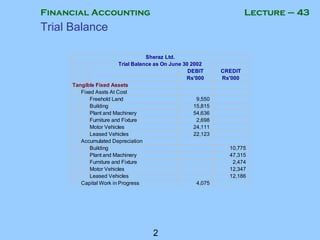

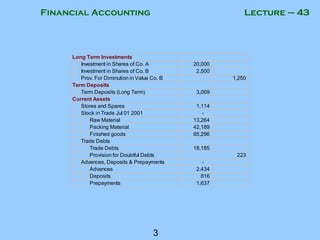

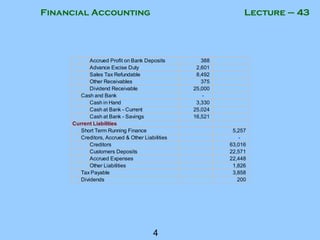

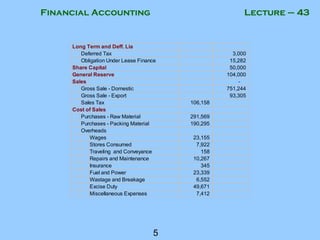

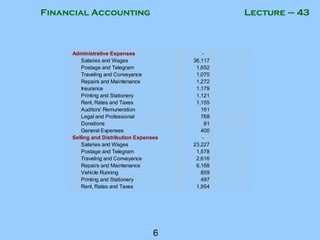

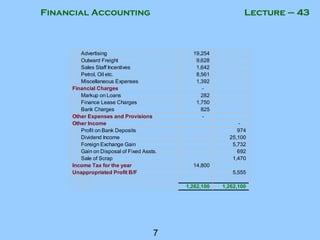

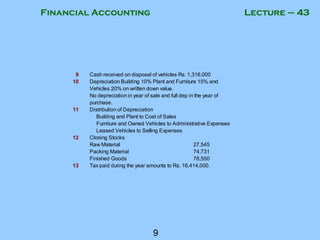

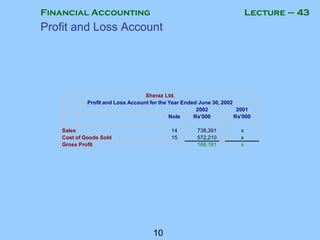

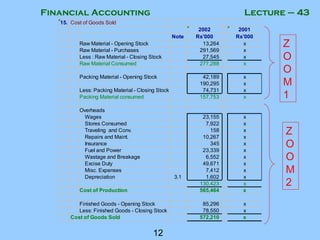

The document provides a comprehensive set of financial data for Sheraz Limited, a manufacturing company, including a trial balance and adjustments necessary for the financial year ending June 30, 2002. It outlines the company's financial position, including assets, liabilities, and equity, as well as necessary calculations for profit and loss statements. The document concludes with instructions for preparing the financial statements and notes on accounting adjustments.