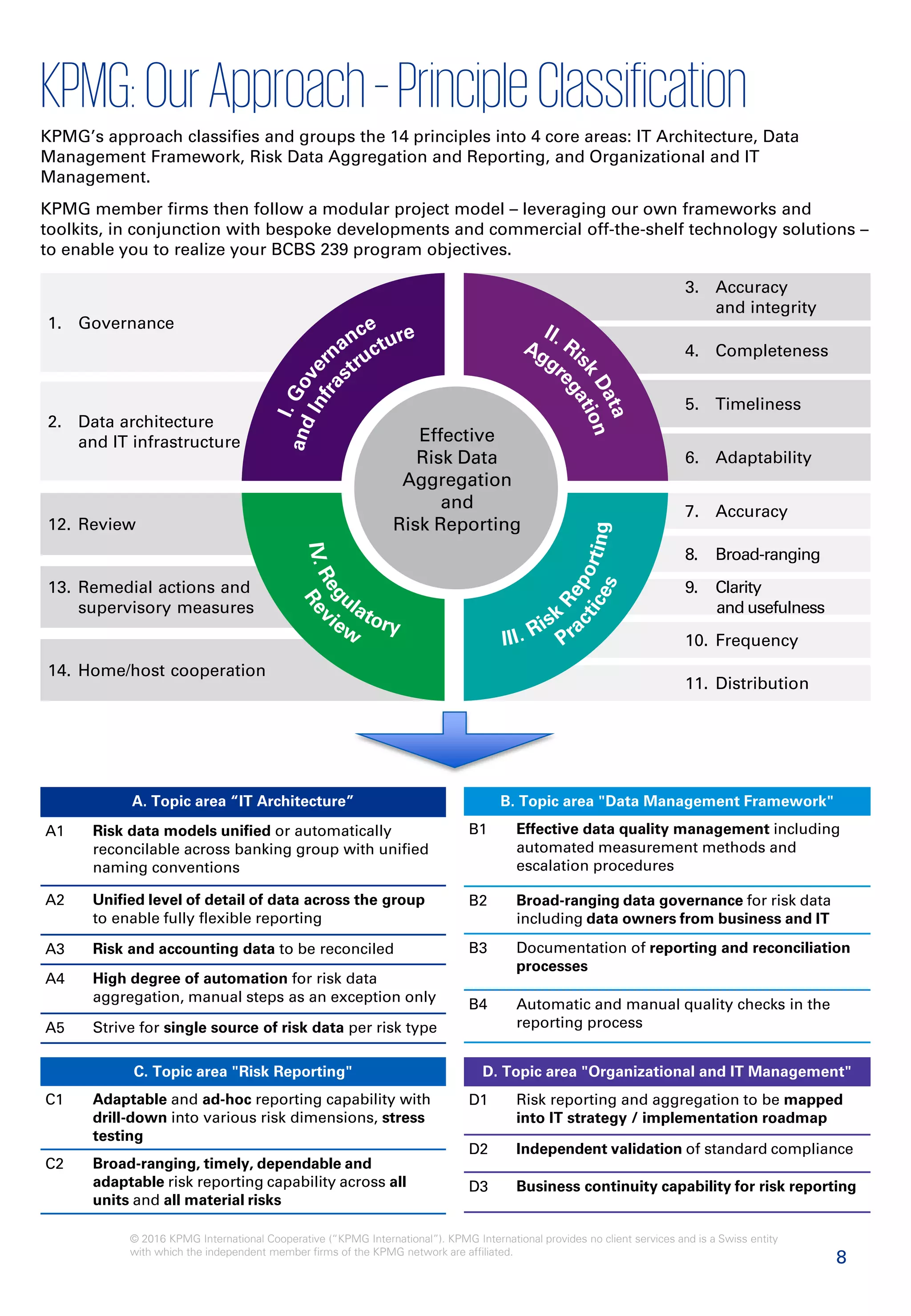

This document discusses the Basel Committee on Banking Supervision (BCBS) 239 principles for effective risk data aggregation and risk reporting (RDARR). Some key points:

- BCBS 239 aims to enhance banks' ability to identify and manage firm-wide risks by improving data aggregation capabilities and risk reporting, especially during a crisis.

