Lending Solution in a Box

•

0 likes•21,817 views

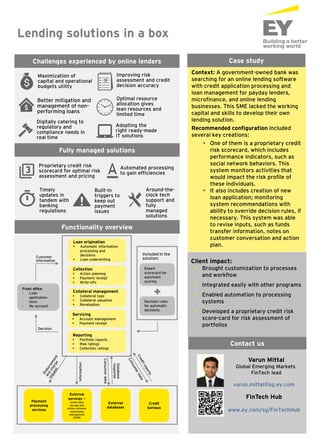

The solution provides a suite of fully incorporated lending solutions, including a proprietary credit risk scorecard for risk assessment, automatic processing for efficiency, regular updates in tandem with banking regulations, built-in triggers to keep out payment issues and around-the-clock-tech-support.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (18)

2015 - GPA Presentation, "Improving Grant Systems for Upcoming Legislation"

2015 - GPA Presentation, "Improving Grant Systems for Upcoming Legislation"

Grant Management Standardization: What's to Come From the Federal Government

Grant Management Standardization: What's to Come From the Federal Government

How Cognizant's ZDLC solution is helping Data Lineage for compliance to Basel...

How Cognizant's ZDLC solution is helping Data Lineage for compliance to Basel...

Baker Hill Client Meeting 2016: It's More Than A Credit Memo

Baker Hill Client Meeting 2016: It's More Than A Credit Memo

Rapid automation and cost avoidance for a large North American property and c...

Rapid automation and cost avoidance for a large North American property and c...

BCBS 239 risk data aggregation reporting_Feb15_PRINT

BCBS 239 risk data aggregation reporting_Feb15_PRINT

Software Advice BuyerView: Customer Service Software Report 2014

Software Advice BuyerView: Customer Service Software Report 2014

8 LOS Features Credit Unions Need to Stay Competitive

8 LOS Features Credit Unions Need to Stay Competitive

Similar to Lending Solution in a Box

Similar to Lending Solution in a Box (20)

The Digital Lending Loan Origination Application | AppsTek Corp

The Digital Lending Loan Origination Application | AppsTek Corp

Presentation DataScoring: Big Data and credit score

Presentation DataScoring: Big Data and credit score

Applications of Data Science in Banking and Financial sector.pptx

Applications of Data Science in Banking and Financial sector.pptx

Achieving Operational Efficiency and Effectiveness with Digital Transformatio...

Achieving Operational Efficiency and Effectiveness with Digital Transformatio...

Lavanya_4.3yrsExp_AutomationTesting_QTP_UFT_VBScript

Lavanya_4.3yrsExp_AutomationTesting_QTP_UFT_VBScript

Digital B2B Credit Best Practices | Emagia Credit Automation | Emagia MasterC...

Digital B2B Credit Best Practices | Emagia Credit Automation | Emagia MasterC...

Integrated Order to Cash (O2C) Automation Software for Global Shared Services...

Integrated Order to Cash (O2C) Automation Software for Global Shared Services...

More from Varun Mittal

More from Varun Mittal (20)

Asian insurance, pensions, and wealth management undergo rapid change, what a...

Asian insurance, pensions, and wealth management undergo rapid change, what a...

Taking Stock & Looking Ahead | Gender Diversity in Southeast Asia’s FinTech L...

Taking Stock & Looking Ahead | Gender Diversity in Southeast Asia’s FinTech L...

Fe credit case study - How one of the first non-bank financial credit compani...

Fe credit case study - How one of the first non-bank financial credit compani...

Digital bad debts collection platform using machine learning

Digital bad debts collection platform using machine learning

How EY and Credit Suisse teams brought growth opportunities to future leaders...

How EY and Credit Suisse teams brought growth opportunities to future leaders...

Migrant workers as customer group of digital banks in Singapore

Migrant workers as customer group of digital banks in Singapore

Gig economy workers as customer group of digital banks in Singapore

Gig economy workers as customer group of digital banks in Singapore

Entrepreneurs as customer group of digital banks in Singapore

Entrepreneurs as customer group of digital banks in Singapore

Recently uploaded

Recently uploaded (20)

How world-class product teams are winning in the AI era by CEO and Founder, P...

How world-class product teams are winning in the AI era by CEO and Founder, P...

