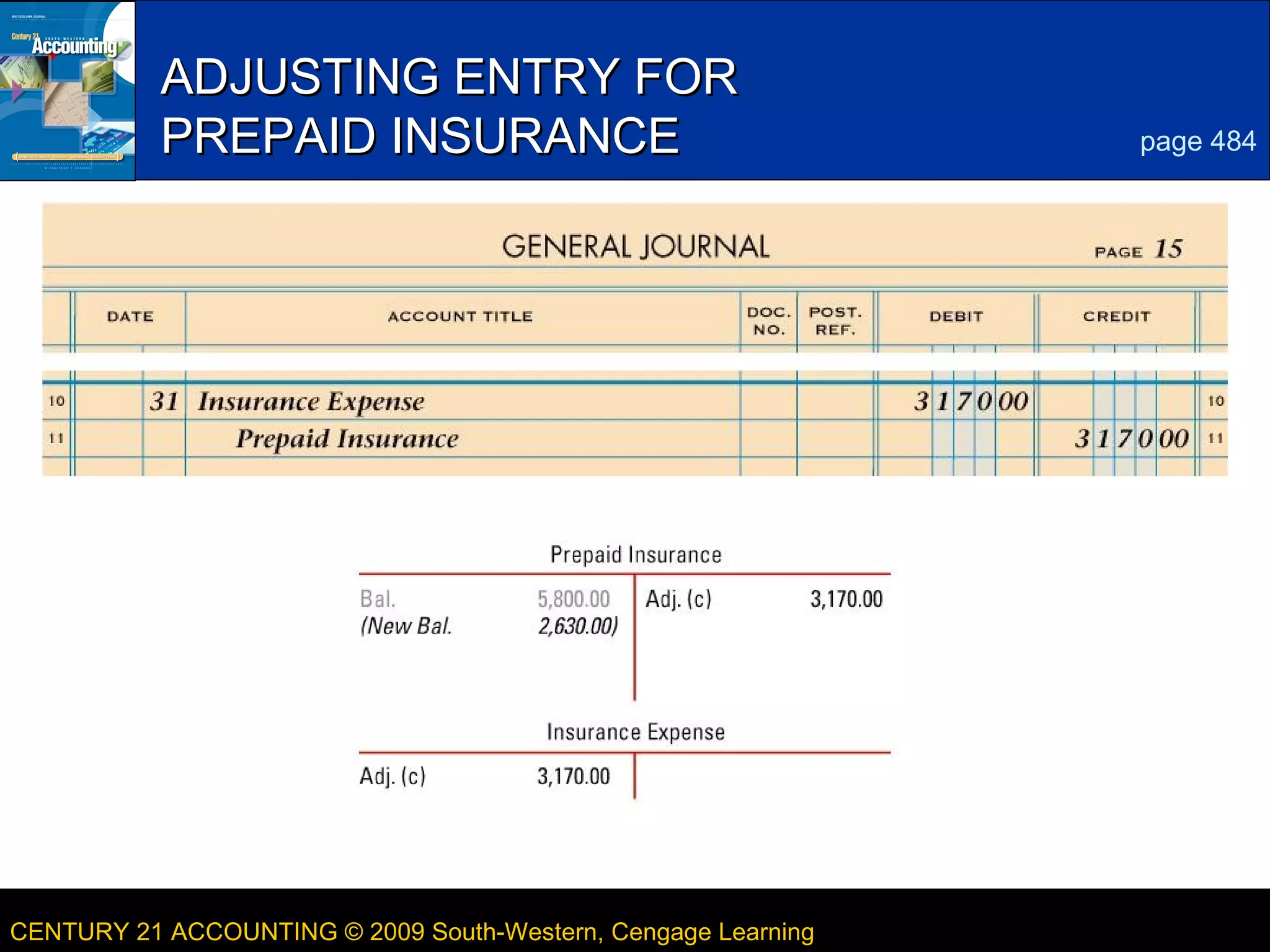

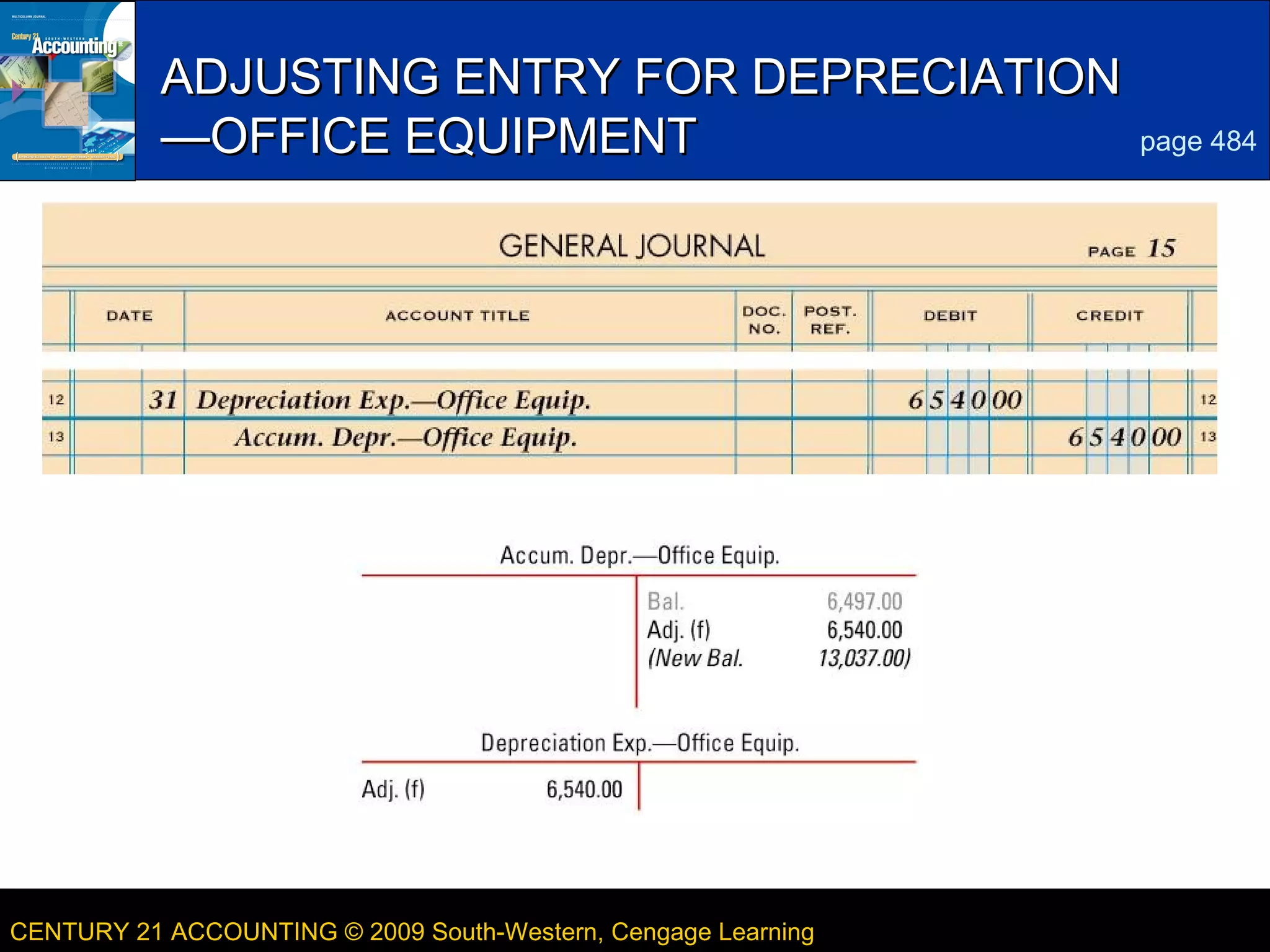

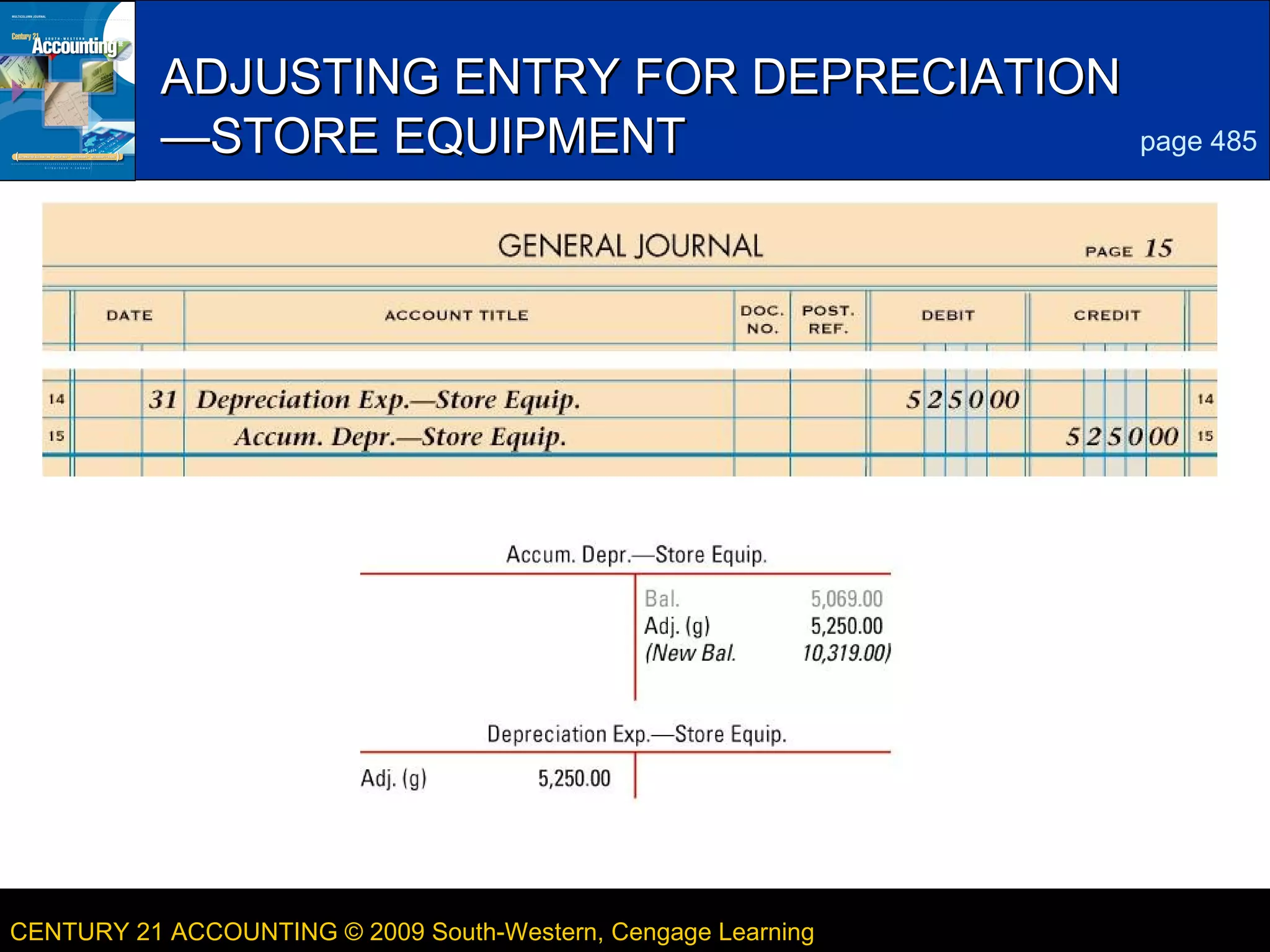

