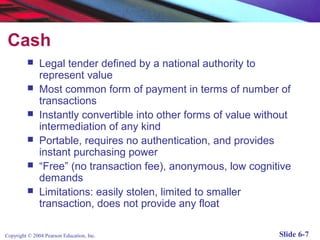

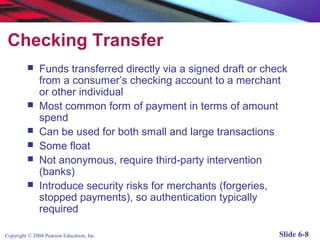

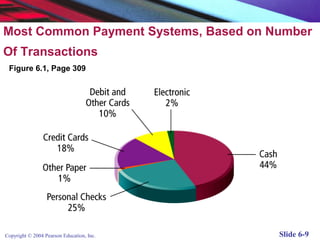

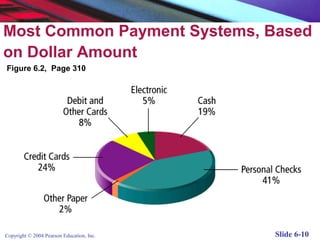

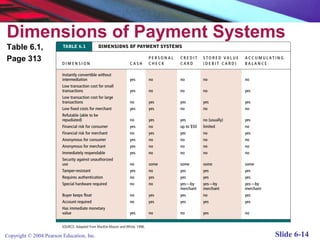

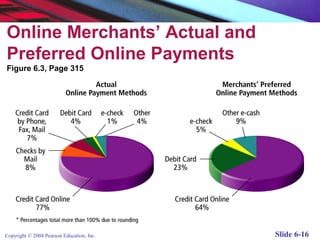

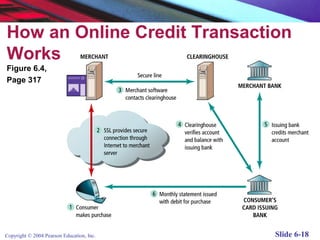

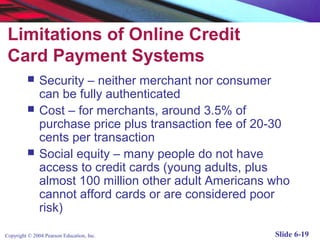

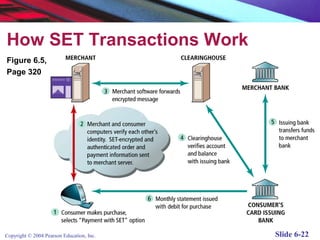

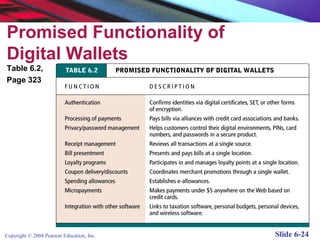

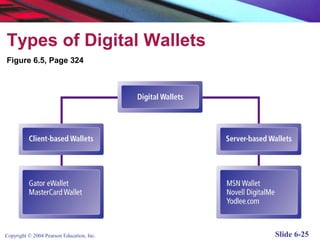

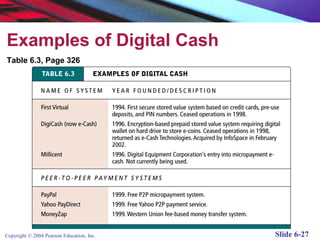

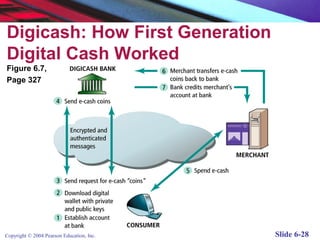

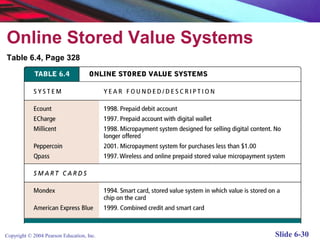

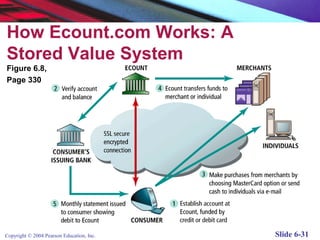

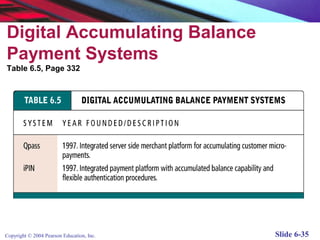

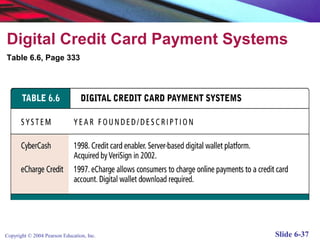

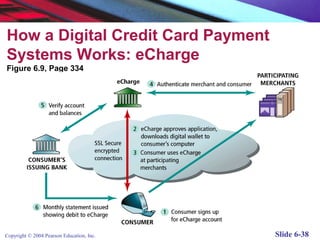

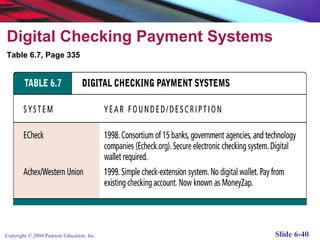

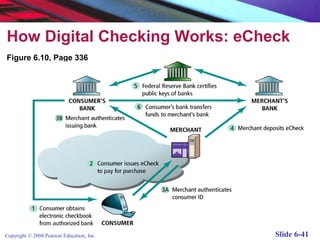

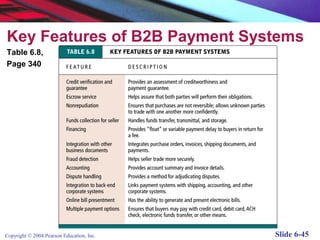

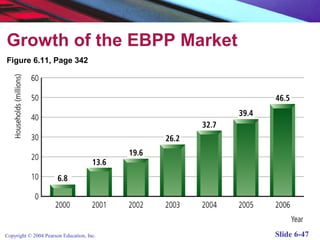

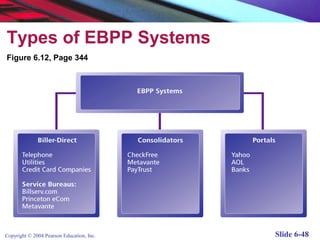

This document summarizes key concepts around e-commerce payment systems from a textbook chapter. It discusses traditional payment methods and their limitations online. It then covers the rise of digital payment methods like digital wallets, digital cash, stored value cards, accumulating balance accounts, and digital check and credit systems. Emerging areas like mobile payments and business-to-business payment networks are also addressed. CheckFree is presented as a case study of a current leader in electronic billing presentment facing challenges from new competitors and technologies.