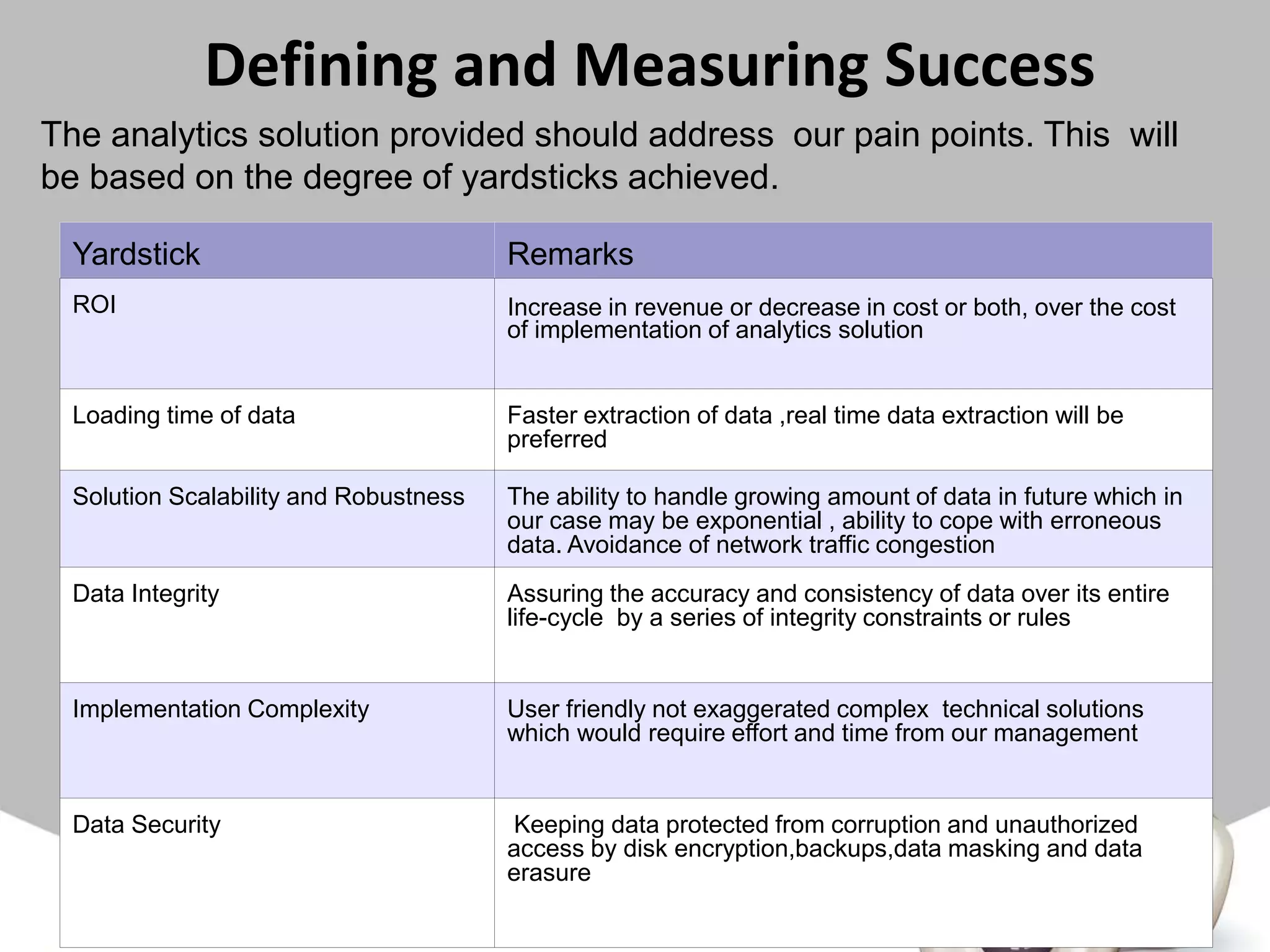

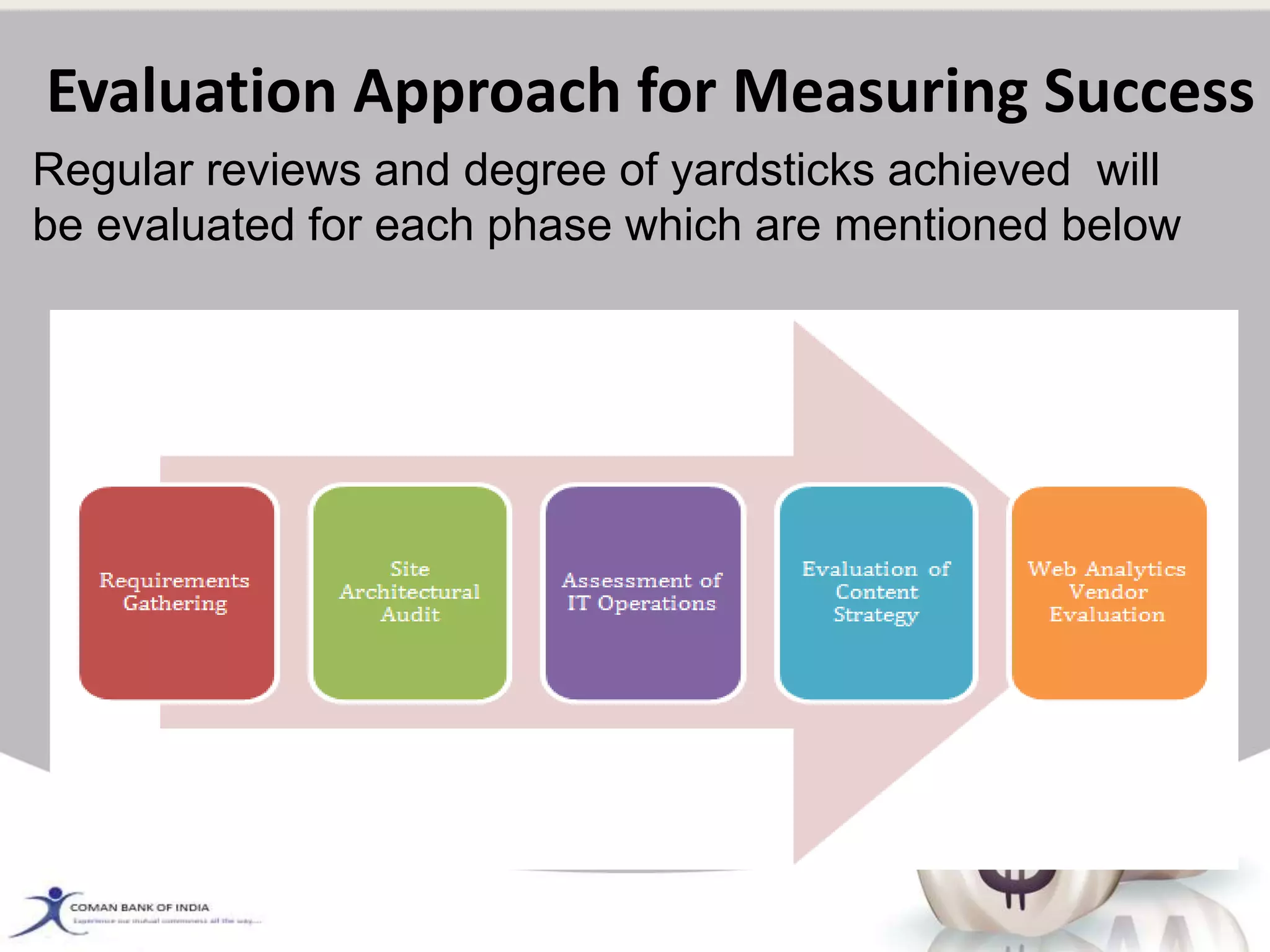

Coman Bank of India is seeking to adopt analytics to improve customer retention, cross-selling, and risk assessment. The bank currently has issues with high customer churn of 4% and single-product customers comprising 50% of its base. It aims to reduce churn to less than 2% and increase cross-selling to 40% of customers. The bank also aims to reduce fraud and loan defaults from the current 4% loss level. It has data available in its FINACLE banking system and enterprise data warehouse. The proposed scope of work includes customer segmentation, identifying reasons for churn, and risk/fraud analysis. Success will be measured based on ROI, data loading time, scalability, integrity, complexity, and security. The