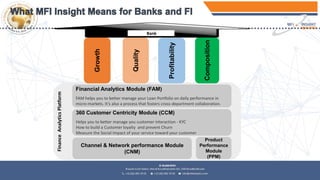

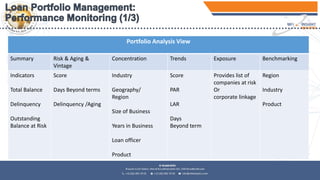

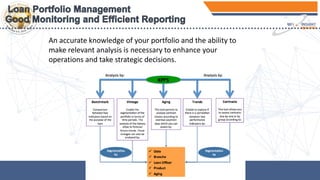

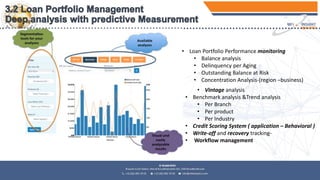

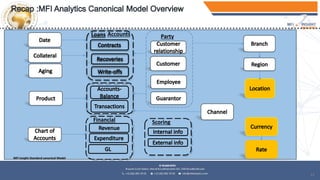

This document summarizes an analytics platform that provides modules for financial institutions to analyze their loan portfolios, customer interactions, and channel and network performance. It has been implemented for over 15 clients in 6 countries across Europe, Africa, and Asia by a company with over 50 years of business intelligence experience. The platform includes modules for financial analytics, customer centricity, and channel/network performance. It provides insights, key performance indicators, risk analysis, and benchmarking to help financial institutions enhance operations and strategic decision making. Implementation typically takes less than 6 weeks.