Embed presentation

Download to read offline

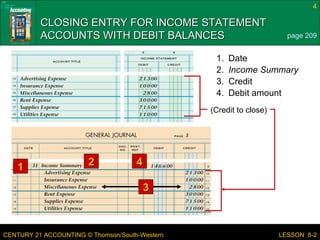

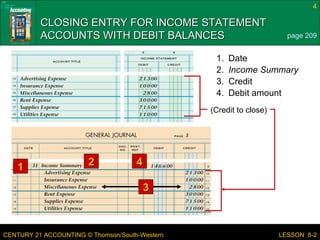

This document discusses closing entries for income statement accounts. It explains that an income statement account with a credit balance requires a debit to close it out to the income summary account. For income statement accounts with debit balances, a credit is needed to close it out. The final closing entry involves debiting the income summary account to close it and crediting either capital or drawings to record the net income or loss for the period.