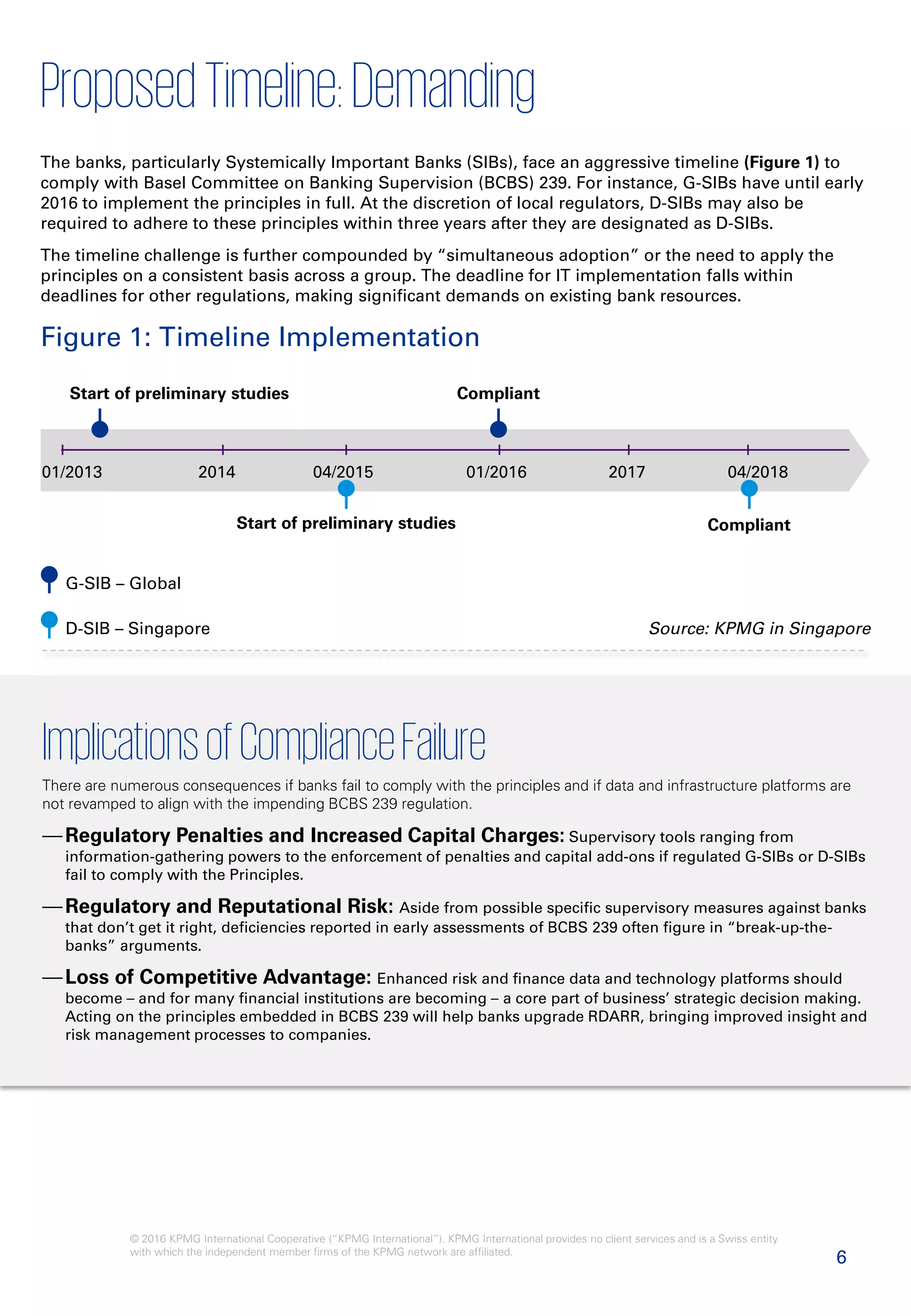

- It applies not just to globally systemic banks but also domestic systemically important banks. Banks face an aggressive timeline for compliance, with globally systemic banks required to implement the principles in full by early 2016.