Free and Effective: Making Flows Publicly Accessible, Yumi Ibrahimzade

Free and Effective: Making Flows Publicly Accessible, Yumi Ibrahimzade

Optimizing NoSQL Performance Through Observability

Optimizing NoSQL Performance Through Observability

Kubernetes & AI - Beauty and the Beast !?! @KCD Istanbul 2024

Kubernetes & AI - Beauty and the Beast !?! @KCD Istanbul 2024

Powerful Start- the Key to Project Success, Barbara Laskowska

Powerful Start- the Key to Project Success, Barbara Laskowska

Custom Approval Process: A New Perspective, Pavel Hrbacek & Anindya Halder

Custom Approval Process: A New Perspective, Pavel Hrbacek & Anindya Halder

Future Visions: Predictions to Guide and Time Tech Innovation, Peter Udo Diehl

Future Visions: Predictions to Guide and Time Tech Innovation, Peter Udo Diehl

Knowledge engineering: from people to machines and back

Knowledge engineering: from people to machines and back

Empowering NextGen Mobility via Large Action Model Infrastructure (LAMI): pav...

Empowering NextGen Mobility via Large Action Model Infrastructure (LAMI): pav...

Assuring Contact Center Experiences for Your Customers With ThousandEyes

Assuring Contact Center Experiences for Your Customers With ThousandEyes

AI for Every Business: Unlocking Your Product's Universal Potential by VP of ...

AI for Every Business: Unlocking Your Product's Universal Potential by VP of ...

Connector Corner: Automate dynamic content and events by pushing a button

Connector Corner: Automate dynamic content and events by pushing a button

UiPath Test Automation using UiPath Test Suite series, part 1

UiPath Test Automation using UiPath Test Suite series, part 1

Behind the Scenes From the Manager's Chair: Decoding the Secrets of Successfu...

Behind the Scenes From the Manager's Chair: Decoding the Secrets of Successfu...

Introduction to Open Source RAG and RAG Evaluation

Introduction to Open Source RAG and RAG Evaluation

Salesforce Adoption – Metrics, Methods, and Motivation, Antone Kom

Salesforce Adoption – Metrics, Methods, and Motivation, Antone Kom

From Daily Decisions to Bottom Line: Connecting Product Work to Revenue by VP...

From Daily Decisions to Bottom Line: Connecting Product Work to Revenue by VP...

Lending Solution in a Box

- 1. Context: A government-owned bank was searching for an online lending software with credit application processing and loan management for payday lenders, microfinance, and online lending businesses. This SME lacked the working capital and skills to develop their own lending solution. Recommended configuration included several key creations: • One of them is a proprietary credit risk scorecard, which includes performance indicators, such as social network behaviors. This system monitors activities that would impact the risk profile of these individuals. • It also includes creation of new loan application; monitoring system recommendations with ability to override decision rules, if necessary. This system was able to revise inputs, such as funds transfer information, notes on customer conversation and action plan. Lending solutions in a box Better mitigation and management of non- performing loans Improving risk assessment and credit decision accuracy Optimal resource allocation gives lean resources and limited time Digitally catering to regulatory and compliance needs in real time Adopting the right ready-made IT solutions Automated processing to gain efficiencies Around-the- clock tech support and fully managed solutions Proprietary credit risk scorecard for optimal risk assessment and pricing Timely updates in tandem with banking regulations Built-in triggers to keep out payment issues Fully managed solutions Challenges experienced by online lenders Case study Maximization of capital and operational budgets utility Client impact: • Brought customization to processes and workflow • Integrated easily with other programs • Enabled automation to processing systems • Developed a proprietary credit risk score-card for risk assessment of portfolios Functionality overview Loan origination • Automatic information processing and decisions • Loan underwriting Collection • Action planning • Payment receipt • Write-offs Servicing • Account management • Payment receipt Reporting • Portfolio reports • Risk ratings • Collection ratings Collateral management • Collateral type • Collateral valuation • Revaluation Front office - Loan application form - My account Customer information Decision Expert scorecard for automatic scoring Decision rules for automatic decisions Included in the solution: Payment processing services External services — online data storage and online customer relationship management (CRM) External databases Credit bureaus Information Varun Mittal Global Emerging Markets FinTech lead varun.mittal@sg.ey.com Contact us FinTech Hub www.ey.com/sg/FinTechHub