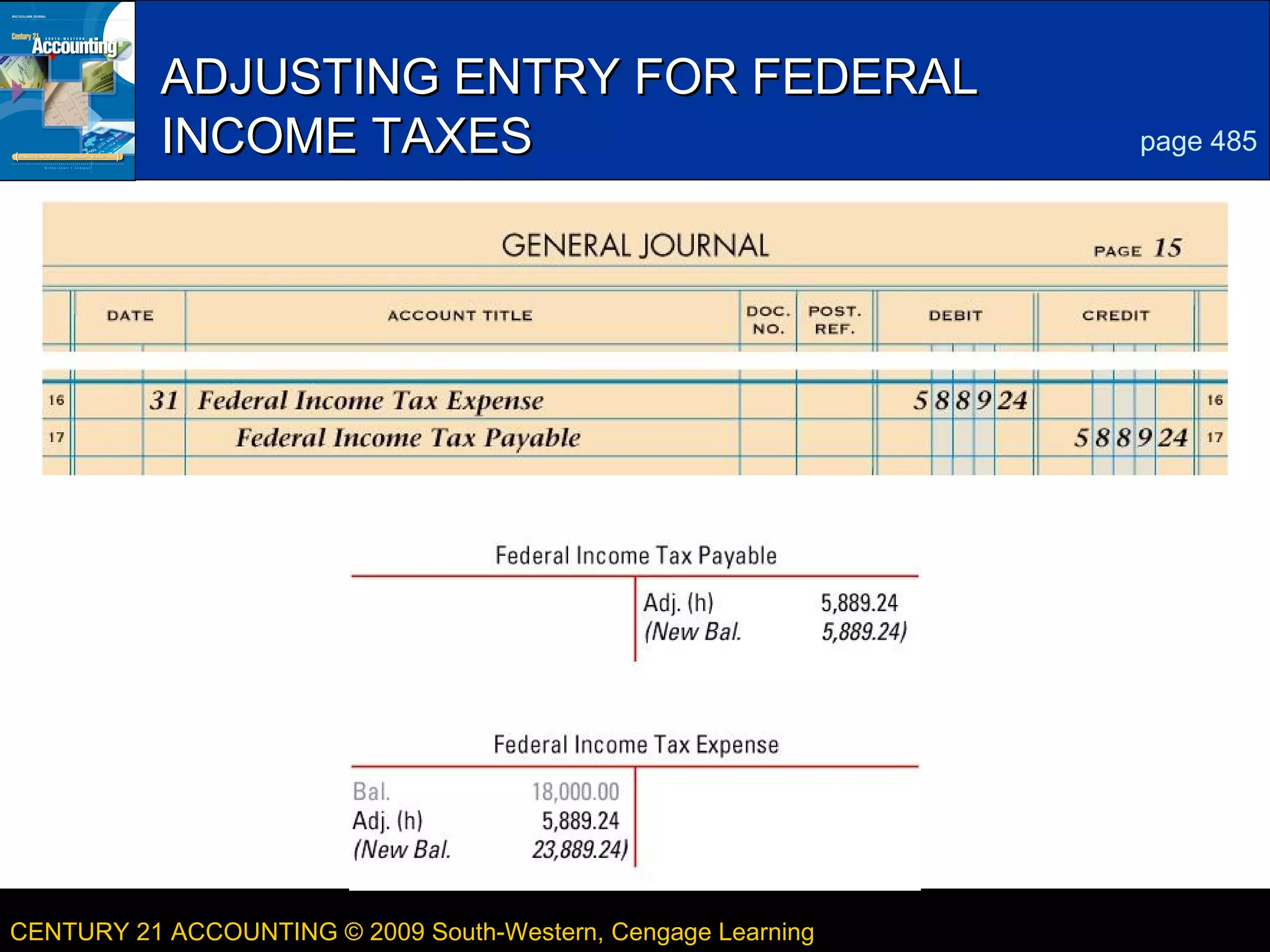

The document discusses how to record adjusting entries from a worksheet. It provides examples of adjusting entries for allowance for uncollectible accounts, merchandise inventory, supplies for the office and store, prepaid insurance, depreciation of office and store equipment, and federal income taxes. Each example lists the date, accounts debited and credited, and debit/credit amounts.