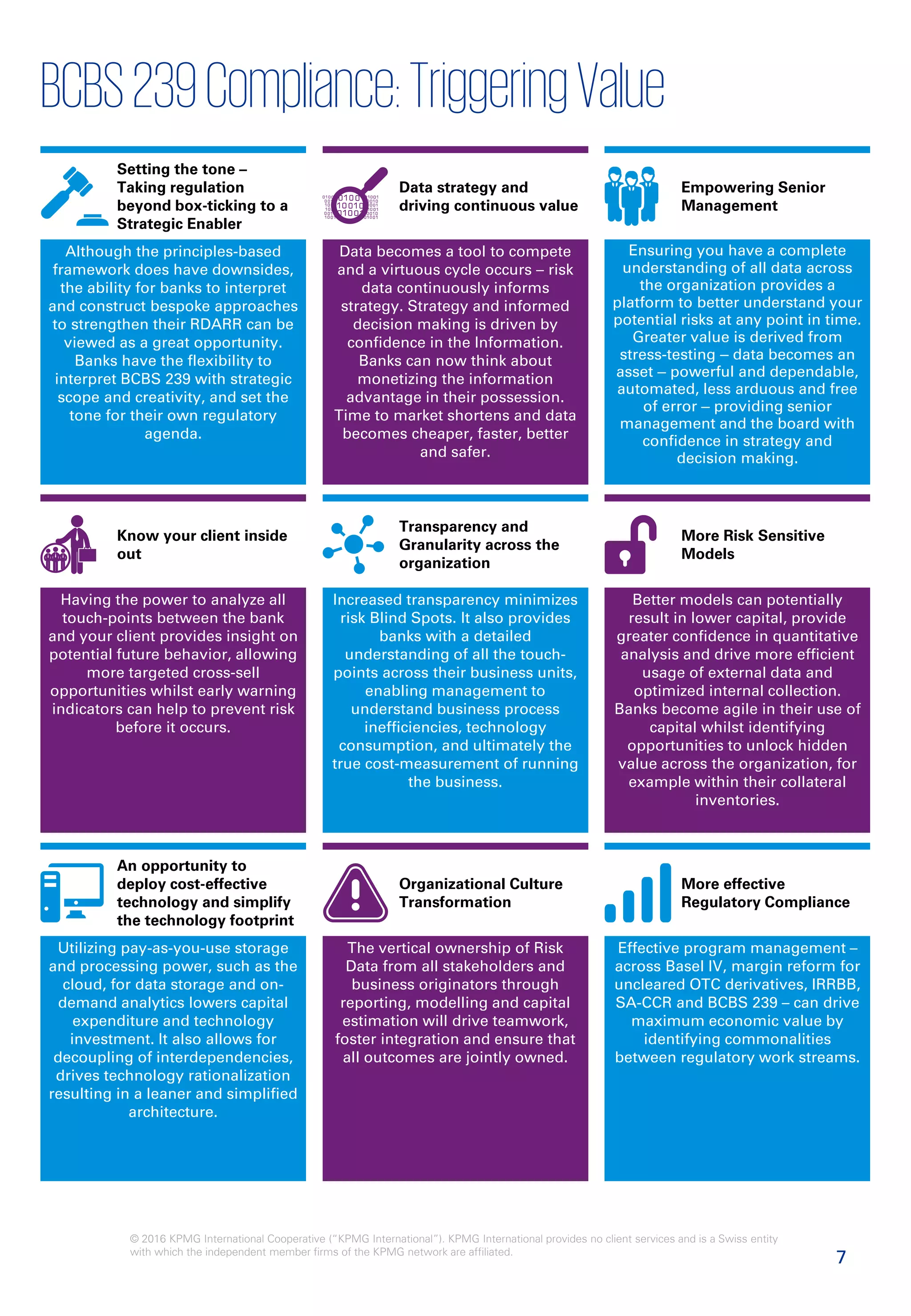

- Failure to comply could result in regulatory penalties, increased capital charges, and reputational risks. Compliance also provides opportunities to unlock strategic value across the organization through better risk management